Global| Mar 28 2007

Global| Mar 28 2007U.S. Durable Goods Weakness - NO RELIEF!

Summary

What results from this is still a series of weak sector growth rates. The economy is not faring as badly as orders suggest because shipments are growing better than orders. Defense shipments are positive although have softened their [...]

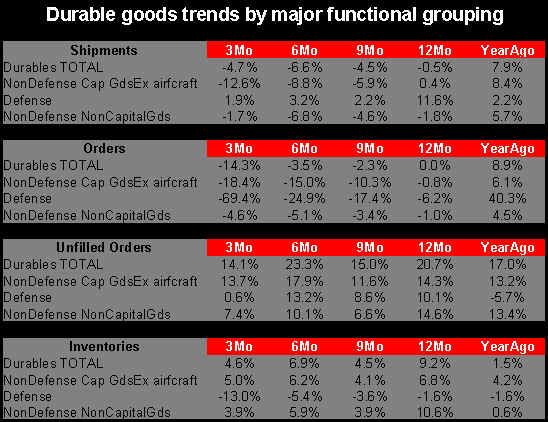

| · For the month, durable goods orders were made even weaker at -9.3% with a February rebound of just 2.5%- pathetic. The table below re-casts some familiar categories to exclude volatile aircraft orders. |

|---|

|

What results from this is still a series of weak sector growth rates.

In the chart on durable orders you see the point about how weak orders are compared to shipments…The worst apt is not how weak they are but that the weakness shows no sign of abating in terms of the speed of the growth rate.

Expanding order backlogs are one factor that reduces the sense of impending doom from the weak orders. But even the strong order backlog growth is beginning to lose some pace.

Another of my ‘favorite charts’ to diagnose this sector is the sequential growth chart of key durable goods sectors. We carry as a footnote item on diffusion accounting on inventory to sales ratios by noting for which time segments sales are outpacing inventories. You can see that inventories out-pace sales for all industries and all segments excerpt the recent three months where about 30% of the sectors saw sales grow faster than inventories. This sort of progress is essential to make progress on excess inventory levels. So far we have too little of it.

Another of my ‘favorite charts’ to diagnose this sector is the sequential growth chart of key durable goods sectors. We carry as a footnote item on diffusion accounting on inventory to sales ratios by noting for which time segments sales are outpacing inventories. You can see that inventories out-pace sales for all industries and all segments excerpt the recent three months where about 30% of the sectors saw sales grow faster than inventories. This sort of progress is essential to make progress on excess inventory levels. So far we have too little of it.  Fabricated metals and electrical equipment are healthy sectors; together they make up about 17% of shipments. Weakness in capital goods is all the more surprising given the strength in exports.For example turbine and generators weakness is surprising:

Fabricated metals and electrical equipment are healthy sectors; together they make up about 17% of shipments. Weakness in capital goods is all the more surprising given the strength in exports.For example turbine and generators weakness is surprising:  The weakness in construction equipment is more expected given the woes in the residential sector.

The weakness in construction equipment is more expected given the woes in the residential sector. And, interestingly, material handling equipment, which is the stuff that helps to load trucks and trains and to move goods around in warehouses, shows a fading trend.

And, interestingly, material handling equipment, which is the stuff that helps to load trucks and trains and to move goods around in warehouses, shows a fading trend.

Summing up. On balance the weakness in durable goods orders is in the VANGUARD of economic weakness. It does not seem due to events abroad as US capital goods exports remain strong. It is not on the back of weak consumer spending since the consumer has been somewhat irregular in early 2007 but ended 2006 on a strong note. Service sector spending continues quite strong; job growth and income growth are still firm. The rate of unemployment is low and wages have seen a boost recently. CEOs do not tell us they have plans to reduce their pace of investment. Yet they seem to be doing it. They nonetheless have excess funds but they use them for other financial transactions to dress-up their balance sheets. We have seen lowered earnings guidance from a variety of companies. Is this now to become a self-fulfilling prophecy?

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.