Global| Sep 29 2015

Global| Sep 29 2015U.S. Consumer Confidence Adds to Gains in September

by:Sandy Batten

|in:Economy in Brief

Summary

The Conference Board's Consumer Confidence Index in September unexpectedly added to its outsized August gains. The overall index rose 1.7% in September from August to 103.0 on top of a 11.3%m/m jump in August. The September reading [...]

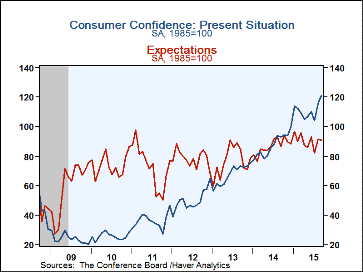

The Conference Board's Consumer Confidence Index in September unexpectedly added to its outsized August gains. The overall index rose 1.7% in September from August to 103.0 on top of a 11.3%m/m jump in August. The September reading was the second highest of the current economic expansion. Respondents to the Action Economics survey had looked for a decline to 97.0 in September. The August figure was revised down marginally to 101.3 from the initially reported 101.5. The Conference Board gauge is currently portraying a slightly more ebullient consumer than are other measures. This is likely because the Conference Board survey is focused more on labor-market conditions than are other surveys. The present conditions index soared to 121.1 in September (a 4.6%m/m increase after a 11.3% surge in August) and is up 30.2% from a year earlier. This was the highest reading since October 2007. By contrast, the expectations index slipped 0.7%m/m in September but is still up 5.3% from a year ago.

On labor-market conditions, 25.1% of respondents thought that jobs were plentiful in September, the highest reading since October 2007. The labor market differential (the difference between the percentage thinking that jobs are plentiful and that jobs are hard to get) continued to rise-to 0.8% in September, only the second positive reading in the current expansion and the highest reading since January 2008. Clearly, consumers think that labor-market conditions are currently quite robust.

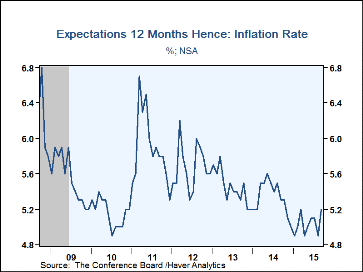

Respondents indicating that business conditions were good recovered in September, rising to 28.0% after having slumped to 23.7% in August. The September reading was the second highest of the current expansion. The percentage of respondents expecting interest rates to rise in the next 12 months rose to 64.4% in September, the highest reading since October 2013.

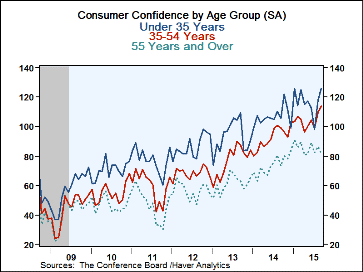

By age group, all of the rise in confidence in September was by consumers less than 55 years old, with the attitudes of those 55 years old and above falling by slightly more than 5%. By income strata, attitudes of those earning less than $25,000 per year fell in September while attitudes in all income groups above $25,000 uniformly increased.

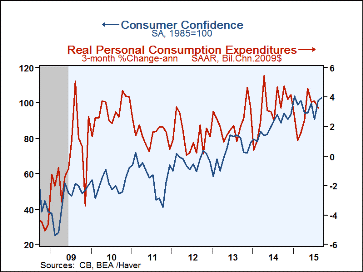

As reported yesterday, personal consumption rose 0.4%m/m in August to stand 3.5% higher than a year ago. Today's consumer confidence report indicates that consumers are even more upbeat about the economy. This should augur further gains in consumer spending going forward.

The Consumer Confidence data is available in Haver's CBDB database. The total indexes appear in USECON and the market expectations are in AS1REPNA.

| Conference Board (SA, 1985=100) | Sep | Aug | Jul | Y/Y % | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 103.0 | 101.3 | 91.0 | 15.7 | 86.9 | 73.2 | 67.1 |

| Present Situation | 121.1 | 115.8 | 104.0 | 30.2 | 87.4 | 67.6 | 49.8 |

| Expectations | 91.0 | 91.6 | 82.3 | 5.3 | 86.6 | 77.0 | 78.6 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 125.9 | 118.0 | 98.1 | 19.1 | 106.6 | 93.1 | 86.5 |

| Aged 35-54 Years | 114.0 | 109.9 | 98.9 | 14.7 | 92.4 | 76.8 | 68.5 |

| Over 55 Years | 81.9 | 86.8 | 82.2 | 11.9 | 73.8 | 61.2 | 56.7 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates