Global| Aug 23 2018

Global| Aug 23 2018U.S. FHFA House Price Index Traces Slower Growth Path

Summary

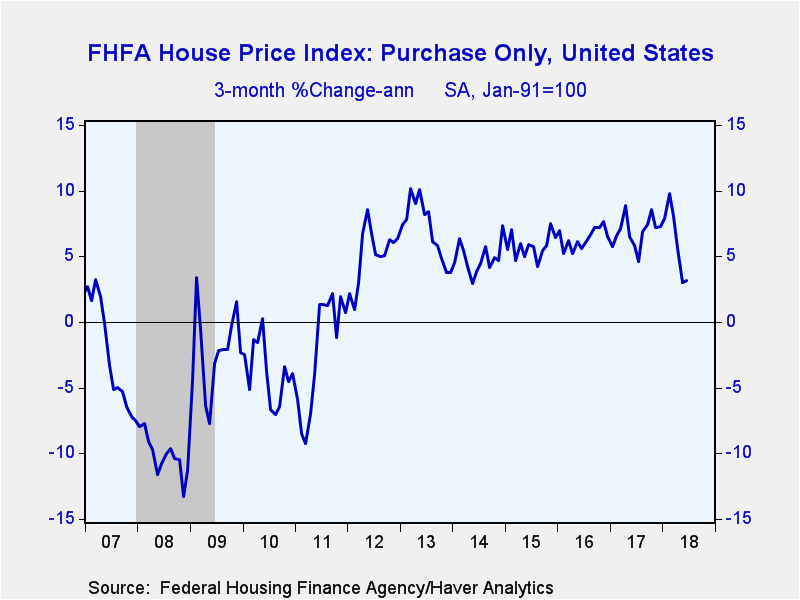

The Federal Housing Finance Agency (FHFA) Price Index for house purchases rose 0.2% in June (6.5% y/y), following a 0.4% increase in May, which was revised from 0.2%. Over the last three months, the index was up at a 3.2% annual rate. [...]

The Federal Housing Finance Agency (FHFA) Price Index for house purchases rose 0.2% in June (6.5% y/y), following a 0.4% increase in May, which was revised from 0.2%. Over the last three months, the index was up at a 3.2% annual rate. The last two months show a marked slowing in that three-month pace back toward the range of 2011-2012.

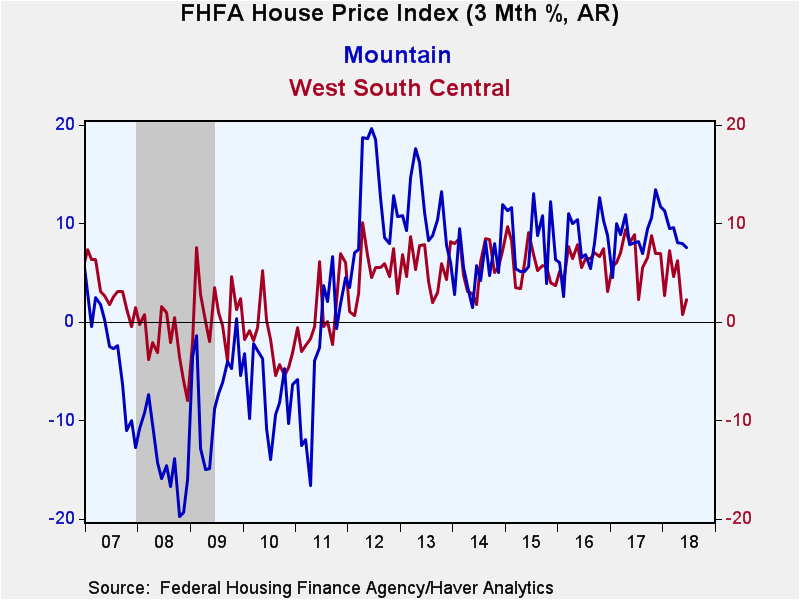

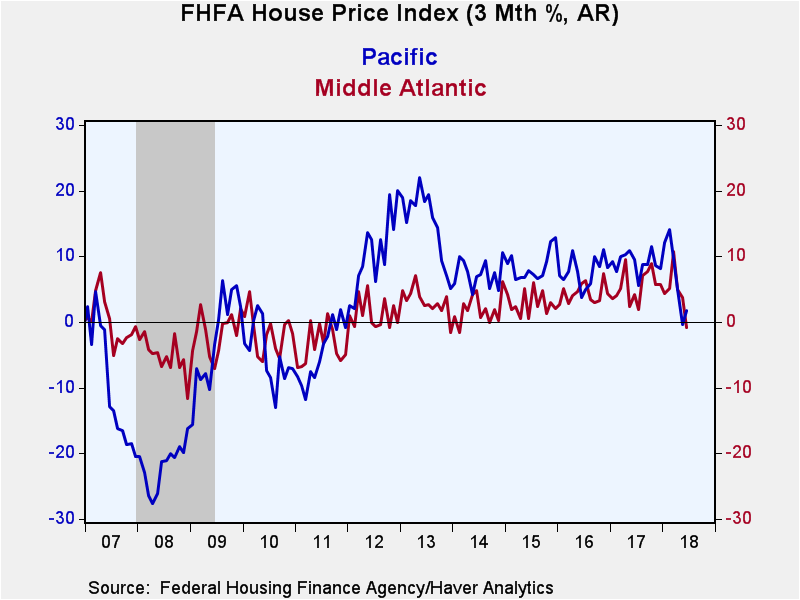

By region, the Mountain states saw the strongest gain in June, 0.7% (9.6% y/y). The East South Central region prices were up 0.6% in the month (6.2% y/y). Prices in the Middle Atlantic region rose 0.5% m/m and 5.7% y/y. West North Central states saw a 0.4% gain in home purchase prices (5.9% y/y).

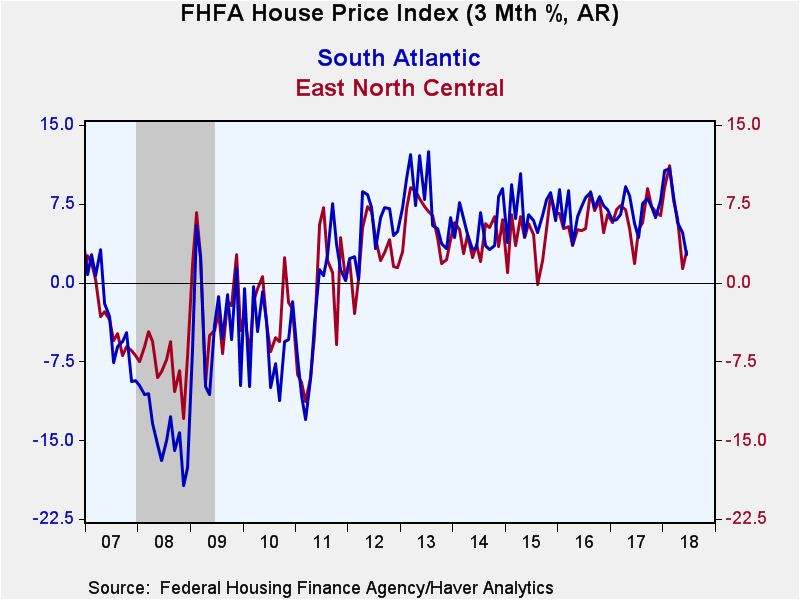

There was more modest 0.2% moves in the Pacific region and in the East North Central states, with prices in the Pacific area up 7.0% y/y and 6.5% in the East North Central area. In the West South Central region, June's prices edged up 0.1% (5.1% y/y).

Prices declined outright in New England and the South Atlantic states, by 0.4% in both regions, with New England up +5.2% y/y and the South Atlantic area, 6.6% y/y.

The FHFA house price index is a weighted purchase-only index that measures average price changes in repeat sales of the same property. An associated quarterly index includes refinancings on the same kinds of properties. The indexes are based on transactions involving conforming, conventional mortgages purchased or securitized by Fannie Mae or Freddie Mac. Only mortgage transactions on single-family properties are included. The FHFA data are available in Haver's USECON database.

| FHFA U.S. House Price Index, Purchase Only (SA %) |

Jun | May | Apr | Jun Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Total | 0.2 | 0.4 | 0.3 | 6.5 | 6.7 | 6.1 | 5.4 |

| New England | -0.4 | 0.7 | 0.6 | 5.3 | 5.9 | 4.1 | 3.3 |

| Middle Atlantic | 0.5 | 0.0 | -0.8 | 5.7 | 4.9 | 3.7 | 2.6 |

| East North Central | 0.2 | -0.3 | 0.8 | 6.5 | 6.1 | 5.4 | 4.3 |

| West North Central | 0.4 | 0.5 | 0.0 | 5.8 | 5.5 | 5.6 | 4.0 |

| South Atlantic | -0.4 | 0.6 | 0.5 | 6.7 | 7.0 | 7.0 | 6.2 |

| East South Central | 0.6 | 1.5 | 0.2 | 6.3 | 5.9 | 5.1 | 4.6 |

| West South Central | 0.1 | 0.5 | -0.1 | 5.1 | 6.6 | 6.0 | 6.2 |

| Mountain | 0.7 | 0.6 | 0.6 | 9.6 | 8.8 | 7.9 | 7.7 |

| Pacific | 0.2 | 0.0 | 0.2 | 7.0 | 8.8 | 8.1 | 7.8 |

New England: Maine, New Hampshire, Vermont, Massachusetts, Rhode Island and Connecticut.

Middle Atlantic: New York, New Jersey and Pennsylvania.

East North Central: Michigan, Wisconsin, Illinois, Indiana and Ohio.

West North Central: North Dakota, South Dakota, Minnesota, Nebraska, Iowa, Kansas and Missouri.

South Atlantic: Delaware, Maryland, D.C., Virginia, West Virginia, North Carolina, South Carolina, Georgia and Florida.

East South Central: Kentucky, Tennessee, Mississippi and Alabama.

West South Central: Oklahoma, Arkansas, Texas and Louisiana.

Mountain: Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona and New Mexico.

Pacific: Alaska, California, Hawaii, Oregon, Washington.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates