Global| Aug 24 2011

Global| Aug 24 2011U.S. Durable Goods Orders Rebound; Heavily Concentrated in Transportation

Summary

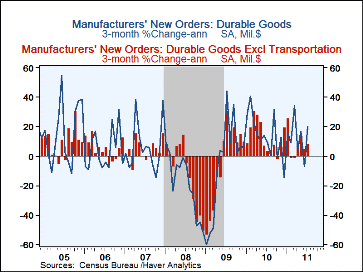

New orders for durable goods rebounded by 4.0% last month and both June and May were revised higher, June from -2.1% to -1.3% and May from 1.9% to 2.0%. The July gain was mainly in transportation; the total excluding transportation [...]

New orders for durable goods rebounded by 4.0% last month and both June and May were revised higher, June from -2.1% to -1.3% and May from 1.9% to 2.0%. The July gain was mainly in transportation; the total excluding transportation was up 0.7%, with June and May also revised upward. The Consensus forecast, at 2.4%, had anticipated some of the July rebound. The gain in transportation orders amounted to 14.6% on the month after June's 6.7% decline; July included an 11.5% increase for motor vehicles and 25.6% for aircraft, all of which involved nondefense orders.

Outside the transportation sector, orders were mixed, but generally on the weak side. Non-electrical machinery orders were off 1.5%, following -1.8% in June. Computers and other electronics saw a 3.4% decline after a 1.0% increase in June. Orders for other electrical machinery, appliances and components fell 1.8% in July and 0.3% in June. Primary metals were a major exception, as their orders rose 10.3% after a bare 0.2% increase in June. In the widely followed nondefense capital goods sector, orders were up 2.4%, almost reversing a 2.6% decline in June; that earlier figure was revised favorably from a 4.1% decline reported last month. Aircraft accounted for the entire July gain and the category excluding nondefense aircraft fell 1.5%.

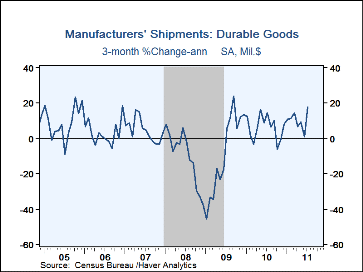

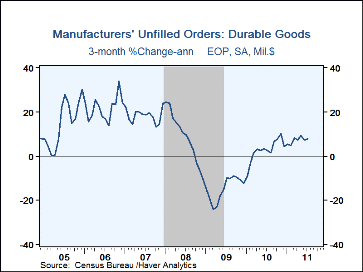

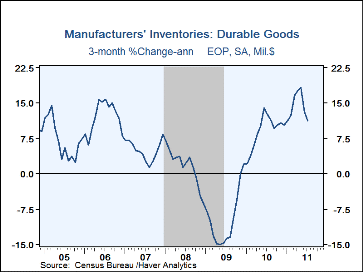

Shipments of durable goods rose 2.5% and June was revised from 0.5% to 1.1%.& The performance excluding transportation seemed to improve, with a 0.9% gain in July, following 1.3% in June and 0.9% in May, which both reflected upward revisions. Factory inventories of durable goods grew 0.8% in July, including 0.5% outside the transportation sector. Unfilled orders expanded 0.7% in July and were even a bit firmer excluding transportation, at a 0.8% advance.

The durable goods figures are available in Haver's USECON database. The expectation figure is in the AS1REPNA database.

| Durable Goods NAICS Classification (%) | Jul | Jun | May | Y/Y | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|

| Orders | 4.0 | -1.3 | 2.0 | 9.2 | 15.4 | -27.3 | -6.3 |

| Excluding Transportation | 0.7 | 0.6 | 0.8 | 9.6 | 14.1 | -23.2 | -1.5 |

| Nondefense Capital Goods | 2.4 | -2.6 | 5.4 | 11.3 | 28.0 | -31.0 | -8.4 |

| Excluding Aircraft | -1.5 | 0.6 | 1.9 | 10.8 | 17.2 | -20.4 | -1.2 |

| Shipments | 2.5 | 1.1 | 0.5 | 7.0 | 6.2 | -20.4 | -2.8 |

| Excluding Transportation | 0.9 | 1.3 | 0.9 | 8.8 | 8.7 | -21.0 | -0.1 |

| Inventories | 0.8 | 0.6 | 1.3 | 12.6 | 9.9 | -9.0 | -0.2 |

| Excluding Transportation | 0.5 | 0.4 | 1.1 | 10.0 | 7.6 | -12.8 | -0.7 |

| Unfilled Orders | 0.7 | 0.3 | 0.9 | 7.0 | 3.9 | -15.2 | 4.3 |

| Excluding Transportation | 0.8 | 0.7 | 1.1 | 13.4 | 11.6 | -12.5 | -2.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.