Global| Dec 27 2017

Global| Dec 27 2017U.S. Consumer Confidence Slackens with Softer Expectations

Summary

The Conference Board Consumer Confidence Index fell 5.1% in December (7.8% y/y) to 122.1 following a downward revised 1.9% rise in November. This move contrasted with the Action Economics survey forecast of 128.0. The indexes are [...]

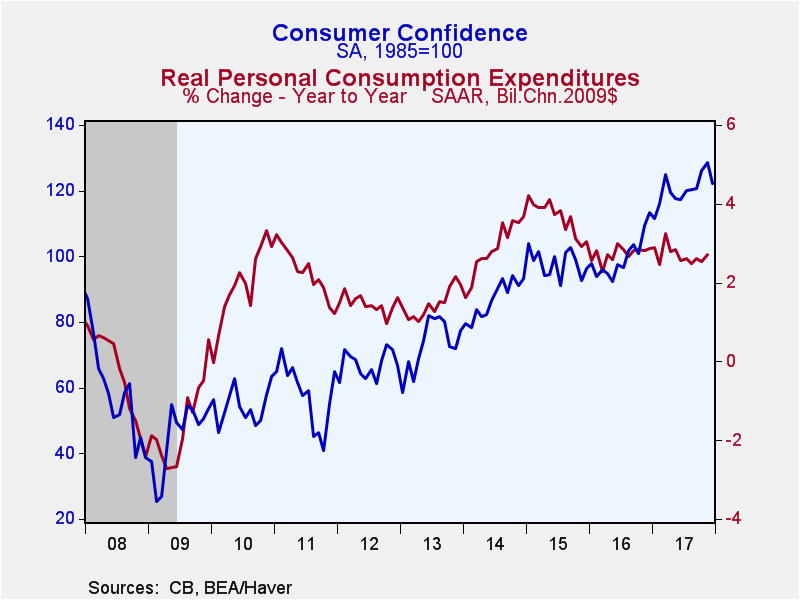

The Conference Board Consumer Confidence Index fell 5.1% in December (7.8% y/y) to 122.1 following a downward revised 1.9% rise in November. This move contrasted with the Action Economics survey forecast of 128.0. The indexes are based on 1985=100. During the past thirty years, there has been a 70% correlation between the level of consumer confidence and the y/y change in real PCE.

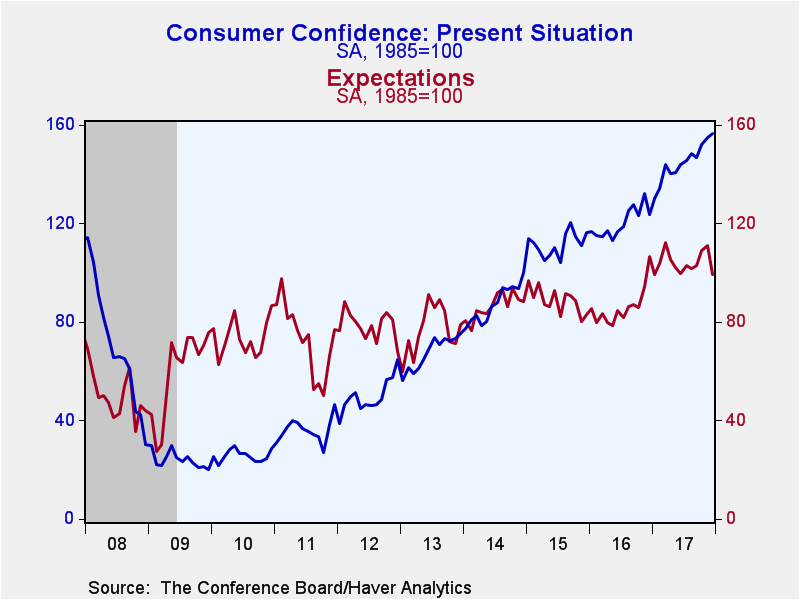

The decline in overall confidence reflected a 10.7% drop (-6.9% y/y) in the expectations index to 99.1. The present situation index reading actually edged higher by 1.1% (16.6% y/y) to 156.6.

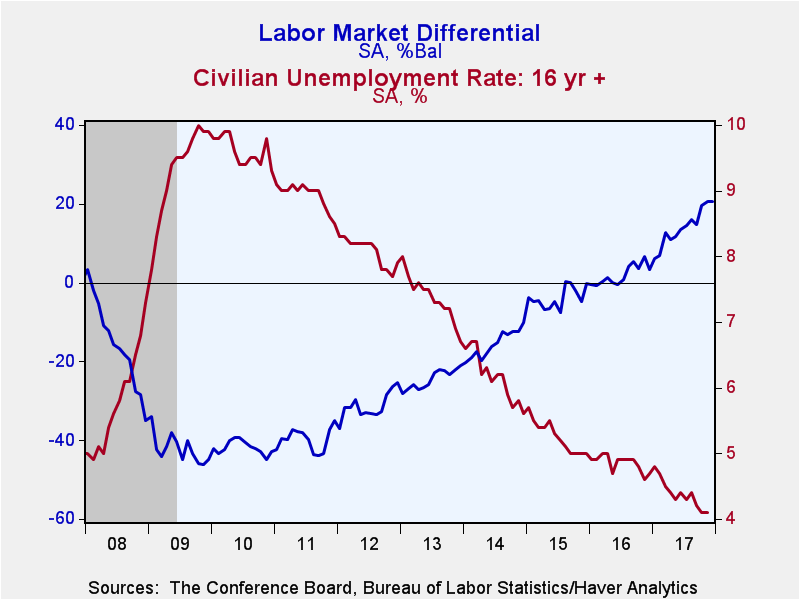

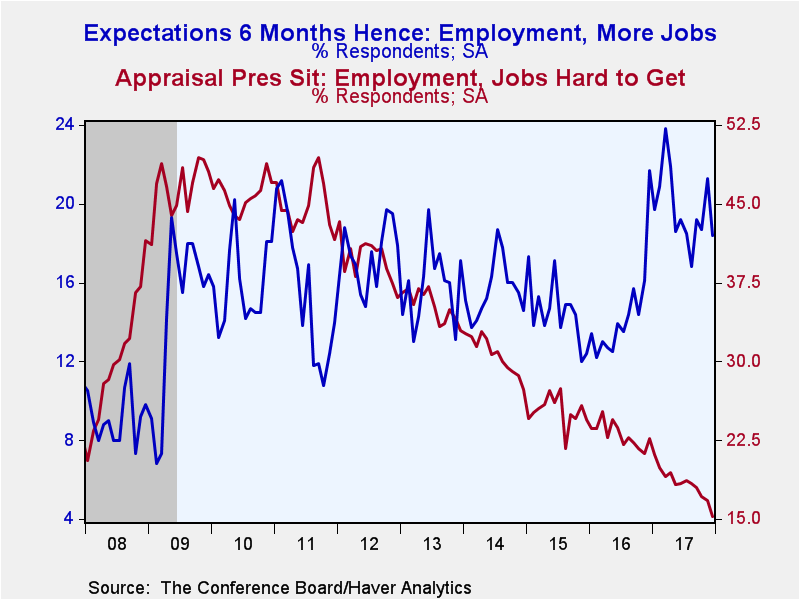

There was little movement in the assessment of overall business conditions. The percentage of respondents indicating conditions are "good" rose from November's 35.0% to 35.2%, the highest level since December 2000. The percentage saying business conditions are "bad" edged down from 12.3% in November to 12.1%, the lowest since May 2001. The labor market readings weren't so positive in December: 35.7% said jobs are "plentiful", down from 37.5% in November. Those saying jobs are "hard to get" also decreased this month, to 15.2% from November's 16.8% The net jobs assessment thus eased very slightly to +20.5% from +20.7%. These readings remain the most favorable since July 2001 The differential is 97% inversely related to the unemployment rate.

The decline in overall expectations is seen in the decrease in the percentage expecting business conditions to improve over the next six months to 20.2% from 23.1% in November. Those expecting more jobs also decreased, to 18.4% from November's 21.3%. Incomes, though, are seen to improve by a larger percentage of respondents, 22.3% versus 20.3% in November.

Expectations for the inflation rate in twelve months rose from November's 4.5% to 4.8%, while the percentage expecting higher interest rates over the next twelve months eased slightly m/m to 64.3% from 64.9% in November. Those looking to buy a home in the next six month rose to 7.6%, touching the highest since July 2006, that is, in the early stages of the 2006-08 housing market crash.

By age group, confidence decreased the most among individuals over age 55, down 10.2% in December, though this basically reversed a jump in November. Year/year, there was still a gain of 10.8%. Confidence among those aged 35-54 edged down 1.3% in the month and was 6.9% above a year ago. Younger respondents, under age 35, saw confidence ease 2.9% in December but still up 4.6% year/year.

The Consumer Confidence data is available in Haver's CBDB database. The total indexes appear in USECON, and the market expectations are in AS1REPNA.

| Conference Board (SA, 1985=100) | Dec | Nov | Oct | Y/Y % | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 122.1 | 128.6 | 126.2 | 7.8 | 99.8 | 98.0 | 86.9 |

| Present Situation | 156.6 | 154.9 | 152.0 | 26.8 | 120.3 | 111.7 | 87.4 |

| Expectations | 99.1 | 111.0 | 109.0 | -6.9 | 86.1 | 88.8 | 86.6 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 130.1 | 134.0 | 127.2 | 4.6 | 122.4 | 116.0 | 106.6 |

| Aged 35-54 Years | 125.1 | 126.8 | 135.0 | 6.9 | 106.2 | 103.9 | 92.4 |

| Over 55 Years | 114.9 | 128.0 | 116.1 | 10.8 | 84.6 | 84.1 | 73.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates