Global| Oct 31 2007

Global| Oct 31 2007U.S. Employment Cost Index Moderates to 0.8% Quarterly Increase

Summary

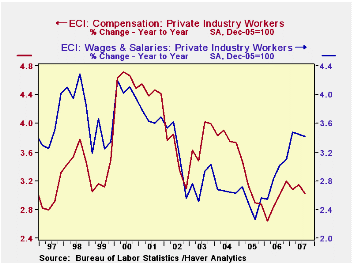

The employment cost index slowed to an 0.8% advance for private industry workers in Q3, compared to 0.9% in Q2 and a Consensus forecast of 0.9%. Wage and salary growth held at the 0.8% quarterly pace seen in Q2, with the year/year [...]

The employment cost index slowed to an 0.8% advance for private industry workers in Q3, compared to 0.9% in Q2 and a Consensus forecast of 0.9%.

Wage and salary growth held at the 0.8% quarterly pace seen in Q2, with the year/year growth also at Q2's amount, 3.4%. Wages account for roughly 70% of the compensation index. The largest recent increase was 1.1% in Q1, driven by outsized increases in several industries.

Benefit costs dropped back from Q2's 1.1% to 0.8%; this put the year/year increase at 2.4%. For the first three quarters this year, the year/year growth rates are the lowest since 1998. This is at least in part due to a more moderate rise in the cost of health benefits, which was up 4.8% y/y again in Q3, the same as in Q2 and less than half the pace of 2002 and 2003.

Compensation costs also eased for state and local government workers. This group saw a rise of 0.8% in Q3, less than 1.1% in Q2 and 1.3% in Q1 and the lowest since Q1 2006. The move was in benefits, which rose "only" 0.7% in Q3, following 1.7% in Q2 and 2.1% in Q1. Wages and salaries actually picked up in Q3 to 1.0% from 0.8% in Q2.

| ECI- Private Industry Workers | 3Q | 2Q | 1Q | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Compensation | 0.8% | 0.9% | 0.6% | 3.1% | 2.9% | 3.1% | 3.8% |

| Wages & Salaries | 0.8% | 0.8% | 1.1% | 3.4% | 2.9% | 2.5% | 4.7% |

| Benefit Costs | 1.1% | 1.1% | -0.3% | 2.7% | 2.9% | 4.6% | 6.8% |

| ECI- State & Local Government Workers | 0.8% | 1.1% | 1.3% | 4.3% | 3.9% | 3.8% | 3.4% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.