Global| Jan 05 2018

Global| Jan 05 2018U.S. Factory Orders Rebound; Shipments & Inventories Firm in November

Summary

Manufacturers' orders gained 1.3% in November (8.6% y/y) following a 0.4% rise in October; this earlier number was revised from a 0.1% decrease initially reported. Durable goods orders were also up 1.3% (8.2% y/y); they had fallen [...]

Manufacturers' orders gained 1.3% in November (8.6% y/y) following a 0.4% rise in October; this earlier number was revised from a 0.1% decrease initially reported. Durable goods orders were also up 1.3% (8.2% y/y); they had fallen 0.4% in October. The upturn was in the transportation sector, where November new orders gained 4.1% (10.1% y/y), reversing a 4.0% drop in October. That swing took place in the nondefense aircraft sector; those orders had dropped 15.8% in October but came back 14.7% in November (110.2% y/y). Orders outside the transportation sector rose 0.8% (7.6% y/y) following a 1.2% jump. Most of that move came in the nondurable goods segment, up 1.4% (8.1% y/y); see the shipments discussion below for more detail. Among durable goods, orders for electrical equipment were up 0.6% (1.1% y/y) in November after 1.1% the month before. Other main sectors had declines, especially computer & electronic products, 0.5% (14.3% y/y), easing after a 1.6% gain in October Orders for machinery fell 1.0% in November (10.4% y/y), also reversing a sizable October rise, 2.8%.

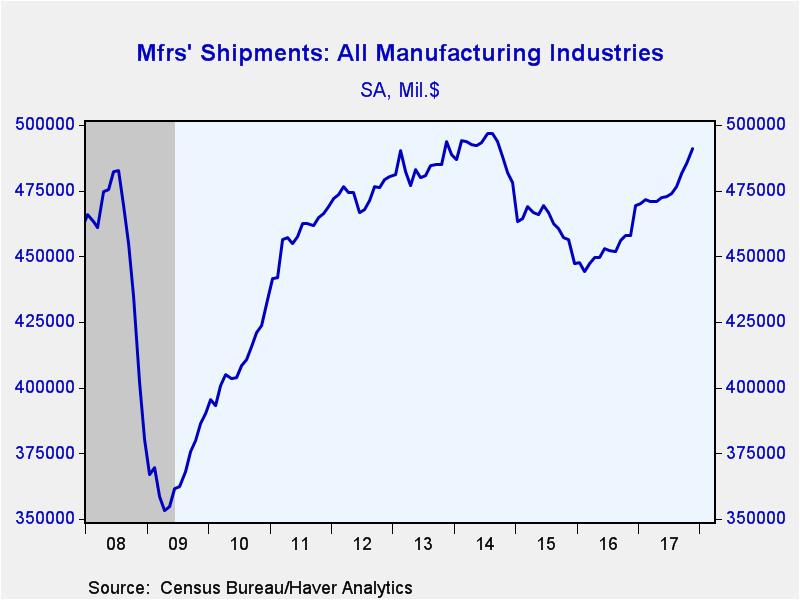

Total factory sector shipments rose 1.2% (7.8% y/y) in November after an 0.8% increase. Durable goods shipments increased 0.9% (7.5% y/y). Transportation equipment shipments jumped 2.6% (6.9% y/y) as nondefense aircraft rebounded 11.9% (10.8% y/y) after October's 12.2% drop. Auto shipments came back 1.1% (-6.8% y/y) after a 2.6% fall. Light truck shipments extended their 4.8% October gain, going up 1.8% in November (13.5% y/y). Excluding the transportation sector, shipments rose 0.9% (7.9% y/y). Those of computer & electronic products gained 0.5% (6.78% y/y), but machinery shipment fell 0.3% (10.3% y/y).

Nondurable goods shipments happen within the same reporting period as orders, and the series are equal. As noted above, these orders/shipments rose 1.4% in November. The value of petroleum refinery shipments increased 6.3% (36.6% y/y) as oil prices continued to rise. Basic chemical shipments were up 1.6% (4.2% y/y), improving on a 1.1% October advance. Textile products and apparel both gained 1.7% in November; textiles were up 5.9% y/y and apparel 6.7% y/y. Food product shipments fell 0.9% (+3.9% y/y)

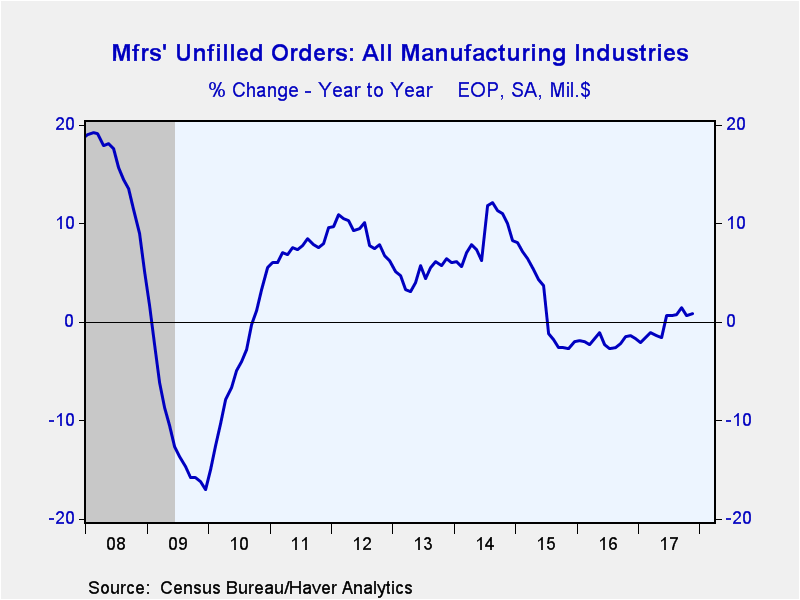

Unfilled orders edged higher 0.1% (0.57% y/y) in November, following a similar 0.1% rise the month before. Outside the transportation sector, unfilled orders rose 0.5% (4.6% y/y); unfilled orders for the whole manufacturing sector are identical to those for durable goods, since orders and shipments for nondurable goods are seen as equal. Transportation backlogs decreased 0.1% (-1.0% y/y) after a 0.2% decrease in October. Other durable goods sectors saw backlogs up 0.5% (4.6% y/y) with furniture up 0.8% (2.1% y/y), computers, 0.3% (3.4% y/y) and machinery, 0.2% (4.1% y/y).

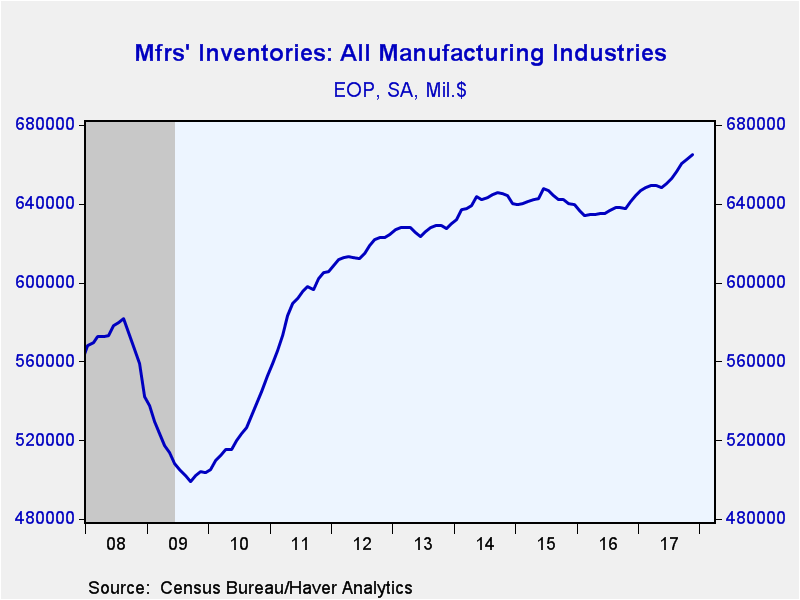

Inventories at the factory level rose 0.6% (3.7% y/y) in November, modestly firmer than October's 0.3% increase. Outside the transportation sector, they were up 0.5% (4.9% y/y) in November. Durable goods inventories gained 0.2% (3.5% y/y), the same as in October. Fabricated metals inventories strengthened 0.4% (6.1% y/y). Machinery inventories rose 0.2% (+5.5% y/y), reversing a 0.1% dip in October. Inventories of computers & electronic products picked up 0.5% (4.2% y/y). Nondurable goods inventories grew 0.6% (4.1% y/y) in November, equaling October's 0.6% rise. The value of petroleum refinery inventories rose 2.9% (24.0% y/y), again reflecting oil price increases. Apparel inventories fell 0.4% (-4.6% y/y) and textile product stocks were unchanged (3.0% y/y). Food product inventories edged down 0.1% (+0.7% y/y).

All these factory sector figures are available in Haver's USECON database.

| Factory Sector- NAICS Classification (%) | Nov | Oct | Sep | Nov Y/Y | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| New Orders | 1.3 | 0.4 | 1.7 | 8.6 | -1.9 | -7.7 | 1.8 |

| Shipments | 1.2 | 0.8 | 1.1 | 7.8 | -1.8 | -5.8 | 1.3 |

| Unfilled Orders | 0.1 | 0.1 | 0.3 | 0.7 | -1.9 | -2.0 | 8.4 |

| Inventories | 0.4 | 0.3 | 0.6 | 3.7 | 0.7 | 0.0 | 1.7 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.