Global| Jul 31 2013

Global| Jul 31 2013U.S. Employment Cost Index Firms in Q2

Summary

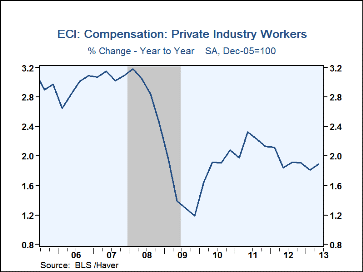

The employment cost index for private industry workers advanced 0.6% (1.9% y/y) in Q2'13, following an upwardly revised 0.4% increase in Q1. The result was stronger than consensus expectations for 0.4%. Q1 and the prior couple of [...]

The employment cost index for private industry workers advanced 0.6% (1.9% y/y) in Q2'13, following an upwardly revised 0.4% increase in Q1. The result was stronger than consensus expectations for 0.4%. Q1 and the prior couple of quarters had been "corrected" by the BLS in June, erasing the unusually weak numbers we discussed in this commentary in April.

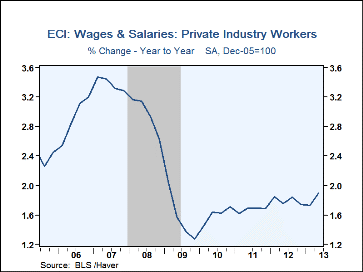

Wage salary costs in private industry were also up 0.6% in Q2, firmer than Q1's 0.5% increase, putting them up 1.9% from a year earlier. Management and professional staff saw a 2.1% yearly increase, up from 1.9% in Q1 and the largest for that occupational category since Q1 2009. Sales and office staff also picked up, to 1.9% y/y from 1.8% in Q1. Construction and maintenance workers held to a 1.5% wage gain on the year earlier, the same as in Q1, and production and transportation workers saw 1.8% yearly increases in both Q1 and Q2.

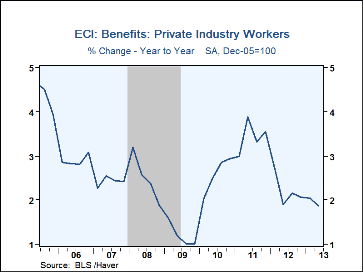

The BLS data corrections concerned benefits, and the 0.3% q/q decline originally reported for Q1 is now shown as a 0.4% increase. They continued at a 0.4% pace in Q2, putting them up 1.9% from Q2 2012.

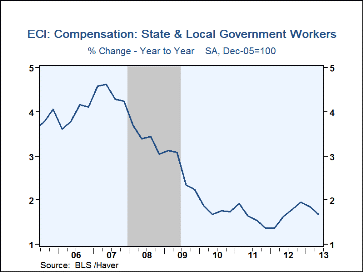

Compensation for state and local government workers was up 1.7% in Q2 versus a year earlier, a bit slower than 1.9% in Q1. Their wages and salaries increased 1.0% in both quarters from year-ago amounts, while their benefits slowed to a 3.3% gain in Q2 from 3.5% in Q1.

The employment cost index figures are available in Haver's USECON database. Consensus estimates come from the Action Economics survey, carried in Haver's AS1REPNA database.

| ECI- Private Industry Workers (%) | Q2'13 | Q1'13 | Q4'12 | Q2 Y/Y | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Compensation | 0.6 | 0.4 | 0.4 | 1.9 | 1.9 | 2.2 | 1.9 |

| Wages & Salaries | 0.6 | 0.5 | 0.3 | 1.9 | 1.8 | 1.7 | 1.6 |

| Benefit Costs | 0.4 | 0.4 | 0.6 | 1.9 | 2.2 | 3.4 | 2.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.