Global| May 11 2021

Global| May 11 2021U.S. Energy Prices on An Upward Trend

Summary

• TEXT. • TEXT. • TEXT. • Gasoline prices continue to rise prior to the potential effects of the Colonial Pipeline shutdown. • Crude oil prices also continue to rise. • Natural gas prices strengthen. The price of retail gasoline rose [...]

• TEXT.

• TEXT.

• TEXT.

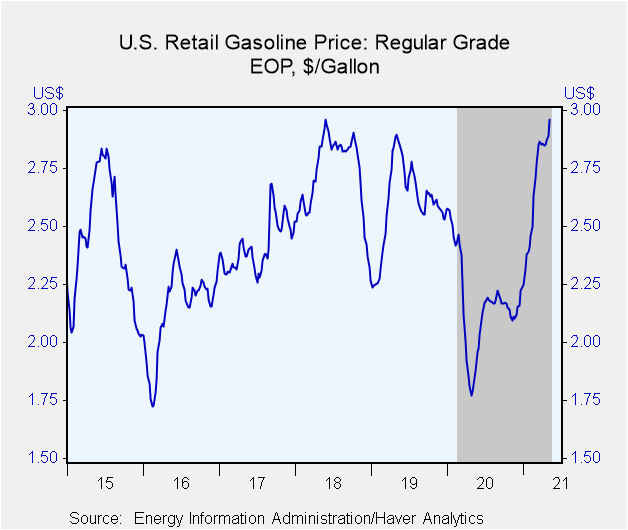

• Gasoline prices continue to rise prior to the potential effects of the Colonial Pipeline shutdown.

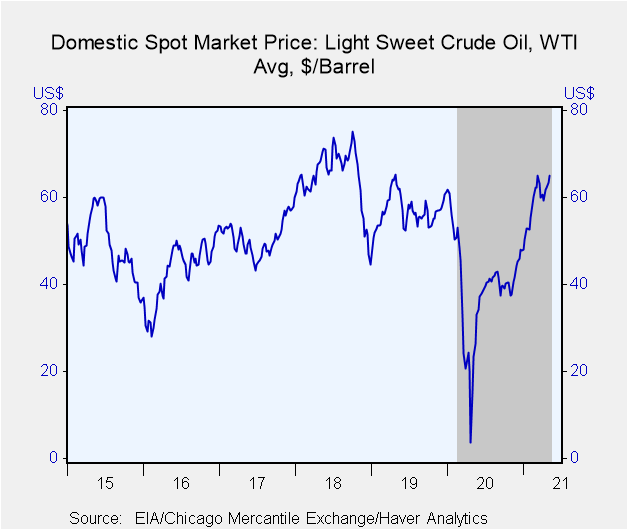

• Crude oil prices also continue to rise.

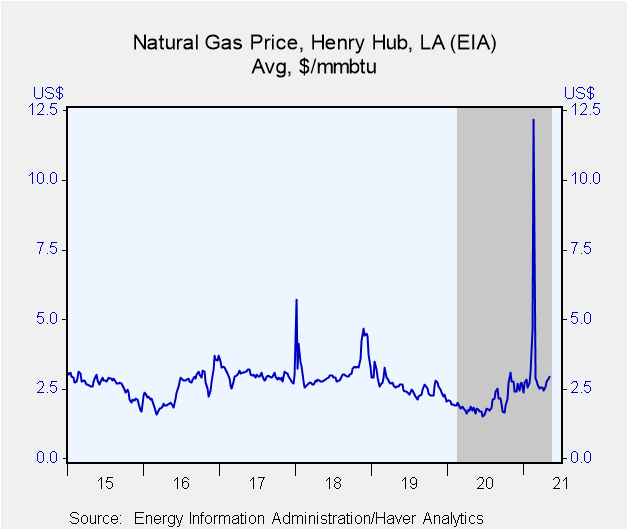

• Natural gas prices strengthen.

The price of retail gasoline rose 7 cents to $2.96 a gallon (59.97% y/y) in the week ended May 10 from $2.89 per gallon the prior week. The low was reached in November of last year when it hit $2.11 a gallon. Haver Analytics adjusts the gasoline price series for normal seasonal variation. The seasonally adjusted price rose 9 cents to $2.79 per gallon in the week ended May 10.

The price of West Texas Intermediate crude oil rose to $65.1 per barrel (up 177.4% y/y) in the week ended May 7 from an average of $63.48 in the week of April 30. The price was $64.92 yesterday. The average price of Brent crude oil rose to $67.84 per barrel (128.7% y/y) in the week ended May 7 from $66.8 the prior week. The price was $68.28 per barrel yesterday.

The price of natural gas rose again to $2.95/mmbtu (60.33% y/y) in the week ended May 7, following the rise to $2.88/mmbtu the week prior. This latest was the highest price since $12.18 in the week of February 19. Yesterday, the price eased some to $2.93/mmbtu.

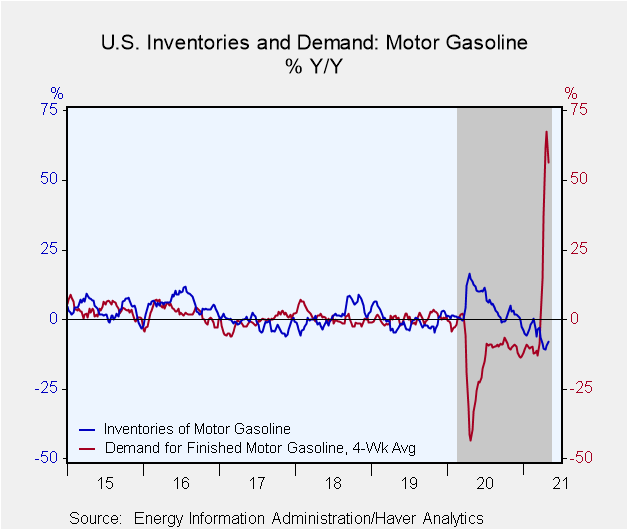

In the four weeks ended April 30, gasoline demand rose 56.2% y/y and demand for all petroleum products rose 34.2% y/y. Crude oil input to refineries rose 18.1% y/y. Gasoline inventories decreased 8.0% y/y while crude oil inventories declined 4.4%. The supply of gasoline in inventory in the week ending April 30 was 26.4 days, slightly down from 27.8 days during all of March. The supply of crude oil in inventory eased to 32.3 days from an average of 39.7 days in March.

These data are reported by the Energy Information Administration of the U.S. Department of Energy. The price data can be found in Haver's WEEKLY and DAILY databases. Greater detail on prices, as well as the demand, production and inventory data are in USENERGY.

These data are reported by the Energy Information Administration of the U.S. Department of Energy. The price data can be found in Haver's WEEKLY and DAILY databases. Greater detail on prices, as well as the demand, production and inventory data are in USENERGY.

| Weekly Energy Prices | 05/10/21 | 05/03/21 | 04/26/21 | Y/Y % | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Retail Gasoline ($ per Gallon, Regular, Monday) | 2.96 | 2.89 | 2.87 | 60.0 | 2.24 | 2.57 | 2.27 |

| Light Sweet Crude Oil, WTI ($ per bbl, Previous Week's Average) | 65.08 | 63.48 | 62.18 | 177.4 | 39.43 | 56.91 | 64.95 |

| Natural Gas ($/mmbtu, LA, Previous Week's Average) | 2.95 | 2.88 | 2.76 | 60.3 | 2.03 | 2.57 | 3.18 |

Kathleen Stephansen, CBE

AuthorMore in Author Profile »Kathleen Stephansen is a Senior Economist for Haver Analytics and an Independent Trustee for the EQAT/VIP/1290 Trust Funds, encompassing the US mutual funds sponsored by the Equitable Life Insurance Company. She is a former Chief Economist of Huawei Technologies USA, Senior Economic Advisor to the Boston Consulting Group, Chief Economist of the American International Group (AIG) and AIG Asset Management’s Senior Strategist and Global Head of Sovereign Research. Prior to joining AIG in 2010, Kathleen held various positions as Chief Economist or Head of Global Research at Aladdin Capital Holdings, Credit Suisse and Donaldson, Lufkin and Jenrette Securities Corporation.

Kathleen serves on the boards of the Global Interdependence Center (GIC), as Vice-Chair of the GIC College of Central Bankers, is the Treasurer for Economists for Peace and Security (EPS) and is a former board member of the National Association of Business Economics (NABE). She is a member of Chatham House and the Economic Club of New York. She holds an undergraduate degree in economics from the Universite Catholique de Louvain and graduate degrees in economics from the University of New Hampshire (MA) and the London School of Economics (PhD abd).

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates