Global| Aug 25 2020

Global| Aug 25 2020U.S. Consumer Confidence Falls Again in August

Summary

• Deterioration in confidence measures widespread. • Current conditions reverse July improvement. • Younger people see largest decline in confidence. The Conference Board's monthly consumer confidence survey showed another decline in [...]

• Deterioration in confidence measures widespread.

• Current conditions reverse July improvement.

• Younger people see largest decline in confidence.

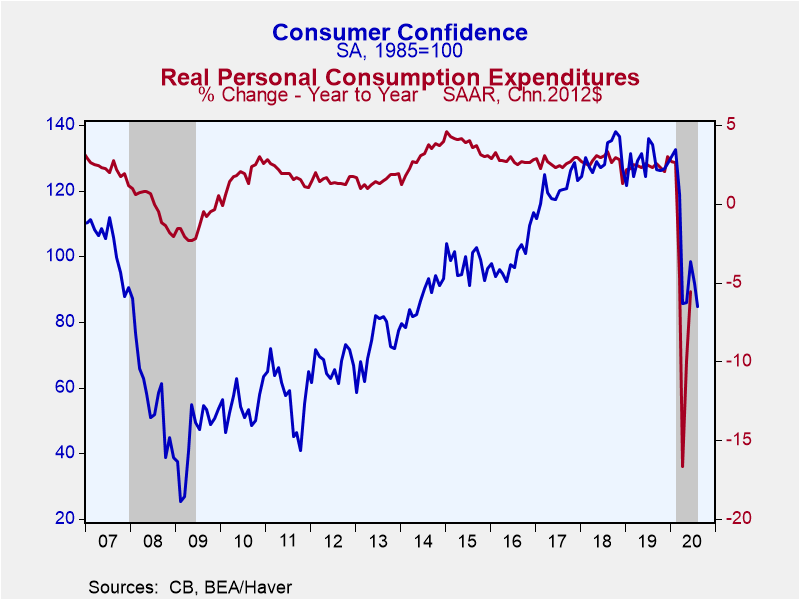

The Conference Board's monthly consumer confidence survey showed another decline in August and a slight downward revision to July's result. The August index was 84.8 (1985=100), 7.5% below July's 91.7, which was lowered from 92.6. The August level was the lowest since May 2014. According to the Action Economics Forecast Survey, forecasters expected a modest decrease to 93.1. Over the last 25 years, there has been a 58% correlation between the level of confidence and the y/y change in real consumer spending.

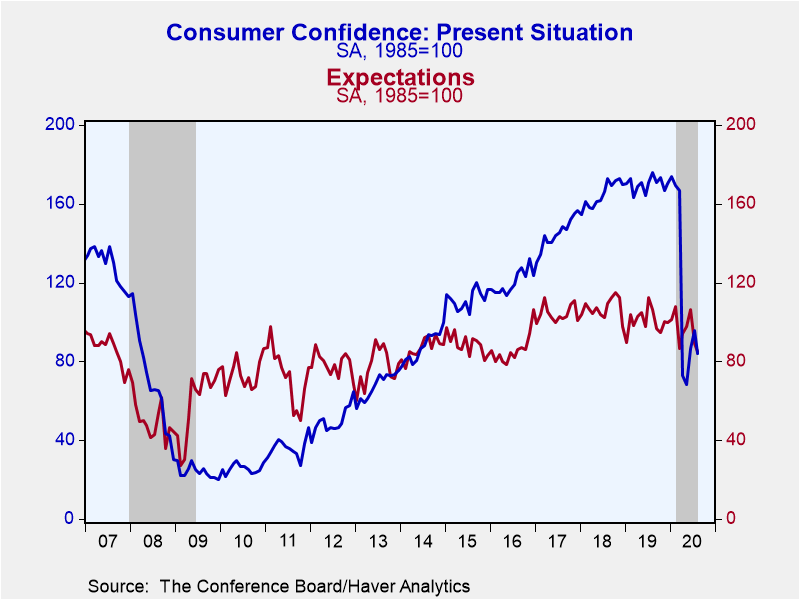

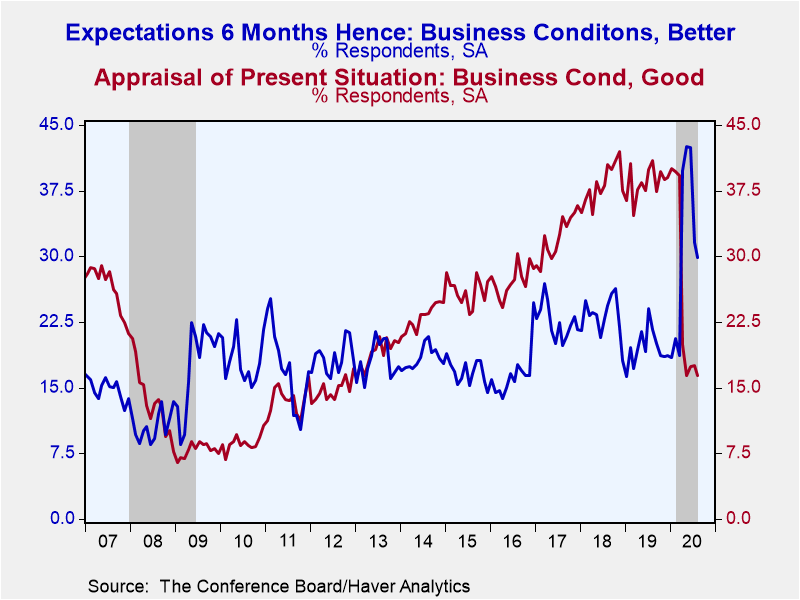

The index of expected conditions in six months for income, business activity and labor markets fell 4.2% in August, while the July level was revised to a decline of 16.2% from 13.8% reported last month. The number of survey respondents who look for improvements in each income, business conditions and employment decreased in August, while the numbers looking for deterioration in those conditions all increased slightly.

The index of the present situation dropped 12.2% in August, more than reversing a 10.6% improvement in July. The July number reflected a modest upward revision from an 8.7% increase reported last month. The August decrease reflected an increase in the share of respondents assessing business conditions as "bad" while the share believing conditions are "normal" went down and those seeing "good" conditions was little changed. Similarly, on the negative side, the share of respondents believing jobs are "hard to get" rose from 20.1% to 25.2%. However, this was partly offset by a decrease in those seeing jobs as "not so plentiful" to 53.3% from 57.6%. Jobs are viewed as plentiful by 21.5% of respondents in August, almost the same as July's 22.3%.

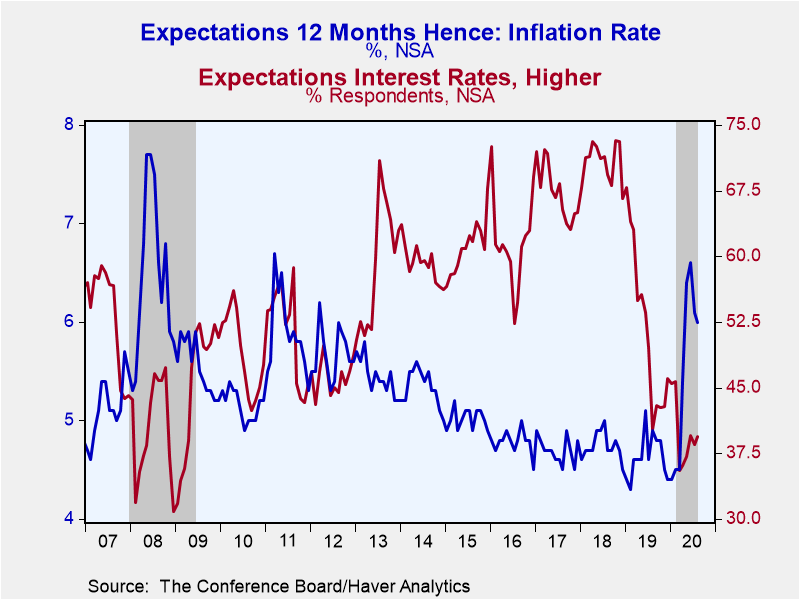

Expectations for the inflation rate in twelve months were little changed in August at 6.0% versus 6.1% in Julye. People thought it was running at 5.4% in April and in the 4.4-4.5% range before then, that is, before the COVID-19 situation impacted the economy. Just over three-quarters of survey respondents, 75.9%, believe interest rates will be the same (36.5%) or higher (39.4%), while those looking for rates to decline remained low at 24.1%. Plans to buy a house, new or lived in, decreased in August to 5.9% of respondents from 7.7% in July, despite continuing historically low mortgage rates. Fewer people also report they plan to buy a car; August saw 9.7% expecting to buy a new or used car, down from 12.5% in July. Fewer people also plan to buy a major appliance, 44.8% in August versus 48.2% in July.

By age group, the index of confidence among those under 35 fell 20.6% in August, a larger decline than July's 16.0%; The August index for younger consumers is down 50.1% from August 2019. Those 36-54 saw a decline of 7.8%, just slightly worse than July's 6.5% decrease, but down 36.8% from a year ago. And those over age 55 saw confidence go down "just" 3.6%, almost the same as July's 3.7% reduction and down 30.1% from August 2019.

The Consumer Confidence data are available in Haver's CBDB database. The total indexes appear in USECON, and the market expectations are in AS1REPNA.

| Conference Board (SA, % Chg.) | Aug | Jul | Jun | Aug Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | -7.5 | -6.7 | 14.4 | -36.8 | -1.4 | 8.0 | 20.7 |

| Present Situation | -12.2 | 10.6 | 26.8 | -52.2 | 3.1 | 13.8 | 20.3 |

| Expectations | -4.2 | -16.2 | 8.7 | -19.9 | -6.0 | 2.6 | 21.1 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | -20.6 | -16.0 | 32.1 | -50.1 | 0.3 | 2.7 | 6.4 |

| Aged 35-54 Years | -7.8 | -6.5 | 8.1 | -38.7 | -1.1 | 7.0 | 16.4 |

| Over 55 Years | -3.6 | -3.7 | 14.5 | -30.1 | -1.9 | 11.8 | 33.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates