Global| Apr 05 2021

Global| Apr 05 2021U.S. Factory Orders & Shipments Fell Back in February

Summary

• Factory orders fell for both durable and nondurable goods. • Shipments decline for both durable and nondurable goods. • But order backlogs & inventories both advance 0.8% in February. New orders for manufactured goods fell back in [...]

• Factory orders fell for both durable and nondurable goods.

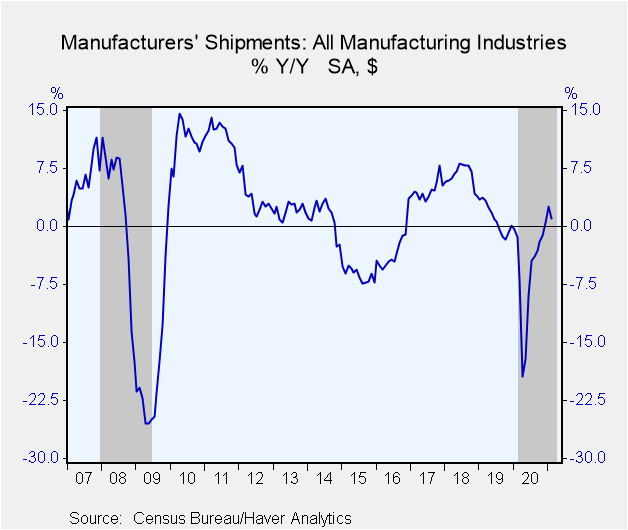

• Shipments decline for both durable and nondurable goods.

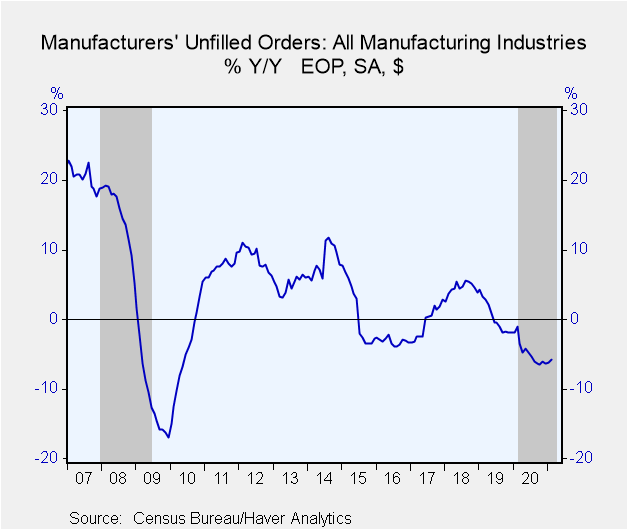

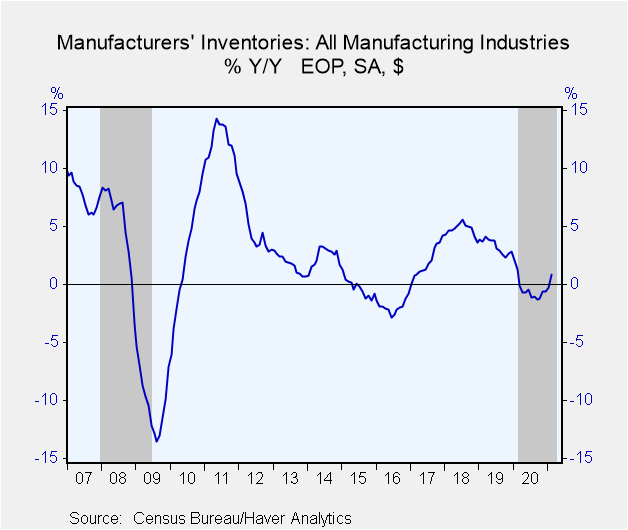

• But order backlogs & inventories both advance 0.8% in February.

New orders for manufactured goods fell back in February by 0.8% (+1.9% y/y) after January's 2.7% surge. These orders had indeed risen by sizable amounts every month beginning in April 2020. The Action Economics Forecast Survey had expected a 0.5% decrease in February.

Orders in durable goods industries decreased 1.2% (+3.2% y/y) in February, revised slightly from 1.1% in the advance report issued on March 24. Transportation sector orders fell 1.8% (-6.0% y/y) after advancing 7.6% in January. That February decline includes 4.6% in motor vehicle bodies, parts and trailers (-0.1% y/y), but an outsized gain of 51.8% in nondefense aircraft. Civilian aircraft order cancellations during several months in mid-2020 and in December meant the "new orders" in those months were actually negative; the February amount was $9.6 billion and was the largest since July 2019. Electrical equipment orders were the only major durable goods category to show a month-to-month increase in February, as they rose 0.6% (+7.9% y/y). The full report on February durable goods activity is available here.

Nondurable goods orders, which equal shipments, decreased 0.4% in February (+0.5% y/y) after gaining 1.8% in January (revised from 1.9% in last month's report) and 2.0% in December. Shipments from petroleum refineries slowed to a 1.8% increase (-9.0% y/y) following 7.1% in January. Among other nondurable goods sectors, basic chemical shipments fell 1.1% (4.6% y/y) in February while paper product shipments edged up 0.2% (6.7% y/y). Textile mill shipments fell back 1.7% (+1.4% y/y); textile products and apparel shipments also declined

Shipments of durable goods fell 3.6% in February (+1.4% y/y) following a 1.8%% increase in January. Nearly all industry groups saw declines in February, especially transportation products of -8.3% (-7.5% y/y), especially nondefense aircraft, -21.0% (-40.9% y/y) after an increase of 15.7% in January. Shipments of computers & electronic products edged down 0.4% (+8.6% y/y) after rising 1.2% the month before.

Inventories of manufactured products rose 0.8% in February (+0.9% y/y) after a 0.2% increase in January. Durable goods inventories increased 0.7% (+1.1% y/y)), well reversing a 0.3% decrease. Both primary metal and fabricated metal products saw 1.4% increases, and automobiles and trucks had sizable increases while inventories of aircraft and parts fell. Nondurable goods inventories rose 1.0% (0.4% y/y), especially including a 6.3% increase in petroleum refineries. Textile mill products, by contrast, had a 2.2% decline.

The value of unfilled orders was up 0.8% in February after a January increase of 0.2%. The amounts are still down from a year ago, January by 6.2% and February by 5.8%. Unfilled orders in the transportation sector increased 0.7% in February after decreasing 0.1% the month before. Computers and electronic product orders edged higher by just 0.1% following virtually no change in January. Electrical equipment & appliances backlogs rose, by comparison, advanced 2.1% in February following 1.5% in January. Order books for both defense and nondefense aircraft grew 0.8% in February.

The factory sector data are available in USECON database.

| Factory Sector (% chg) - NAICS Classification | Feb | Jan | Dec | Feb Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| New Orders | -0.8 | 2.7 | 1.6 | 1.9 | -6.7 | -0.1 | 6.8 |

| Shipments | -2.0 | 1.8 | 2.1 | 1.0 | -5.7 | 1.0 | 6.6 |

| Unfilled Orders | 0.8 | 0.2 | -0.2 | -5.8 | -6.4 | -1.8 | 3.9 |

| Inventories | 0.8 | 0.2 | 0.3 | 0.9 | -0.6 | 2.8 | 3.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates