Global| Feb 07 2020

Global| Feb 07 2020U.S. Consumer Credit Issuance Continues Monthly Zig Zag, Annual Growth Stable

Summary

• Consumer credit jumped $22.1 billion in December. • Credit growth for 2019 was fairly steady at 4.7% versus 4.8% in 2018. Consumer credit outstanding increased $22.1 billion (4.7% year-on-year) to $4.197 trillion in December, [...]

• Consumer credit jumped $22.1 billion in December.

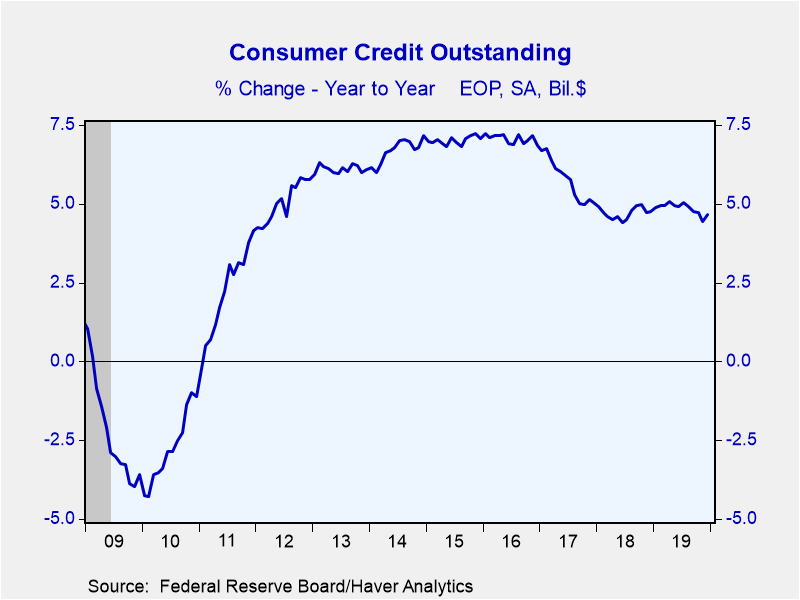

• Credit growth for 2019 was fairly steady at 4.7% versus 4.8% in 2018.

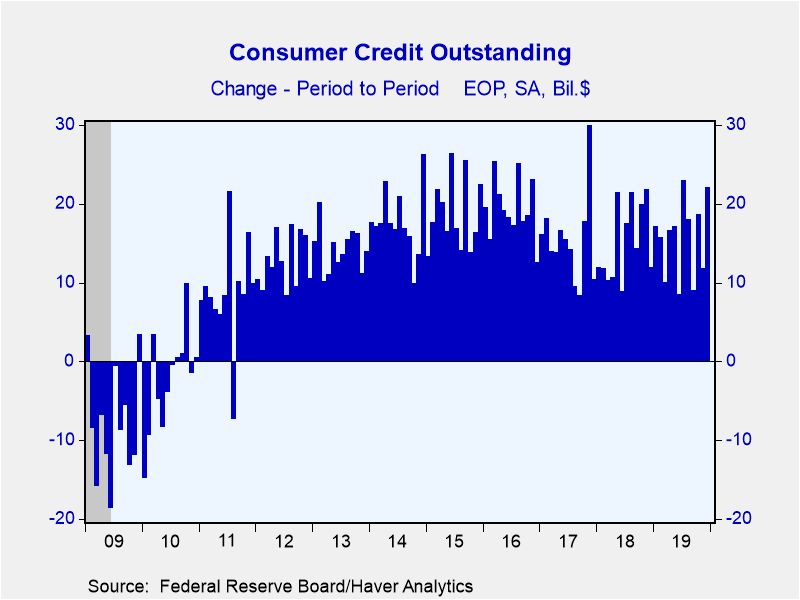

Consumer credit outstanding increased $22.1 billion (4.7% year-on-year) to $4.197 trillion in December, following a downardly revised $11.8 bil. in November (was $12.5 bil.). A $14.4 billion gain had been expected by the Action Economics Forecast Survey.

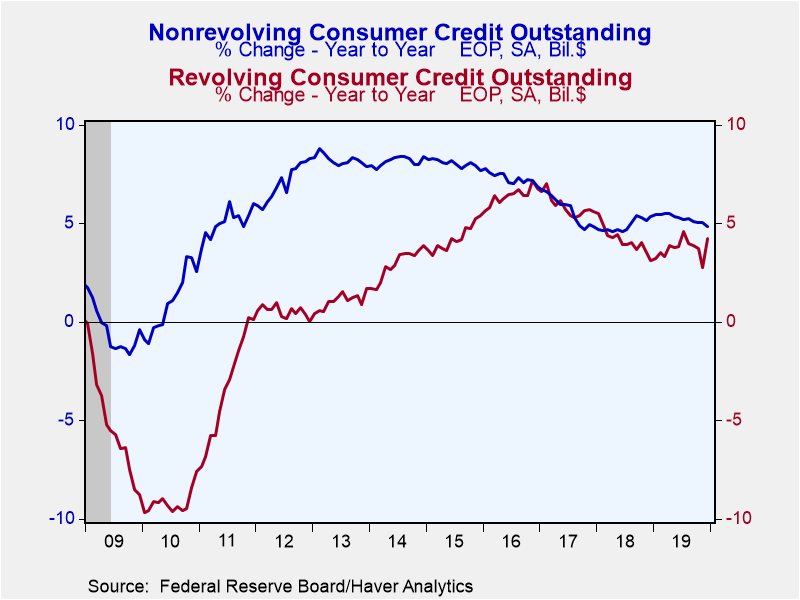

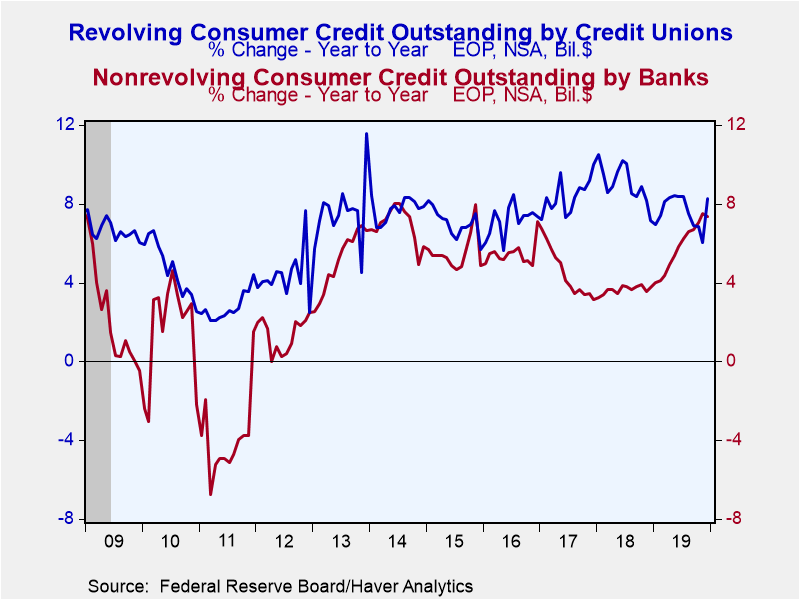

Nonrevolving credit usage grew $9.4 billion (4.8% y/y) during December, down from $14.7 bil. in November. Borrowing from the federal government, which issues over 40% of nonrevolving credit, grew 6.7% y/y. Depository institutions (25% of credit) gained 7.4% y/y. Both of these sectors’ share of issuance continues grow at the expense of finance and credit unions.

Revolving consumer credit balances grew $12.6 billion (4.2% y/y) in December, after falling $2.9 billion in November. Credit provided by depository institutions, which makes up 90% of revolving balances, grew 4.4% y/y.

During 2019, student loan debt increased 4.7% Q4/Q4, somewhat slower than the 5.3% growth 2018. Motor vehicle financing gained 3.5% Q4/Q4, similar to the previous year.

These Federal Reserve Board figures are break-adjusted and calculated by Haver Analytics. The breaks in the series in 2005, 2010 and 2015 are the result of the incorporation of the Census and Survey of Finance Companies, as well as changes in the seasonal adjustment methodology.

The consumer credit data are available in Haver's USECON database. The Action Economics figures are contained in the AS1REPNA database.

| Consumer Credit Outstanding (M/M Chg, SA) | Dec | Nov | Oct | Dec % y/y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Total ($ bil) | 22.06 | 11.80 | 18.69 | 4.7 | 4.7 | 4.8 | 5.1 |

| Nonrevolving | 9.42 | 14.73 | 11.26 | 4.8 | 4.8 | 5.4 | 4.9 |

| Revolving | 12.64 | -2.92 | 7.43 | 4.2 | 4.2 | 3.1 | 5.6 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates