Global| Mar 16 2011

Global| Mar 16 2011U.S. Current Account Deficit Narrows in Q4 as Exports Rebound

Summary

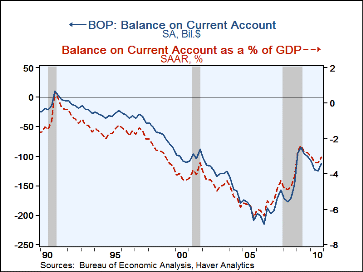

The U.S. current account deficit narrowed in Q4 to $113.3B from a revised $125.5B in Q3. Consensus expectations had called for $110.0B. The ratio to GDP was 3.1%. For 2010 as a whole, the deficit came to $470.2B, or 3.2% of GDP. The [...]

The

U.S. current account deficit narrowed in Q4 to $113.3B from a revised $125.5B in

Q3. Consensus expectations had called for $110.0B. The ratio to GDP was 3.1%.

For 2010 as a whole, the deficit came to $470.2B, or 3.2% of GDP.

The

U.S. current account deficit narrowed in Q4 to $113.3B from a revised $125.5B in

Q3. Consensus expectations had called for $110.0B. The ratio to GDP was 3.1%.

For 2010 as a whole, the deficit came to $470.2B, or 3.2% of GDP.

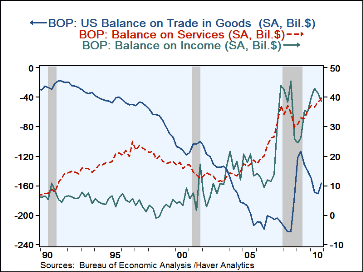

The deficit on goods in Q4 was $156.2B, down from Q3's $170.8B; a resurgence in exports generated the improvement while imports were sluggish, rising just 0.8%. In all of 2010, exports totaled $1,288.7B, up 20.6% from 2009, and imports were $1935.7B, 22.9% above 2009.

The surplus on services was $39.5B in Q4, marginally larger than $38.2B in Q3. This balance moved in a narrow range during the year, averaging $37.8B in the four quarters, making a total of $151.4B for the whole year. Exports of services expanded 8.6% during the year from 2009, with marked turnarounds in travel and passenger fares. Imports of services expanded modestly from quarter to quarter during 2010 and for the year were 6.5% ahead of 2009. "Other transportation", i.e., mainly freight, stood out with a 17.7% bounce after plunging 22.6% during 2009's widespread contraction.

The balance on income eased again in Q4 to $38.6B from $41.3B in Q3 and $42.9B in Q2. The Q4 result reflected a sizable $8.0B increase in US income payments on foreign direct investment; US receipts of direct investment income also gained, but only $4.2B. For all of 2010, the balance on income was a surplus of $163.0B, a new record and a rebound of $41.6B after a deterioration of $30.6B in 2009.

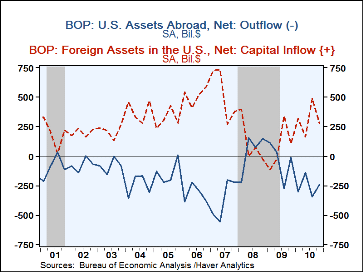

Among financial flows, there was somewhat less movement in Q4 than Q3, with US assets abroad up by $241B compared to $341B in Q3, and foreign flows into the US at $274B, less than Q3's $489B. Foreign investors cut back on all major activities, as they bought fewer securities and less direct investment. On the US side, bank-related flows were smaller in Q4 than in Q3, but direct investment was moderately larger and securities investment about the same. For the year as a whole there were massively larger amounts of international funds flows through the US from both US and foreign investors. US flows abroad came to $1.025Tr and foreign flows here were $1.245Tr.

Balance of Payments data are in Haver's USINT database, with summaries available in USECON.

| US Balance of Payments SA | Q4'10 | Q3'10 | Q2'10 | Year Ago | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|

| Current Account Balance($ Bil.) | -113.3 | -125.5 | -122.7 | -100.9 | -470.2 | -378.4 | -668.9 |

| Deficit % of GDP | 3.1% | 3.4% | 3.4% | 2.8% | 3.2 | 2.7% | 4.6% |

| Balance on Goods ($ Bil.) | -156.3 | -170.8 | -169.1 | -140.1 | -647.1 | -506.9 | -834.7 |

| Exports | 5.8 | 2.2% | 3.4% | 17.8% | 20.6 | -18.1% | 12.5% |

| Imports | 0.8 | 1.8% | 6.3% | 23.3% | 22.9 | -26.4% | 7.9% |

| Balance on Services ($ Bil.) | 39.5 | 38.2 | 36.6 | 35.4 | 151.4 | 132.0 | 135.8 |

| Exports | 1.2 | 3.2% | 0.3% | 7.7% | 8.6 | -6.0% | 9.4% |

| Imports | 0.4 | 2.8% | 0.8% | 6.4% | 6.5 | -7.0% | 8.5% |

| Balance on Income($ Bil.) | 38.6 | 41.3 | 42.9 | 35.1 | 163.0 | 121.4 | 152.0 |

| Unilateral Transfers ($ Bil.) | -35.2 | -34.2 | -33.2 | -31.3 | -137.5 | -124.9 | -122.0 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates