Global| Apr 15 2009

Global| Apr 15 2009U.S. Factory Output Decline Is The Sharpest Since The Deindustrialization After WWII

by:Tom Moeller

|in:Economy in Brief

Summary

In March, the year-to-year decline in U.S. industrial output of 12.7% was the result of reduced U.S. demand, inventory cutbacks and recessions abroad. To emphasize the size of that decline, it was the largest since the factory [...]

In March, the year-to-year decline in U.S. industrial output of 12.7% was the result of reduced U.S. demand, inventory cutbacks and recessions abroad. To emphasize the size of that decline, it was the largest since the factory sector's wind-down following World War II.

It's the same story as earlier for the U.S. industrial sector. Output fell 1.5% last month, the same as an unrevised 1.5% drop during February. For 2008 and 2007, however, production was revised weaker. Consensus expectations had been for a 0.9% decline in March output.

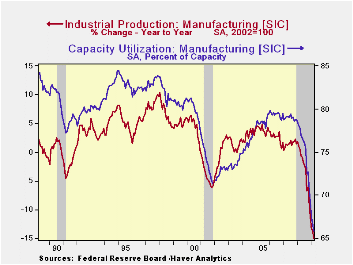

And the rate of decline has picked up steam. During the last three months, the rate of decline of 18.5% (AR) about matches the quickest of the last few months. Factory sector output alone is off at an 18.7% annual rate during the last three months versus a full-year drop of 3.2% during 2008.

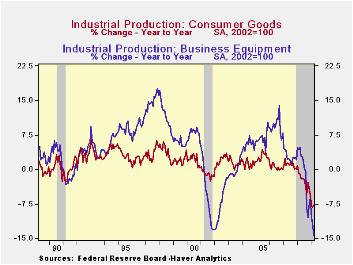

The downturn in the housing market continued to lower output of construction supplies which fell 2.7% last month and at a 30.0% annual rate during the last three. Output of consumer goods overall fell 0.4% last month and at a 12.5% rate since so far this year. Production of autos fell at a 37.3% rate while furniture output fell at a 21.9% rate so far this year after the 10.5% drop during all of 2008. Apparel output actually posted a modest March increase but it's off at a 16.5% rate so far in 2009. Production of business equipment continued lower last month by 2.4% and at a 27.6% rate for the year.

Pain has come to an area which previously was immune. Industrial production in the high-tech sector fell another 3.1% last month and at a 23.8% rate during the last three. That follows a downwardly revised 11.4% increase during all of last year. Less high tech, overall industrial production fell 1.5% during March and the annual rate of change of -18.5% was near the weakest since 1975.

Outside of the both the auto and the high tech sectors, total factory production fell 1.5% last month and the three-month annual rate of decline remained more than firm at -16.8%.

Excess capacity grew even further last month. Capacity utilization fell to 69.3%, a record low for the series which dates to 1966. Utilization in the factory sector dropped even harder to 65.8% from a peak near 80% back in 2007. The latest rate was a record low since WW II. Growth in the total productive capacity of the factory sector has slowed to 0.5% (y/y) and the growth during the last two years was revised down.

The industrial production data are available in Haver's USECON database.

| INDUSTRIAL PRODUCTION (SA, %) | March | February | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Total Output | -1.5 | -1.5 | -12.7 | -2.2 | 1.5 | 2.3 |

| Manufacturing | -1.7 | -0.6 | -15.0 | -3.2 | 1.4 | 2.5 |

| Consumer Goods | -0.4 | -0.7 | -7.8 | -2.6 | 0.9 | 0.4 |

| Business Equipment | -2.4 | -1.5 | -14.4 | -1.1 | 2.7 | 9.4 |

| Construction Supplies | -2.7 | -2.0 | -21.0 | -6.3 | -2.0 | 2.3 |

| Utilities | 1.9 | -7.8 | -2.8 | 0.3 | 3.4 | -0.6 |

| Capacity Utilization | 69.3 | 70.3 | 79.8 (March '08) | 77.6 | 80.6 | 80.9 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.