Global| May 25 2012

Global| May 25 2012U.S. Consumer Sentiment Regains Pre-Recession Levels

Summary

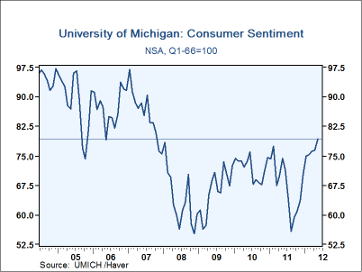

The University of Michigan's Index of Consumer Sentiment for rose further in its Final May reading to 79.3 (Q1 1966 = 100) from 77.8 in mid-month and 76.4 in April. This put it at the highest level since October 2007, before the [...]

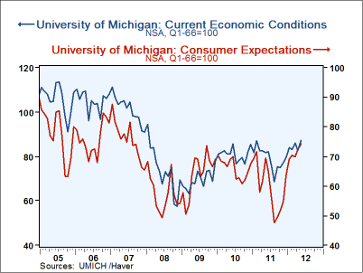

The University of Michigan's Index of Consumer Sentiment for rose further in its Final May reading to 79.3 (Q1 1966 = 100) from 77.8 in mid-month and 76.4 in April. This put it at the highest level since October 2007, before the recent recession began. Forecasters had looked for a continuation at the mid-month 77.8 level, so the actual is noticeably better both in an absolute sense and compared to expectations. Interestingly, the reading on current economic conditions, which had driven the gain in the early-month move, eased a bit in the final read, standing at 87.2, down a tick from the 87.3 before, although still up nicely from 82.9 in April. In contrast, the consumer expectations index, which had dipped to 71.7 in mid-May, rebounded to 74.3 in the final report, its highest since July 2007.

The Reuters/University of Michigan survey data are not seasonally adjusted. The readings are based on telephone interviews with over 300 households. Data can be found in Haver's USECON database. The expectations figure is from Action Economics and is found in Haver's AS1REPNA database.

| University of Michigan (Q1'66 = 100) |

May Final | Mid-May | Apr | Mar | May Y/Y % |

2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|

| Consumer Sentiment | 79.3 | 77.8 | 76.4 | 76.2 | 6.7 | 67.3 | 71.8 | 66.3 |

| Current Economic Conditions | 87.2 | 87.3 | 82.9 | 86.0 | 6.5 | 79.1 | 80.9 | 69.6 |

| Consumer Expectations | 74.3 | 71.7 | 72.3 | 69.8 | 6.9 | 59.8 | 66.0 | 64.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates