Global| Jun 08 2017

Global| Jun 08 2017U.S. Financial Accounts Exhibit Mixed Pattern of Q1 Borrowing as Total Borrowed Slowed

Summary

The Federal Reserve's Financial Accounts data show continued slowing of debt issuance in U.S. financial markets in Q1 2017. The total came to $1,197 billion at a seasonally adjusted annual rate, down from $1,742 billion in Q4. The Q1 [...]

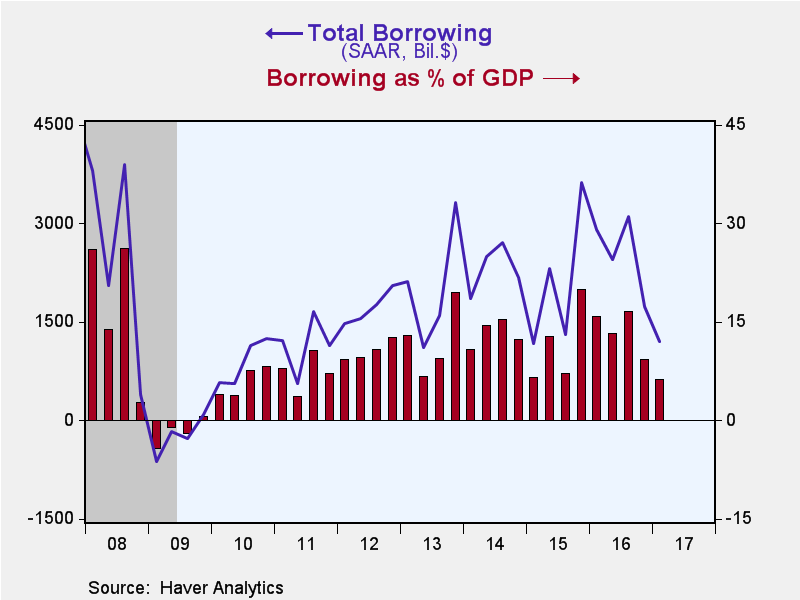

The Federal Reserve's Financial Accounts data show continued slowing of debt issuance in U.S. financial markets in Q1 2017. The total came to $1,197 billion at a seasonally adjusted annual rate, down from $1,742 billion in Q4. The Q1 amount was 6.3% of GDP versus 9.2% in Q4, and the lowest ratio since Q2 2011. A general range of 10-13% has prevailed since 2012, but that compares to the almost 29% average in the five years before the Great Recession and just under 20% over long stretches before then.

The federal government figured in the overall slowdown in Q1 borrowing, as debt was liquidated by $523 billion SAAR in Q1, reflecting the onset of a debt ceiling situation in March. The Treasury continued raising money through marketable coupon securities, adding $190 billion for the quarter as a whole, while they paid down $243 billion in Treasury bills and $469 billion in nonmarketable debt; this last included paydowns of $423 billion of securities held by the Treasury Savings Plan G Fund, a vehicle for government employees similar to the private sector's 401(k) plans.

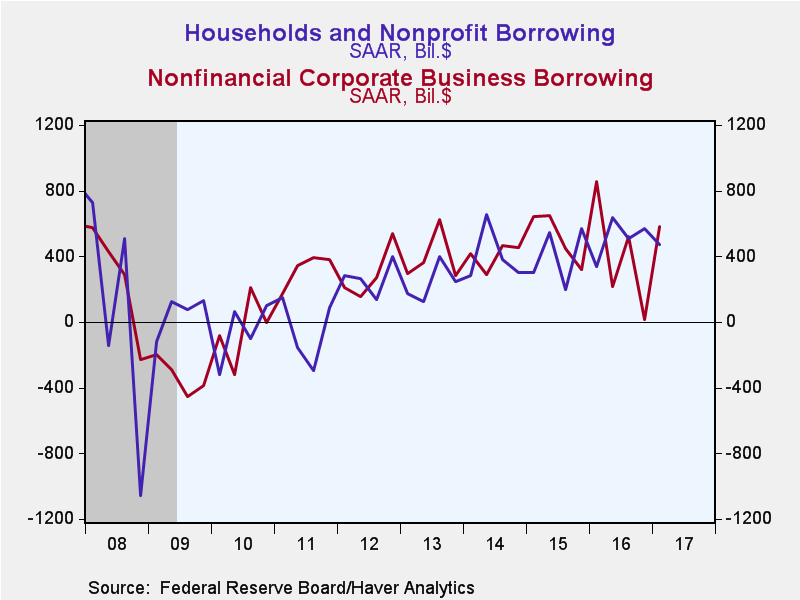

Households added debt at a $474 billion annual rate in Q1, down from $569 billion in Q4. Home mortgage borrowing was $296 billion SAAR, slightly less than the $314 billion pace in Q4. Consumer credit also slowed, with $190 billion net increase versus $242 billion the quarter before. Depository institution loans were paid down at a $32 billion pace after rising by $97 billion in Q4.

Household borrowing was 3.3% of disposable personal income in Q1, down from 4.0% in Q4. As we have repeatedly pointed out in these summaries, this measure of debt burden is far smaller than in the run-up to the Great Recession: in 2003 through 2006, this ratio was just over 12%. We thus don't mind saying again that part of the reason the current expansion has been relatively slow is the restrained pace of borrowing after the excesses of that pre-recession period.

In contrast, both corporate business and financial institutions increased their debt usage in Q1. Corporate businesses borrowed $582 billion SAAR compared to just $16 billion in Q4. Security issuance was $427 billion versus $54 billion; the Q1 amount included $423 billion in corporate bonds. Loans went up by $155 billion compared to net liquidation of $38 billion in Q4. Financial institutions raised $269 billion in new debt in Q1, up from $81 billion in Q4; while the latest quarter was stronger, it is still noticeably less than even the first three quarters of last year, which averaged $550 billion.

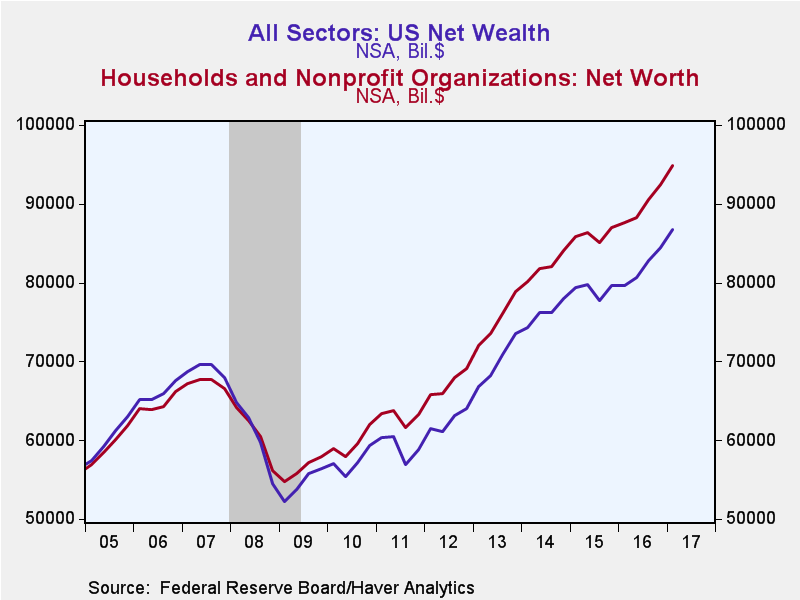

Press reports of these Financial Accounts highlight household balance sheets and net worth, and yet again describe the latest quarter-end amount, $94.8 trillion, as a "record." Net worth did rise in Q4, by $2.3 trillion (quarterly rate, not seasonally adjusted). On the asset side, homeowners' equity contributed to the increase as did holdings of corporate shares and mutual fund shares.

Net wealth of the total economy moved ahead $2.3 trillion in Q1 to $86.7 trillion from $84.4 trillion at end-Q4 (also levels, not seasonally adjusted). The total market value of domestic corporations rose to $33.1 trillion from $31.6 trillion. Net financial claims on the "rest of the world" remained steady at -$5.98 trillion versus -$5.99 trillion. The remainder of the net wealth measure consists of nonfinancial assets held by households, noncorporate business and governments; these totaled $59.3 trillion at end-Q1, up $756 billion from end-Q4.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.