Global| Jul 31 2018

Global| Jul 31 2018U.S. Employment Costs Moderate in Q2 after Strong Q1

Summary

The employment cost index (ECI) for civilian workers rose 0.6% q/q in Q2 2018, easing from the sizable 0.8% gain in Q1 that had been among the strongest quarterly moves since late 2007. The year/year movement still benefited, of [...]

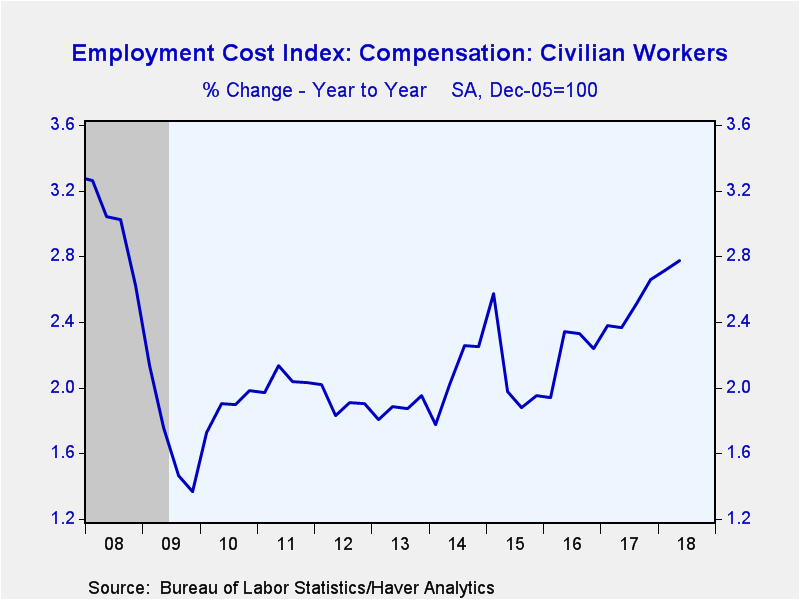

The employment cost index (ECI) for civilian workers rose 0.6% q/q in Q2 2018, easing from the sizable 0.8% gain in Q1 that had been among the strongest quarterly moves since late 2007. The year/year movement still benefited, of course, from the large Q1 number, and the 4-quarter increase firmed to 2.8% from 2.7% ending in Q1. The Action Economics Forecast Survey had looked for a 0.7% q/q increase. Civilian workers include those in private industry and state & local government, but not federal government employees.

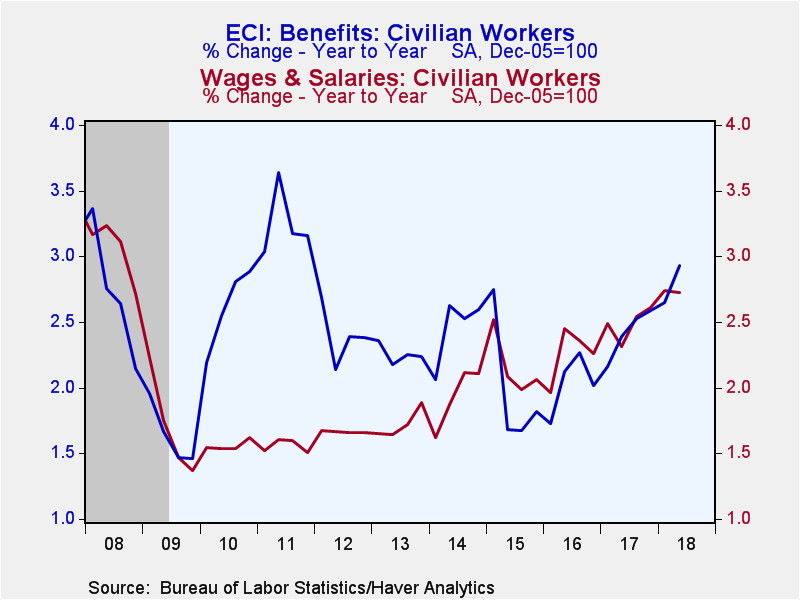

The slower Q2 compensation increase for civilian workers was due to slower wage and salary growth, which was 0.5% after 0.9% in Q1 (2.7% y/y). Benefits for civilian workers were up 0.9% (2.9% y/y), firmer than the 0.7% in Q1.

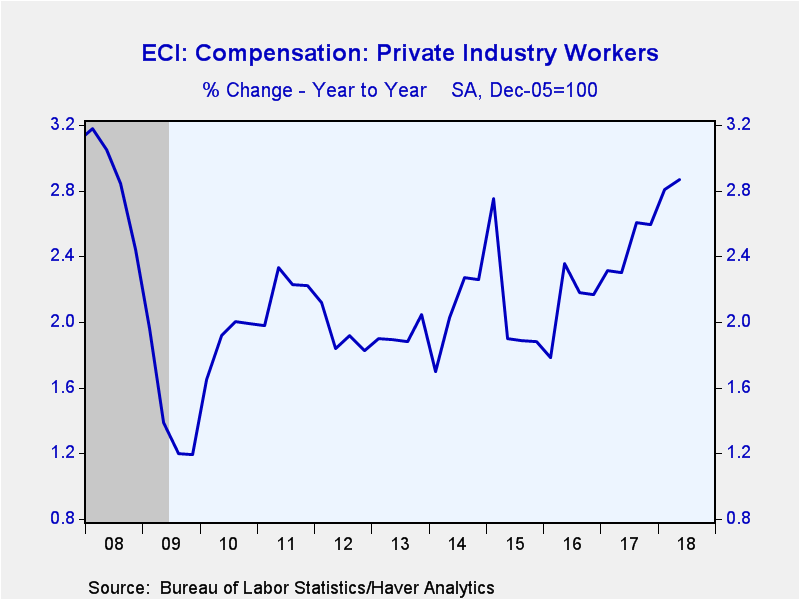

Employment costs in private industry had a more pronounced slowing in Q2 to 0.6% from their stronger 1.0% advance in Q1; the Q2 result was up 2.9% y/y. In several industries, sizable gains in Q1 were followed by more moderate gains in Q2, and in the case of wholesale trade, an outright decline. Finance and insurance, which had the largest increase in Q1, 1.8%, moderated to 1.1% in Q2; real estate compensation had grown 1.2% in Q1 and slowed more sharply to just 0.3% in Q2. Retail trade had increased 1.1% in Q1 and remained almost as strong in Q2, 1.0%, while wholesale trade, as noted, went from 1.0% in Q1 to -0.1% in Q2. Transportation and warehousing slowed from Q1's strong 1.3% to just 0.4% in Q2. Among other industries, manufacturing compensation grew 0.7% in Q1 and was almost as strong in Q2, 0.6%. Construction actually firmed, rising 0.9% in Q1 and then 1.0% in Q2. Education services picked up to 0.6% from 0.5% in Q1; labor costs in hospitals increased 0.5% for a fourth consecutive quarter. The strongest industry in Q2 was information, which surged 3.0%, but compensation in that sector had been up just 0.6% in Q1.

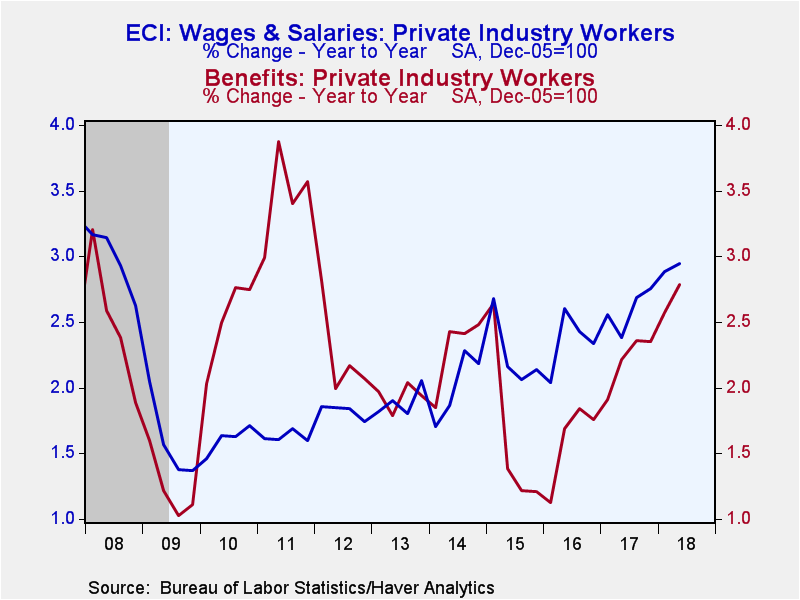

The wages and salaries component in private industries was up 0.6% in Q2 (2.9% y/y) after their 1.0% advance in Q1. Benefits increased 0.8% in Q2, the same as their Q1 move, and they were up 2.8% y/y.

In state and local governments, labor costs picked up in Q2, rising 0.7% after Q1's relatively slow 0.4%; the year/year gain was 2.3%. Wages and salaries firmed to 0.5% in Q2 (1.9%) after just 0.4% in Q1 while benefits surged 0.9% (3.1% y/y) followed a sluggish 0.5% rise in Q1.

The employment cost index figures are available in Haver's USECON database. Consensus estimates come from the Action Economics survey in Haver's AS1REPNA database. This quarter's release included annual seasonal adjustment revisions affecting the last five years.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.