Global| May 28 2013

Global| May 28 2013U.S. Consumer Confidence Continues To Strengthen

by:Tom Moeller

|in:Economy in Brief

Summary

Consumer confidence has been building across the board. The Conference Board's Consumer Confidence Index rose to 76.2 this month and built on the upwardly revised April figure of 69.0. Consensus expectations had been for a roughly [...]

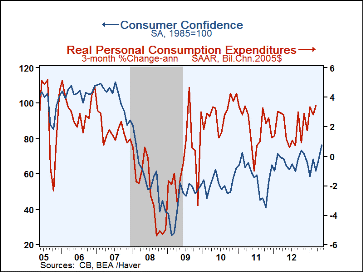

Consumer confidence has been building across the board. The Conference Board's Consumer Confidence Index rose to 76.2 this month and built on the upwardly revised April figure of 69.0. Consensus expectations had been for a roughly stable 70.8. During the last ten years, there has been a 47% correlation between the level of confidence and the three-month change in real PCE.

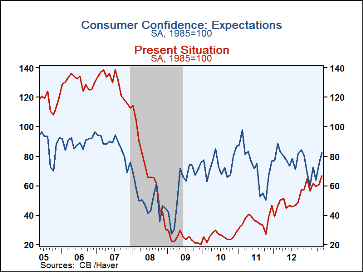

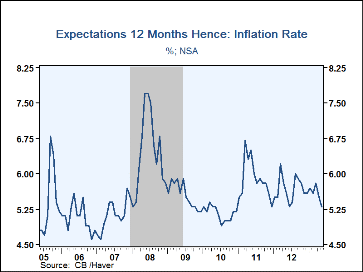

Another sharp improvement in the consumer expectations reading to 82.4 from 74.3 led the strength in the overall confidence index this month. Expectations for better business conditions improved the most, followed by expectations for more jobs. Expectations for the inflation rate in twelve months dropped sharply to 5.3%, the lowest level since December 2010. The percentage expecting higher stock prices surged to its highest since May 2007.

The present situations index improved sharply m/m to 66.7, a breakout to its highest level since May 2008. The 18.8% of respondents who thought that business conditions were good was the most since February 2008. Jobs were thought to be hard to get by 36.1% of respondents. That was down slightly m/m and down sharply versus the high of 49.4% in June 2011. Jobs were viewed as not so plentiful by 53.1% of individuals, down from the recent high but up sharply from the 2011 low of 45.0%.

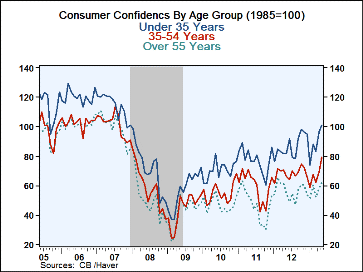

The consumer confidence index for those under 35 years rose to its highest level since October 2007. Confidence amongst middle-aged individuals also improved to the highest since January 2008 but individuals over 55 years remained the most skeptical age group. Their confidence this month is no higher than February of last year.

The Consumer Confidence data is available in Haver's CBDB database.

| Conference Board (SA, 1985=100) | May | April | Mar | Y/Y % | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 76.2 | 69.0 | 61.9 | 18.3 | 67.1 | 58.1 | 54.5 |

| Present Situation | 66.7 | 61.0 | 59.2 | 48.6 | 49.8 | 36.1 | 25.7 |

| Expectations | 82.4 | 74.3 | 63.7 | 6.6 | 78.6 | 72.8 | 73.7 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 100.9 | 96.1 | 83.2 | 23.7 | 86.5 | 77.3 | 70.4 |

| Aged 35-54 Years | 79.3 | 69.1 | 62.3 | 20.2 | 68.5 | 59.8 | 55.1 |

| Over 55 Years | 62.0 | 58.1 | 52.1 | 12.7 | 56.6 | 47.3 | 47.4 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates