Global| Nov 25 2020

Global| Nov 25 2020U.S. Durable Goods Orders Rise Further in October

by:Sandy Batten

|in:Economy in Brief

Summary

• Orders again surprise to upside in October with upward revision to September. • Sixth consecutive monthly increase in orders. • Shipments jumped; inventories rose; order backlogs eased. Manufacturers' orders for durable goods [...]

• Orders again surprise to upside in October with upward revision to September.

• Sixth consecutive monthly increase in orders.

• Shipments jumped; inventories rose; order backlogs eased.

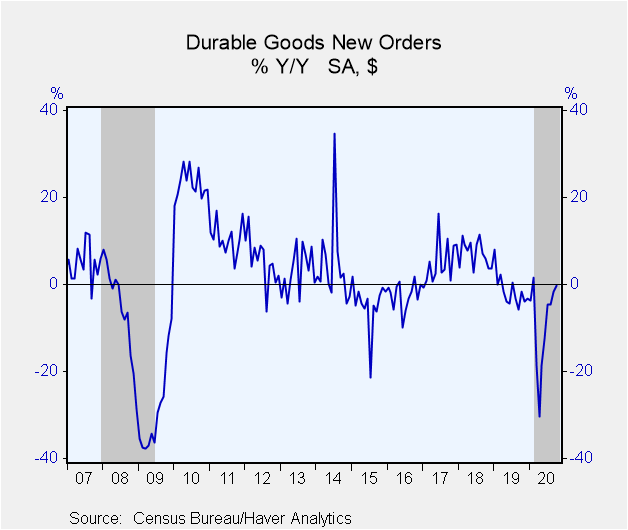

Manufacturers' orders for durable goods increased 1.3% m/m (-0.3% y/y) in October on top of an upwardly revised 2.1% m/m rise in September (initially +1.9%). A 0.9% m/m gain had been expected by the Action Economics Forecast Survey. New orders have risen 43.7% since their recession low in April, but are still 2.2% below their pre-COVID February level.

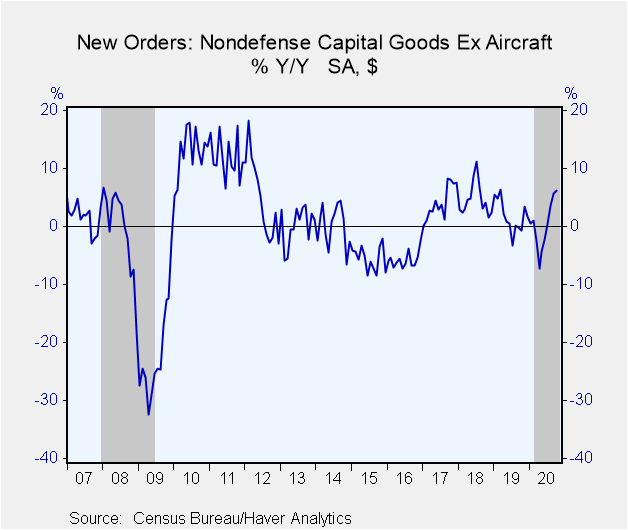

Orders for nondefense capital goods excluding aircraft, a reliable leading indicator of business capital spending, also rose further, increasing 0.7% m/m (+6.2% y/y) in October with upward revisions to both September (+1.9% m/m) and August (+2.4% m/m). This was the sixth consecutive monthly increase. From their April low, nondefense capital goods orders excluding aircraft have risen 14.2% and are 4.5% above their pre-COVID January level.

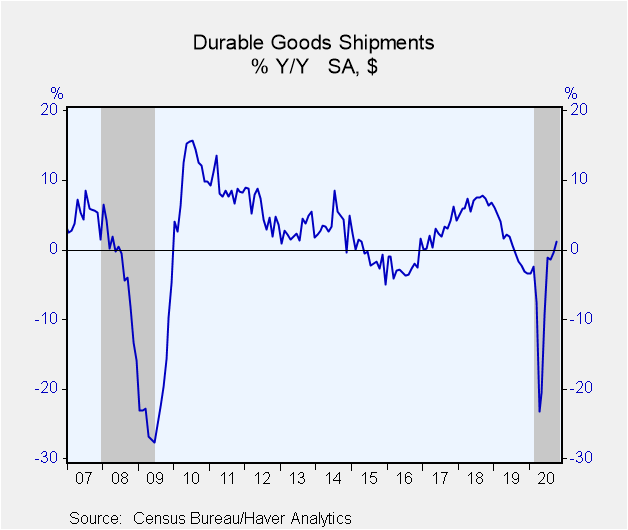

Shipments of core capital goods, a reliable coincident indicator of business spending on equipment, jumped up 2.3% m/m (4.7% y/y) in October after upwardly revised gains in September and August. The October figure was the highest level of core capital goods shipments on record, dating back to 1992. The October level of core shipments was 3.3% above the Q3 average, providing a great starting point for capex in Q4.

Orders for transportation equipment rose 1.2% m/m (-8.4% y/y), down from a 3.3% m/m jump in September (revised down from +4.1% m/m). Orders for motor vehicles and parts fell 3.2% m/m, their second monthly decline in the past three months, following a 1.1% monthly gain in September. Aircraft orders jumped up 57.5% m/m, reflecting meaningful gains in both nondefense and defense orders. Computer and electronic product orders rose 3.1% m/m (9.8% y/y).

Total shipments increased 1.3% m/m (+1.1% y/y) in October following an upwardly revised 0.5% m/m gain in September. Shipments of transportation products slipped 0.2% m/m (-2.2% y/y). Shipments excluding transportation rose a solid 2.0% y/y (+2.8% y/y) after an upwardly revised 0.5% gain in September. Apart from the monthly decline in transportation shipments, all other major categories experienced increases in October.

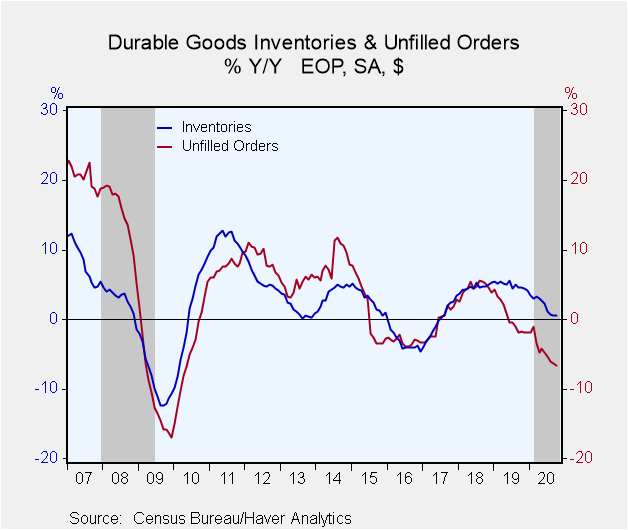

Unfilled orders for durable goods slipped 0.3% m/m (-6.6% y/y). Excluding transportation, they rose 0.5% m/m (1.6% y/y).

Inventories of durable goods rose 0.3% m/m (0.5% y/y), the same monthly increase as in September. The September/October increases followed three consecutive monthly declines. Excluding transportation, inventories rose 0.2% (-2.7% y/y), the same rise as in September, after haven fallen for five consecutive months.

The durable goods figures are available in Haver's USECON database. The Action Economics consensus forecast figure is in the AS1REPNA database.

| Durable Goods NAICS Classification | Oct | Sep | Aug | Oct Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| New Orders (SA, % chg) | 1.3 | 2.1 | 0.4 | -0.3 | -1.5 | 7.1 | 5.0 |

| Transportation | 1.2 | 3.3 | -0.9 | -8.4 | -4.8 | 9.2 | 4.7 |

| Total Excluding Transportation | 1.3 | 1.5 | 1.1 | 4.0 | 0.4 | 5.9 | 5.1 |

| Nondefense Capital Goods Excl. Aircraft | 0.7 | 1.9 | 2.4 | 6.2 | 1.7 | 4.6 | 4.1 |

| Shipments | 1.3 | 0.5 | -0.2 | 1.1 | 0.8 | 6.6 | 2.6 |

| Nondefense Capital Goods Excl. Aircraft | 2.3 | 0.7 | 1.6 | 4.7 | 2.4 | 5.7 | 1.1 |

| Unfilled Orders | -0.3 | -0.2 | -0.6 | -6.6 | -1.8 | 3.9 | 2.8 |

| Inventories | 0.3 | 0.3 | -0.1 | 0.5 | 4.1 | 5.2 | 3.4 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates