Global| Mar 12 2021

Global| Mar 12 2021U.S. Credit Demand Picks Up in Q4, but Still Much Less than COVID Period in Q1 and Q2

Summary

• Total borrowing in U.S. economy = 24.3% of GDP in Q4, up from 15.4% in Q3. • Federal government biggest borrowing sector, at $2.5 trillion in Q4 (SAAR). • Financial institutions were next largest, borrowing $1.1 trillion in Q4; had [...]

• Total borrowing in U.S. economy = 24.3% of GDP in Q4, up from 15.4% in Q3.

• Federal government biggest borrowing sector, at $2.5 trillion in Q4 (SAAR).

• Financial institutions were next largest, borrowing $1.1 trillion in Q4; had paid down debt in Q2 and Q3.

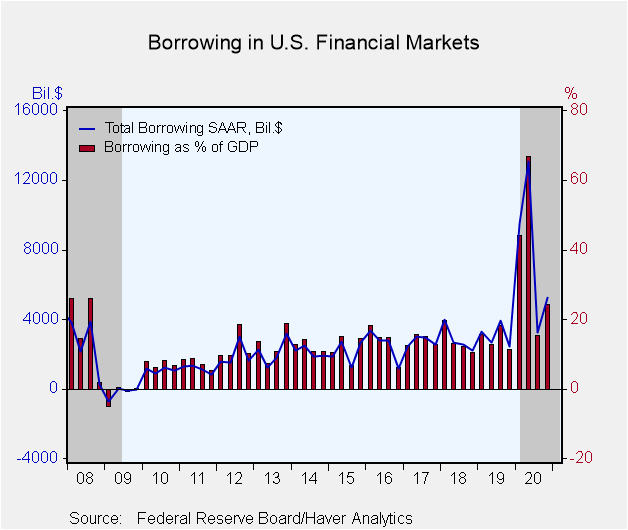

Borrowing in U.S. financial markets and institutions picked up in the fourth quarter of 2020 from its third quarter pace, and together with that third quarter amount, looked that it might be re-establishing a more normal sustainable volume. Businesses, governments, households, foreign borrowers and financial institutions together borrowed at a seasonally adjusted annual rate of $5.225 trillion, equal to 24.3% of GDP. The Q3 amount was $3.265 trillion or 15.4% of GDP, revised moderately from $2.888 trillion reported back in December. These amounts, while appearing quite large – and indeed are -- they are well down from the first half of 2020, when borrowing totaled $9.523 trillion in Q1 and $13.043 trillion in Q2. [Note that all the dollar figures quoted here for the borrowing amounts are seasonally adjusted annual rates.]

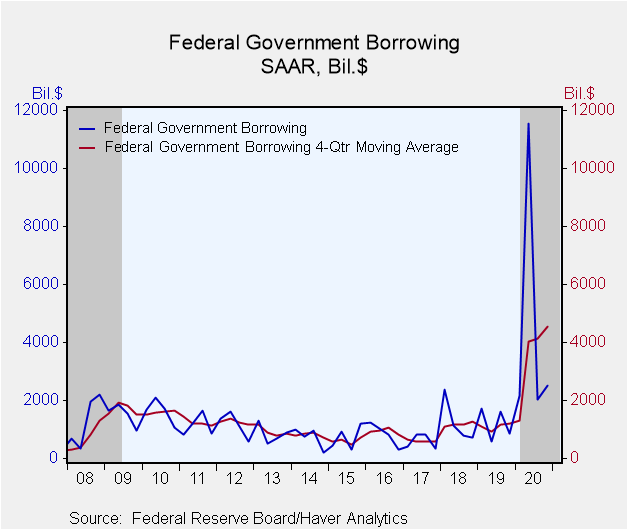

The federal government had been responsible for the vast majority of the big Q2 amount, when it was raising funds for the CARES Act distributions and other COVID-related programs. That quarter it had borrowed $11.535 trillion out of a total of $13.043 trillion in new debt issuance. In Q3 and Q4, by contrast, it needed just $2.045 trillion and $2.513 trillion, respectively. These were still the largest sectoral borrowing needs in those two quarters.

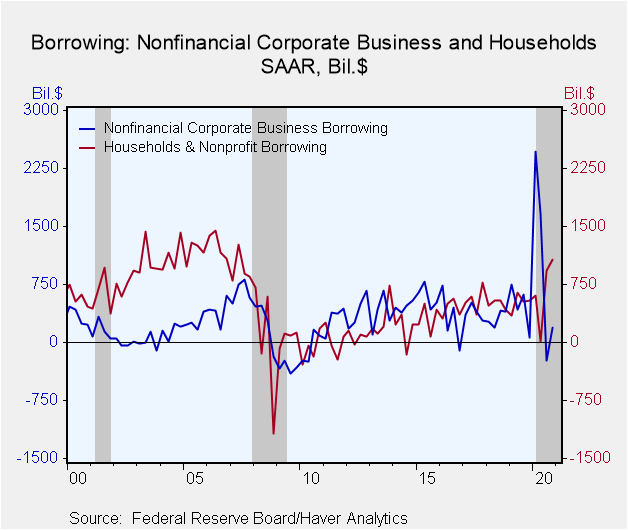

Corporate businesses had borrowed sizable amounts in Q1 and Q2, $2.474 trillion and $1.651 trillion. As we pointed out before, though, in Q3 companies paid down debt, now estimated at $240 billion, and then they borrowed just $189 billion in Q4.

As we’ve also noted before, household borrowing has been impacted by record low home mortgage rates. Relatively speaking, this has encouraged the largest amounts of mortgage borrowing since the period just before the Great Recession in 2008 and 2009. In Q3 2020, the amount of one-to-four family home mortgages increased at an annual rate of $608 billion and then $559 billion in Q4. These data, which are net changes in debt amounts, do not show separately the amount of mortgage refinancing, which are likely quite sizable at present.

Consumer credit has grown quite modestly recently, with Q3 up $85 billion and Q4 up $95 billion. These do contrast, however, with the net paydown of $234 billion in Q2.

Financial institutions borrowed notably in Q4, $1.106 trillion, after paying debt down in Q2 and Q3. Those paydowns, however, followed a record amount of borrowing by these institutions in Q1, $4.020 trillion

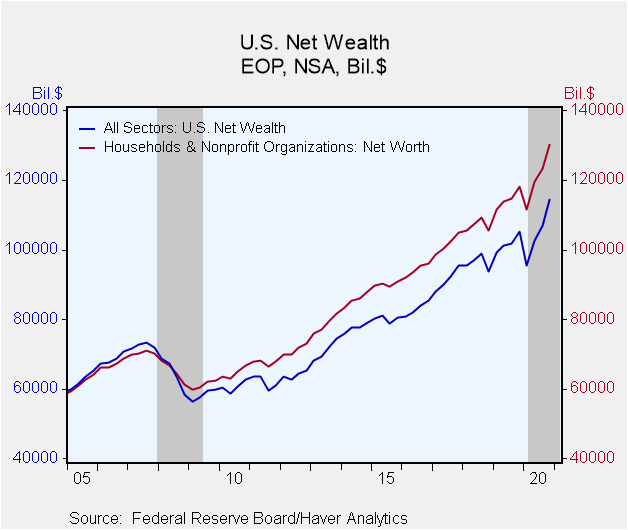

Net wealth in the total U.S. economy increased $7.419 trillion (quarterly rate, not annualized or seasonally adjusted) in Q4, following an increase of $4.107 trillion in Q3. The vast majority of the Q4 gain was the increase in equity values, $6.703 trillion.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database as well as in FFUNDS.

| Financial Accounts (SAAR, Bil.$) | Q4'20 | Q3'20 | Q2'20 | Q1'20 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Total Borrowing* | 5,225 | 3,265 | 13,043 | 9,523 | 7,764 | 3,091 | 2,861 |

| % of GDP | 24.3 | 15.4 | 66.8 | 44.2 | 37.1 | 14.4 | 13.9 |

| Federal Government | 2,513 | 2,045 | 11,535 | 2,168 | 4,565 | 1,191 | 1,258 |

| Households | 1,070 | 924 | 11 | 604 | 652 | 517 | 498 |

| Nonfinancial Corporate Business | 189 | -240 | 1,651 | 2,474 | 1,019 | 467 | 317 |

| Financial Sectors | 1,106 | -111 | -1,388 | 4,020 | 907 | 372 | 347 |

| Foreign Sector | 348 | 137 | 202 | -386 | 75 | 253 | 198 |

*Previously called "credit market borrowing" and includes debt securities plus loans. The total here includes borrowing by noncorporate business and state & local governments, not shown separately.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.