Global| Feb 19 2021

Global| Feb 19 2021U.S. E-Commerce Sales Decrease Modestly in Q4

Summary

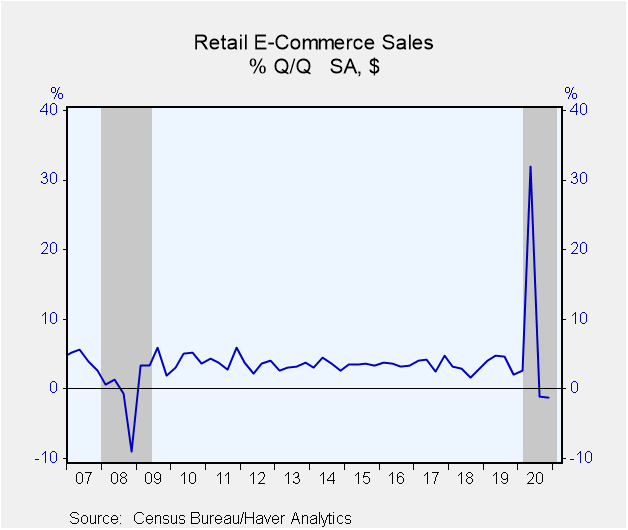

Online retail sales, more formally known as "E-Commerce sales," edged lower once again in Q4 on a seasonally adjusted basis; according to the U.S. Census Bureau, they fell 1.2% after a 1.1% decrease in Q3. These did follow a 31.9% [...]

Online retail sales, more formally known as "E-Commerce sales," edged lower once again in Q4 on a seasonally adjusted basis; according to the U.S. Census Bureau, they fell 1.2% after a 1.1% decrease in Q3. These did follow a 31.9% surge in Q2, as the coronavirus was constricting people's ability to get out and about and go to stores.

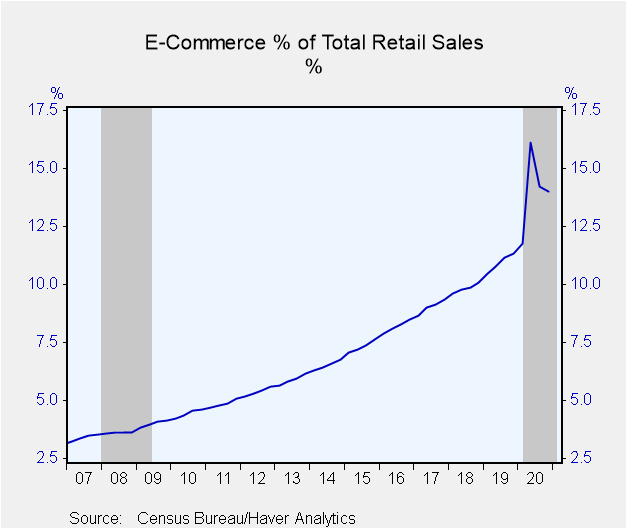

The Q4 E-Commerce sales decline compares to a 0.5% increase in overall retail sales during the same period. [This overall measure of retail sales excludes the "food services" category or restaurants.] As a result, E-Commerce sales made up 14.0% of total retail sales, a share just marginally smaller than the 14.2% in Q3. In Q2, when E-Commerce was stronger still, it constituted 16.1% of overall retail sales. By comparison, these shares were 10.9% in 2019 and 4.4% in 2010.

Details of the E-Commerce data by sector are not seasonally adjusted; the most of the component series extend back just to Q2 2018, so they are not long enough to establish an identifiable seasonal pattern. Thus, we examine the NSA data themselves. Sales of nonstore retailers, which accounted for 54% of total E-Commerce sales in Q4, remained strong and posted a 19.0% quarterly increase following 4.3% in Q3 and 24.2% in Q2. Online sales of motor vehicles and parts increased by 16.6% in Q4. Building materials & garden equipment sales stabilized with a 2.1% rise in Q4 after they had fallen 16.6% in Q3; these sales, though, had more than doubled in Q2, expanding 103.9%. General merchandise store sales advanced 60.5% after they had declined by 14.3% in Q3. Sporting goods, hobby, musical instrument & book sales rebounded by 25.5% in Q4 after falling 10.4% in Q3. Food & beverage purchases also rebounded in Q4, gaining 11.7% after weakening 8.1% in Q3, while furniture & home furnishing store sales gained 22.9% after falling 3.3%. Clothing & accessory store sales surged 48.2% as they rebounded after a 4.6% decrease in Q3.

E-commerce sales are sales of goods and services whereby the buyer places an order, or the terms of the sale and price are negotiated over an Internet, mobile device (M-commerce), extranet, Electronic Data Interchange (EDI) network, electronic mail, or other comparable online system. Payment may or may not be made online. Total sales estimates are adjusted for seasonal variation, but not for price changes. They are also adjusted for trading-day differences and moving holidays.

The retail sales and retail E-Commerce sales data can be found in Haver's USECON database.

| Q4'20 | Q3'20 | Q2'20 | Q4'20 Y/Y | 2020 | 2019 | 2018 | ||

|---|---|---|---|---|---|---|---|---|

| Total Retail Sales (%) | 0.5 | 12.1 | -3.8 | 6.9 | 3.2 | 3.4 | 4.2 | |

| % of E-Commerce Sales (Q4'20) | ||||||||

| Total E-Commerce Sales (SA) | 100.0 | -1.2 | -1.1 | 31.9 | 32.1 | 32.3 | 14.9 | 13.4 |

| Total E-Commerce Sales (NSA) | -- | 23.1 | -0.7 | 36.9 | 32.1 | -- | -- | -- |

| Nonstore Retailers (NSA) | 54 | 19.0 | 4.3 | 24.2 | 23.6 | 23.4 | 16.1 | -- |

| Motor Vehicles & Parts | 5 | 2.0 | 16.6 | 14.1 | 20.3 | 13.2 | 9.8 | -- |

| Furniture & Home Furnishings | 2 | 22.9 | -3.3 | 39.4 | 54.6 | 47.7 | 6.8 | -- |

| Building Materials & Garden Equipment | 3 | 2.1 | -16.6 | 103.9 | 62.4 | 61.7 | 14.8 | -- |

| Clothing & Accessories | 8 | 48.2 | -4.6 | 40.0 | 24.8 | 27.8 | 8.7 | -- |

| General Merchandise | 10 | 60.5 | -14.3 | 80.6 | 42.2 | 50.3 | 14.2 | -- |

| Food & Beverages | 3 | 11.7 | -8.1 | 102.0 | 125.0 | 147.1 | 58.7 | -- |

| Sporting Goods, Hobby, Musical Instruments & Books | 1 | 25.5 | -10.4 | 84.2 | 54.0 | 60.7 | -3.4 | -- |

| Miscellaneous (Including Gas Stations) | 3 (Q3'20) | -- | 8.9 | 48.4 | -- | -- | 7.2 | -- |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates