Global| Sep 19 2013

Global| Sep 19 2013U.S. Current Account Deficit Diminishes to 4-Year Low

Summary

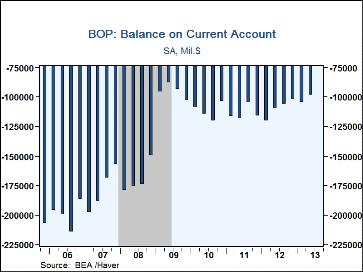

The U.S. current account deficit decreased In Q2 to $98.9 billion from $104.9 billion in Q1. Q2 had the smallest such deficit since Q3 2009. It represents 2.4% of GDP, and that ratio is the smallest since Q2 1998, that is, 15 years [...]

The U.S. current account deficit decreased In Q2 to $98.9 billion from $104.9 billion in Q1. Q2 had the smallest such deficit since Q3 2009. It represents 2.4% of GDP, and that ratio is the smallest since Q2 1998, that is, 15 years ago. A consensus forecast did anticipate the smaller result this time, calling for $97 billion. Exports of goods and services grew just 1.1% in Q2 (+1.9% y/y), while imports of goods and services edged up just 0.2% and were down 1.1% y/y.

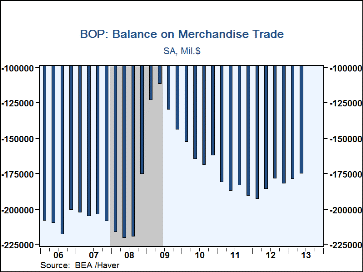

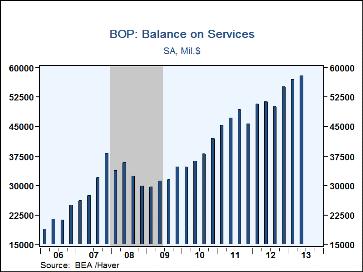

Goods exports rose 1.0% (+0.7% y/y). Services exports increased 1.2% (4.6% y/y). Travel exports gained 1.3% q/q (+9.5% y/y) but passenger fares fell 0.4% (+1.1% y/y). Imports of goods increased marginally in Q2 and were down 1.4% y/y. Service imports rose 0.9% (+0.6% y/y), as travel imports were up 1.5% (+1.4% y/y).

Balance of Payments data are in Haver's USINT database, with summaries available in USECON. The expectations figure is in the AS1REPNA database.

| US Balance of Payments SA | Q2'13 | Q1'13 | Q4'12 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|

| Current Account Balance ($ Bil.) | -98.9 | -104.9 | -102.3 | -440.1 | -457.7 | -449.5 |

| Deficit % of GDP | 2.8% | 2.8% | 3.0% | 2.7% | 2.9% | 3.0% |

| Balance on Goods ($ Bil.) | -175.7 | -179.5 | -182.4 | -741.5 | -744.1 | -650.2 |

| Exports | -0.7% | -0.2% | 1.4% | 4.4% | 16.1% | 20.5% |

| Imports | 0.0% | -0.5% | 0.4% | 2.8% | 15.5% | 22.7% |

| Balance on Services ($ Bil.) | 57.9 | 56.8 | 55.0 | 206.8 | 187.3 | 150.8 |

| Exports | 1.2% | 0.0% | 1.3% | 5.2% | 11.0% | 9.2% |

| Imports | -0.9% | -0.8% | -0.3% | 3.0% | 6.1% | 6.0% |

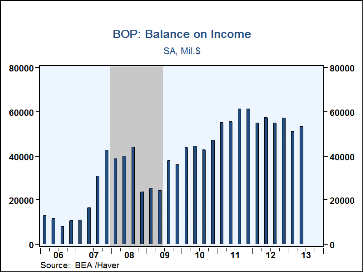

| Balance on Income ($ Bil.) | 53.1 | 50.9 | 57.0 | 223.9 | 232.6 | 177.7 |

| Unilateral Transfers ($ Bil.) | -34.2 | -33.1 | -31.9 | -129.7 | -133.5 | -127.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.