Global| Dec 03 2010

Global| Dec 03 2010U.S. Factory Shipments & Inventories Continue To Throw Off Mixed Signals

Summary

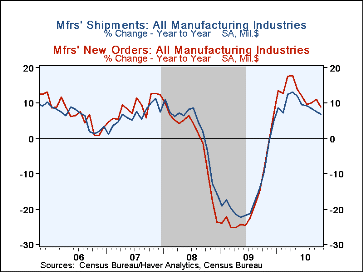

As indicated by the advance report on durable goods industries last week, the total manufacturing sector appears to have lost some momentum in the last few months through October. Shipments of manufactured goods rose just 0.3% in [...]

As indicated by the advance report on durable goods industries last week, the

total manufacturing sector appears to have lost some momentum in the last few

months through October. Shipments of manufactured goods rose just 0.3% in

October (+6.8% y/y) and new orders fell 0.9% (+8.9% y/y). Revisions to

durable goods previously reported were mild; shipments are still seen with a

0.9% decline in the month and orders were shaved to a 3.4% decrease from 3.3% in

the advance release. Nondurable goods shipments rose 1.5% in October and

were 7.7% above year-ago amounts; while this looks good, it compares to gains

back during the spring at about twice that year-to-year rate.

As indicated by the advance report on durable goods industries last week, the

total manufacturing sector appears to have lost some momentum in the last few

months through October. Shipments of manufactured goods rose just 0.3% in

October (+6.8% y/y) and new orders fell 0.9% (+8.9% y/y). Revisions to

durable goods previously reported were mild; shipments are still seen with a

0.9% decline in the month and orders were shaved to a 3.4% decrease from 3.3% in

the advance release. Nondurable goods shipments rose 1.5% in October and

were 7.7% above year-ago amounts; while this looks good, it compares to gains

back during the spring at about twice that year-to-year rate.

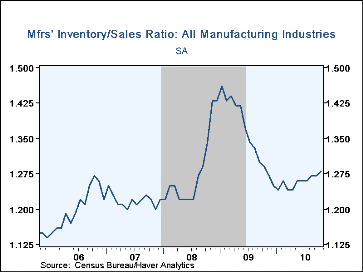

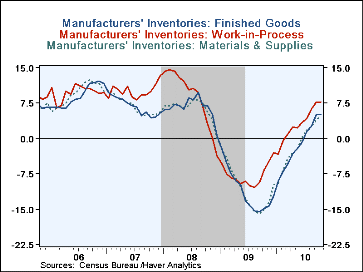

Factory inventories are growing, with October's up 0.9% (+5.8% from a year ago). The inventory/shipments ratio ticked up in October to 1.28 from 1.27 in September; it is about the same as a year ago, but higher than last winter when shipments seemed stronger. Inventories at all three stages of fabrication are rising; the increases in materials & supplies, +4.8% y/y, and work-in-process, +7.7% y/y, suggest that factory managers may believe their demand is moving ahead, so they should rebuild stocks. But the increase in finished goods, +5.1% y/y, could be associated with the recent moderation in shipments, a less desirable development.

Thus, while there are some signs of improving activity, these continue to look quite uneven and tenuous.

The Manufacturers' Shipments, Inventories and Orders (MSIO) data are available in Haver's USECON database.

| U.S. Manufacturing Sector (NAICS, %) | Oct | Sept | Aug | Y/Y | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Inventories | 0.9 | 1.1 | 0.4 | 5.8 | -8.8 | -0.8 | 7.6 |

| New Orders | -0.9 | 3.0 | 0.0 | 8.9 | -17.8 | -1.0 | 8.7 |

| Shipments | 0.3 | 0.7 | -0.2 | 6.8 | -15.6 | 2.3 | 6.4 |

| Unfilled Orders | 0.6 | 1.3 | 0.2 | 1.8 | -11.1 | 2.8 | 31.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates