Global| Feb 06 2012

Global| Feb 06 2012U.S. Fed Loan Officer Survey Shows Firmer Loan Demand

Summary

Demand for bank loans to business firmed noticeably at the very end of 2012, according to the Federal Reserve Senior Loan Officer Survey, which was released Monday, February 4. The survey covered 68 domestic banks and 22 U.S. branches [...]

Demand for bank loans to business firmed noticeably at the very end of 2012, according to the Federal Reserve Senior Loan Officer Survey, which was released Monday, February 4. The survey covered 68 domestic banks and 22 U.S. branches or agencies of foreign banks; it includes questions on lending standards, terms and customer demand for business loans, mortgages and consumer credit. The latest quarterly survey reporting period ran from December 27, 2012, to January 15, 2013. The data are included in Haver's SURVEYS database.

Demand for bank loans to business firmed noticeably at the very end of 2012, according to the Federal Reserve Senior Loan Officer Survey, which was released Monday, February 4. The survey covered 68 domestic banks and 22 U.S. branches or agencies of foreign banks; it includes questions on lending standards, terms and customer demand for business loans, mortgages and consumer credit. The latest quarterly survey reporting period ran from December 27, 2012, to January 15, 2013. The data are included in Haver's SURVEYS database.

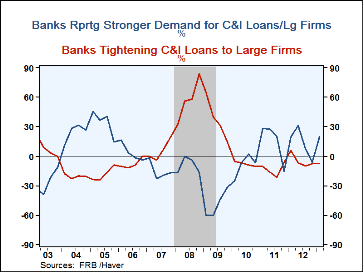

Business loan demand increased markedly in this most recent report, but has actually been somewhat uneven in recent quarters. In the early January report, 30.9% of banks reported increasing loan demand from medium and large companies, up from 20.0% in October. At the same time, the share of banks with weaker business loan demand fell to 11.8% from 26.1%, so that the net positive balance (increasing less weaker) in early January was +19.1% versus -6.2% in October. The mid-summer reading had been a mildly positive +7.9%, while last spring had a sizable net plus of 31.0%. There was a similar pattern for small businesses, with the January reading +15.4% versus +4.5% in October. For both sets of borrowers, strengthening during the first half of 2012 faded completely before the latest pick-up. So it clearly remains to be seen if this latest firming is a substantive upturn or simply a repeat of the recent pick-ups and slowdowns.

Banks' lending policies for commercial and industrial loans to medium- and large-size companies have shown a fairly steady net easing pattern over the last couple of years. The January reading was -7.4%, measured as those tightening less those easing credit standards. Indeed, over the last four quarters, only one bank reported even a "moderate" tightening, that in the October survey. Terms on these loans showed net easing at 17.6% of banks in January, following 12.3% in October. Credit standards for small firms had about the same magnitude of net easing during the last few quarters, while terms were eased on balance by 9.2% of banks in January after 13.6% in October.

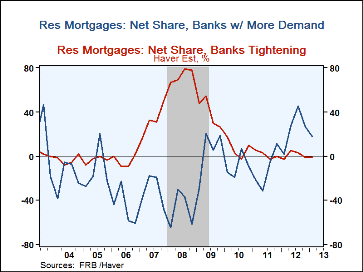

The housing market has shown signs of recovery recently, and banks indeed have seen stronger demand for residential mortgages. In the latest loan officer survey, a net of 18.1% of the banks said mortgage demand was increasing, following three quarters of even wider gains. Lending standards for mortgages have been almost unchanged on balance since early 2010, with the latest period showing net easing at 1% of banks. Notably in the survey report, 65 banks offered prime residential mortgages, about the same number as over the last year; 34 offered so-called non-traditional mortgages, such as the Alt-A variety, this is up noticeably from an average of 25 during 2012. Only five banks even offered subprime mortgages, similar to 4 banks in October and 6 banks last July. Prior to that, no banks at all had offered them since early 2009. Note that the Fed's survey asks separately about prime, nontraditional and subprime mortgages, and Haver calculates the overall mortgage demand and credit policy series based on the proportions of banks offering these types of loans.

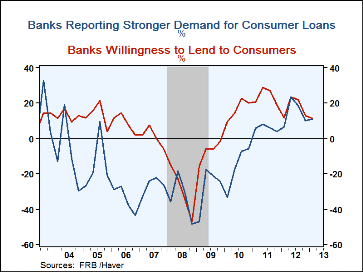

Among consumer lending, the Fed reports a series called "increased willingness to make consumer installment loans". This is the inverse of the usual "increased tightening" measures; it was 11.1% in January, down from 12.7% in October and 21.7% in July, indicating that fewer banks are easing these lending standards. Demand for consumer loans of all kinds was increasing at 10.9% of banks in January, marginally more than the 10.1% of banks in October. These numbers are somewhat lower than during the middle of last year, but they contrast with six years of net declines at more than 15% of banks.

| Senior Loan Officer Survey (Net % of Banks Responding) | ||||||

|---|---|---|---|---|---|---|

| Jan | Oct | Jul | Annual Averages | |||

| 2013 | 2012 | 2012 | 2012 | 2011 | 2010 | |

| C&I Loan Standards, medium & large firms (net % tightening) | -7.4 | -7.6 | -9.5 | -4.7 | -13.7 | -8.0 |

| C&I Loan Demand, medium & large firms (net % stronger) | 19.1 | -6.2 | 7.9 | 13.1 | 14.9 | -9.4 |

| C&I Loan Standards, small firms | -7.7 | -7.6 | -9.5 | -4.7 | -13.7 | -8.0 |

| C&I Loan Demand, small firms | 15.4 | 4.5 | 0.0 | 10.04 | 0.5 | -16.0 |

| Mortgage Standards* | -1.0 | -1.1 | 3.2 | 1.1 | 1.3 | 6.6 |

| Mortgage Demand* | 18.1 | 26.1 | 44.7 | 25.0 | -11.4 | -11.9 |

| Consumer Credit Standards | -2.0 | -11.1 | -10.9 | -11.4 | -11.9 | -1.5 |

| Consumer Credit Demand* | 10.9 | 10.1 | 18.5 | 14.6 | 5.9 | -15.9 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.