Global| May 15 2014

Global| May 15 2014U.S. Consumer Price Index Remains Firm

Summary

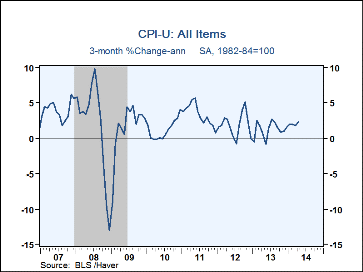

Consumer prices increased 0.3% (2.0% y/y) in April, the largest increase since last June. The number equaled consensus expectations in the Action Economics Forecast Survey. The pick-up in the year-on-year change from 1.5% in March to [...]

Consumer prices increased 0.3% (2.0% y/y) in April, the largest increase since last June. The number equaled consensus expectations in the Action Economics Forecast Survey. The pick-up in the year-on-year change from 1.5% in March to this period's 2.0% reflected the firm monthly increase, but also a decline in April last year, mostly in energy. Consumer prices excluding food and energy rose 0.2% in April (+1.6% y/y), the same as in March but ahead of consensus expectations for a 0.1% gain.

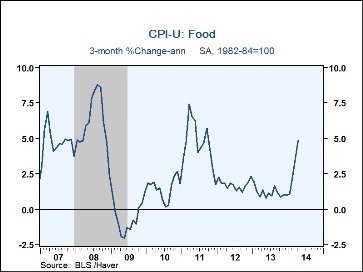

Food prices rose 0.4% for a third consecutive month (1.9% y/y), Meats -- beef, pork, lamb and "other" -- surged 2.9% in April; that's 8.4% year-on-year. Poultry prices dropped 1.6%, taking their year-on-year increase down to 1.3% from 3.0% in March.. Egg prices had a more moderate 0.5% increase in April, bringing their year-on-year move to 9.3% from 9.9% in March. Cereal and bakery items saw largely unchanged prices in April (-0.1% y/y), with cereals down 0.8% and bakery goods up 0.5%. Dairy costs slowed somewhat to a 0.5% rise (+2.8% y/y) from 1.0% in March, and fruit & vegetable prices also rose 0.5% last month (0.7% y/y). The cost of eating out maintained its recent 0.3% monthly increases (2.2 y/y).

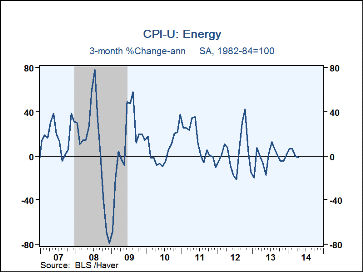

Energy prices, which had been down modestly for two months, picked up to a 0.3% rise in April (+3.3% y/y). Motor fuels -- nearly all gasoline -- advanced 2.3% after two consecutive 1.7% monthly declines; those prices were up 2.5% from a year ago. Fuel oil prices dropped 5.4% last month and were up 4.7% year-on-year. Among energy services, electricity prices fell 2.6% in the month; according to BLS, this reflects special "climate credits" in California, a one-time event. Natural gas delivered by utilities had been up strongly in the prior three months; it steadied in April, rising just 0.3%, making an 11.8% year-on-year gain.

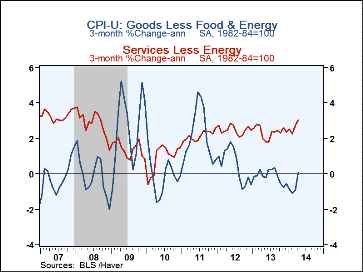

Consumer prices for goods less food and energy edged up 0.1% (-0.3% y/y). Household furnishings and supplies fell 0.3% and were off 2.3% year-on-year. Apparel prices were basically unchanged in the month and up 0.5% y/y. New vehicle prices rose 0.3%, these have moved little since late 2012 and are up a mere 0.4% from a year ago. Used cars & trucks were up 0.5% in April after March's 0.4% rise, but previous weakness means they were still up just 0.2% year-on-year. Medical care commodities were up 0.3% in April, reversing March's 0.3% decline and putting them up 1.6% y/y.

Core services prices were up 0.3% (2.6% y/y) for a second consecutive month. Shelter costs (32% of the CPI) increased 0.2% (2.8% y/y), reflecting a similar pattern in owners equivalent rent of primary residences (+2.6% y/y). Medical care services prices were up 0.3% (2.7% y/y). Physicians' services firmed to a 0.3% rise in April (+1.4% y/y) from 0.2% in March, while hospital charges slowed to a 0.5% rise (6.1% y/y) from 0.8% in March. Transportation services, including public transportation and personal vehicle maintenance and insurance charges, saw a 0.7% price rise (+2.3% y/y), impacted by a 2.6% advance in airline fares; those had been weak, however, and their year-to-year change is -0.2%.

The consumer price data is available in Haver's USECON database while detailed figures can be found in CPIDATA. The expectations figure is from Action Economics and is found in the AS1REPNA database.

| Consumer Price Index (%) | Apr | Mar | Feb | Apr Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Total | 0.3 | 0.2 | 0.1 | 2.0 | 1.5 | 2.1 | 3.2 |

| Total less Food & Energy | 0.2 | 0.2 | 0.1 | 1.8 | 1.8 | 2.1 | 1.7 |

| Goods less Food & Energy | 0.1 | 0.0 | -0.1 | -0.3 | -0.0 | 1.3 | 1.3 |

| Services less Energy | 0.3 | 0.3 | 0.2 | 2.6 | 2.4 | 2.4 | 1.8 |

| Food | 0.4 | 0.4 | 0.4 | 1.9 | 1.4 | 2.6 | 3.7 |

| Energy | 0.3 | -0.1 | -0.5 | 3.3 | -0.7 | 0.9 | 15.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.