Global| Jun 17 2010

Global| Jun 17 2010U.S. Current Account Deficit Widens in Q1 After Annual Revisions Reduce Earlier Periods; Some Definition Changes, Too

Summary

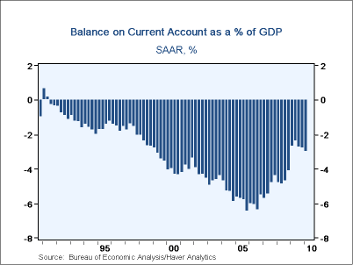

The U.S. current account deficit widened in Q1 to $109.0 billion from a revised $100.9 billion in Q4 2009. The year 2009 was revised from $419.9 billion to $378.4 billion. Relative to GDP, the Q1 number is 3.0%, the widest gap since [...]

The

U.S. current account deficit widened in Q1 to $109.0 billion from a

revised $100.9 billion in Q4 2009. The year 2009 was revised

from $419.9 billion to $378.4 billion. Relative to GDP, the

Q1 number is 3.0%, the widest gap since much bigger numbers prevailing

through Q4 2008. Consensus forecasts had called for $121.9 billion in

Q1. Taking account of annual revisions, the actual widening

in the period from the quarter before was larger, $8.1 billion, than

the $3.5 billion in the forecasts. These revisions also

included some changes in coverage, which we describe below where

applicable.

The

U.S. current account deficit widened in Q1 to $109.0 billion from a

revised $100.9 billion in Q4 2009. The year 2009 was revised

from $419.9 billion to $378.4 billion. Relative to GDP, the

Q1 number is 3.0%, the widest gap since much bigger numbers prevailing

through Q4 2008. Consensus forecasts had called for $121.9 billion in

Q1. Taking account of annual revisions, the actual widening

in the period from the quarter before was larger, $8.1 billion, than

the $3.5 billion in the forecasts. These revisions also

included some changes in coverage, which we describe below where

applicable.

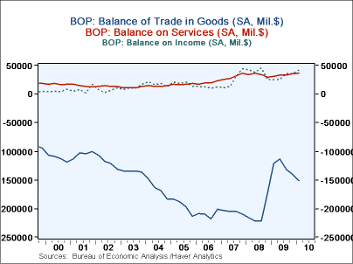

The balance on goods was $151.3 billion in Q1, larger than the $140.1 billion in Q4. Exports of goods gained 5.2%, a third consecutive quarterly increase, putting that total up 19.8% from a year ago. Imports grew 6.1% in the quarter and were up 21.5% from a year ago. The coverage of "goods" has been altered by the annual revisions. It now includes the military goods that had previously been part of services. This change added $3.7 billion to goods in Q4 and $23.0 billion for all of 2009, subtracting commensurately from services. In addition, fuel purchased in domestic and foreign ports by foreign and domestic aircraft and shippers, respectively, has been added to goods; it was previously also included in services. This is a nontrivial shift; purchases by U.S. carriers in foreign terminals added $4.0 billion to goods imports in Q4 and $13.1 billion for 2009. All of these changes begin with 1999 data; the Bureau of Economic Analysis indicated that as of today, it does not expect to carry these changes farther back in history.

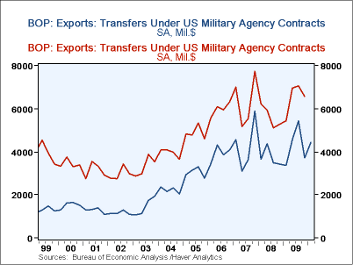

The balance on services was lowered modestly by the coverage revisions just described. It remained fairly near its old values, compared to both the pre-revision levels and the historical trend. Q1 was a surplus of $36.0 billion, following $35.4 billion in Q4; this earlier period was previously reported at $36.5 billion. Exports of services rose 2.6% in the latest quarter and they were 4.6% ahead of the year-earlier period. Travel and passenger fares both showed notable gains. The item "Transfers under U.S. military agency sales contracts" was cut in Q4 from $6.6 billion reported previously to $3.7 billion under the new definition, which now includes only actual services on military aircraft and other equipment under foreign ownership. These service exports rose to $4.4 billion in Q1. Among imports, "other transportation", which now consists mainly in freight charges paid to foreign carriers, increased somewhat, recovering so far about one-third of its recessionary drop.

The balance on income was also subject to sizable revisions, but these apparently resulted only from updated benchmarking to the U.S. Treasury's broadest investment surveys. Investment income receipts and payments were both revised higher, indicating larger inter-national investment holdings than understood before. The net result is an increase in the balance on income from $25.1 billion initially reported for Q4 to $35.1 billion in today's report. Q1 showed a further increase to $41.7 billion. For 2009 as a whole, net income was $121.4 billion, considerably more than the previously reported $89.0 billion. Finally, unilateral transfers showed a net outflow of $35.5 billion in Q1, up from $31.6 billion in Q4 and very little revised from before. Generally the trend in these transfers was reduced somewhat in the revised history, with 2009 showing outflows of $124.5 billion, compared with $130.2 billion in the old data. Government grants increased markedly in the latest period, while private remittances nudged up only marginally.

Commentary on accompanying capital flow data will follow in a subsequent item.

These Balance of Payments data all appear in Haver's USINT database, with summaries available in USECON.

| US Balance of Payments SA | 1Q '10 | 4Q '09 | 3Q '09 | YearAgo | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Current Account Balance ($ Bil.) | -109.0 | -100.9 | -97.5 | -95.6 | -378.4 | -668.9 | -718.1 |

| Deficit % of GDP | 3.0% | 2.8% | 2.7% | 2.7% | 2.7% | 4.6% | 5.1% |

| Balance on Goods ($ Bil.) | -151.3 | -140.1 | -132.1 | -121.2 | -506.9 | -834.7 | -823.2 |

| Exports | 5.2% | 8.1% | 5.8% | 19.8% | -18.1% | 12.5% | 12.0% |

| Imports | 6.1% | 7.4% | 9.1% | 21.5% | -26.4% | 7.9% | 5.8% |

| Balance on Services ($ Bil.) | 36.0 | 35.4 | 32.8 | 30.8 | 132.0 | 135.8 | 121.1 |

| Exports | 2.3% | 3.7% | 1.2% | 7.8% | -6.0% | 9.4% | 17.1% |

| Imports | 2.6% | 2.1% | 1.9% | 4.6% | -7.0% | 8.5% | 9.1% |

| Balance on Income ($ Bil.) | 41.7 | 35.1 | 35.5 | 24.6 | 121.4 | 152.0 | 99.6 |

| Unilateral Transfers ($ Bil.) | -35.5 | -31.6 | -33.6 | -29.7 | -124.5 | -122.0 | -115.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates