Global| Dec 31 2019

Global| Dec 31 2019U.S. Consumer Confidence Down Slightly, but Prior Month Revised Upward

Summary

The Conference Board's Consumer Confidence Index eased slightly in December, by 0.2% to 126.5 (1985=100), but November was revised upward to 126.8 from its originally reported 125.5. A December index level of 128.3 had been expected [...]

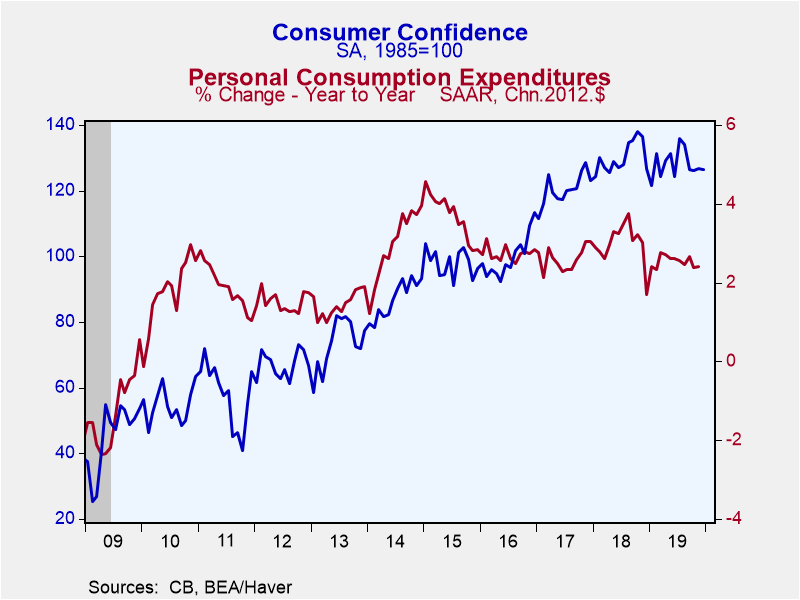

The Conference Board's Consumer Confidence Index eased slightly in December, by 0.2% to 126.5 (1985=100), but November was revised upward to 126.8 from its originally reported 125.5. A December index level of 128.3 had been expected in the Action Economics Forecast Survey. Across all of 2019, the level of confidence was basically unchanged, just edging down 0.1% from December 2018. During the last 20 years, there has been 70% correlation between the level of confidence and the y/y change in real consumer spending.

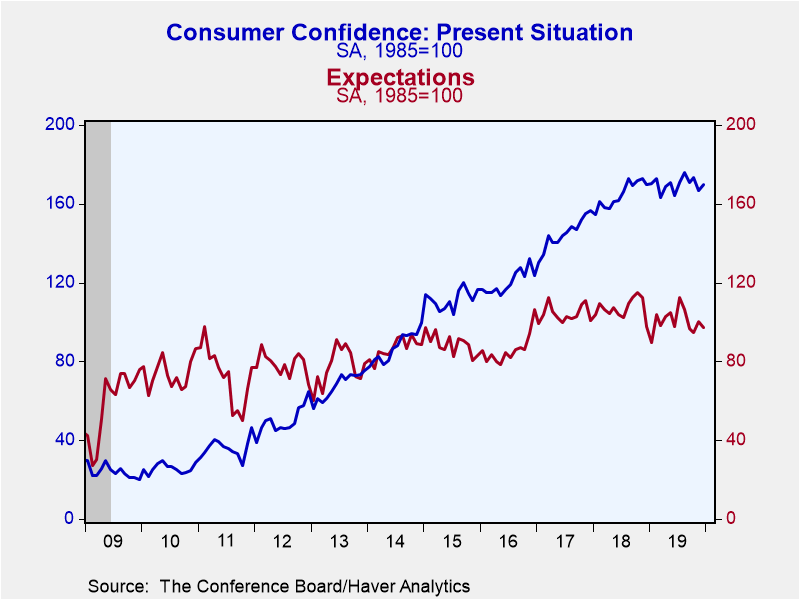

The decrease in confidence in December encompassed a 2.0% increase in the present situation reading accompanied by a 2.9% decline in expectations. The present situation index of 170.0 was 0.1% above December 2018, while the expectations index was 97.4, down 0.3% from the year ago.

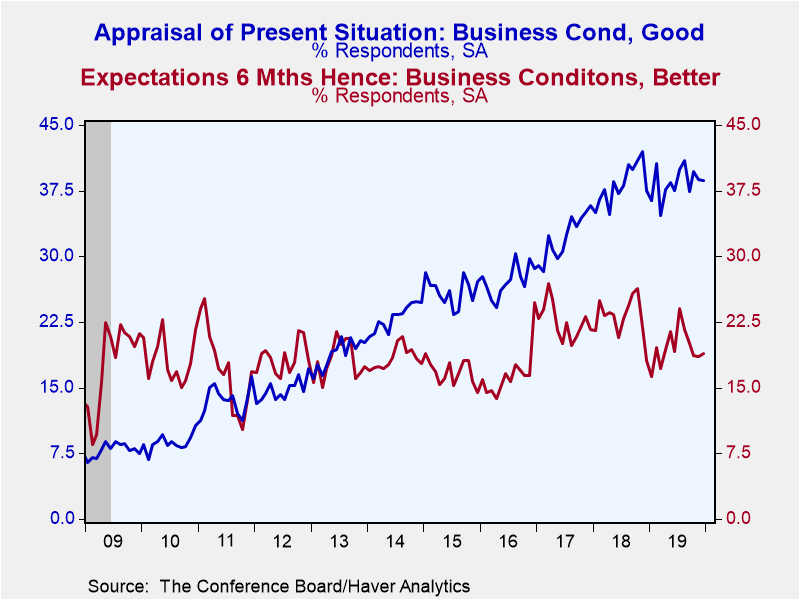

Within the present situation assessment, the share of respondents believing business conditions are good was 38.7%, down marginally from a revised 38.8% in November (originally reported at 40.2%). Jobs are seen as plentiful by 47.0% of respondents, up from 44.0% in November, while 13.1% believe jobs are hard to get, up modestly from 12.4% in November.

There was little change in the expectations for conditions six months from now. Overall business conditions are expected to be the "same" by 71.8% of respondents in December versus 70.0% the previous month; just 9.3% expect business conditions to worsen. Similarly, 69.8% look for the overall employment situation to remain the "same" versus 70.1% in November. And 71.2% believe incomes will be the "same," following 70.9% in November.

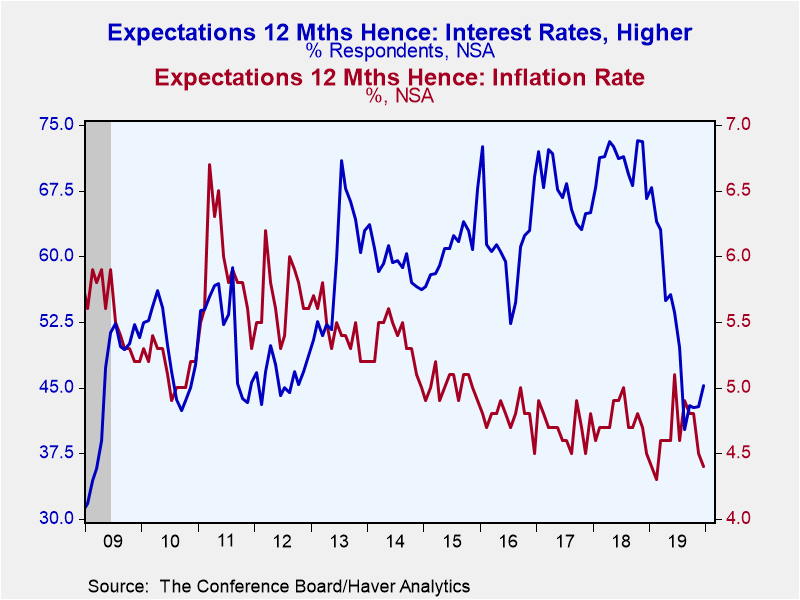

Respondents in the December survey estimate that inflation will be 4.4% over the next 12 months, down minimally from 4.5% in November. The share expecting higher interest rates did increase to 45.3% from 42.9%; those looking for lower rates decreased to 17% from 21.0%. The share expecting stock prices to rise declined to 37.7% from November's 39.8%, but these two months are up noticeably from 31.9% and 31.8% in September and October, respectively. The portion currently expecting a stock market correction did increase in the December data to 29% from 26.3% in November, but these are the smallest since July's 22.3%.

The number of participants planning to buy a house during the next six months is 6.0% in December, up from November's relative low of 4.7%, which was indeed the lowest since mid-2015. Major appliance purchases are planned by 48.6% in December, down from 49.3% the prior month and the fifth consecutive monthly decrease in that portion; this reading frequently swings up and down, so even though the share isn't small, it does seem to be forming a downtrend.

The confidence reading amongst survey respondents under age 35 had weakened 8.1% in November (revised from -10.9%), but it rebounded by 8.2% in this latest survey (-0.6% y/y). Confidence amongst respondents aged 35-54 increased 0.9% (-7.8% y/y), evidently stabilizing after three declines in four months. Confidence amongst respondents over age 55 fell 3.1% (+8.1% y/y) after November's 8.3% increase.

The Consumer Confidence data are available in Haver's CBDB database. The total indexes appear in USECON, and the market expectations are in AS1REPNA.

| Conference Board (SA, 1985=100) | Dec | Nov | Oct | Dec Y/Y % | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 126.5 | 126.8 | 126.1 | -0.1 | 130.1 | 120.5 | 99.8 |

| Present Situation | 170.0 | 166.6 | 173.5 | 0.1 | 164.8 | 144.8 | 120.3 |

| Expectations | 97.4 | 100.3 | 94.5 | -0.3 | 107.0 | 104.3 | 86.1 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 128.7 | 118.9 | 129.4 | -0.6 | 133.7 | 130.2 | 122.4 |

| Aged 35-54 Years | 125.3 | 124.2 | 130.7 | -7.8 | 132.2 | 123.5 | 106.2 |

| Over 55 Years | 126.7 | 130.8 | 120.8 | 8.1 | 126.3 | 112.9 | 84.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates