Global| Dec 12 2019

Global| Dec 12 2019U.S. Financial Accounts Show Larger Government Borrowing, Somewhat Less Household Borrowing

Summary

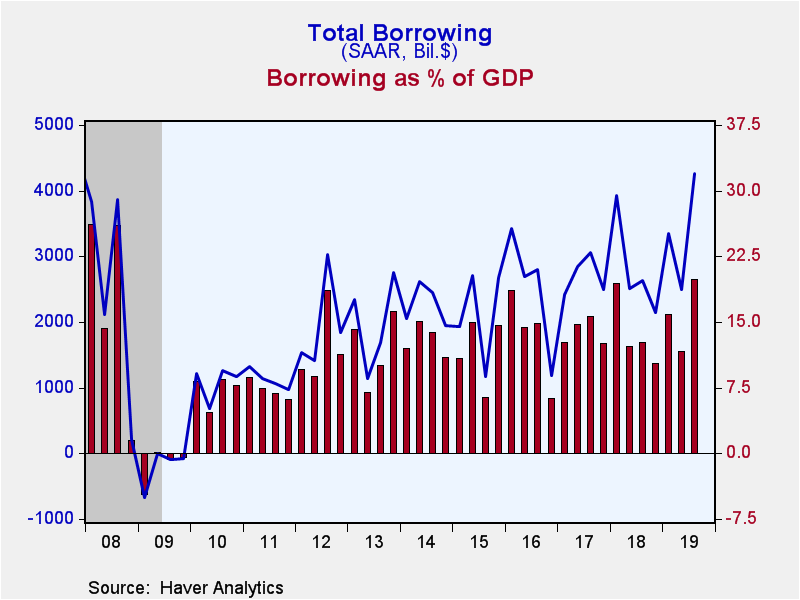

Total borrowing in U.S. financial markets rose to $4,266 billion in Q3 2019 from $2,489 billion in Q2, according to the Federal Reserve's Financial Accounts data. The Q3 amount represented 19.8% of GDP, compared to 11.7% of GDP in Q2. [...]

Total borrowing in U.S. financial markets rose to $4,266 billion in Q3 2019 from $2,489 billion in Q2, according to the Federal Reserve's Financial Accounts data. The Q3 amount represented 19.8% of GDP, compared to 11.7% of GDP in Q2. The borrowing amount was the largest since Q3 2007 and the ratio to GDP was largest since Q3 2008. Note that all the dollar figures quoted here are seasonally adjusted annual rates.

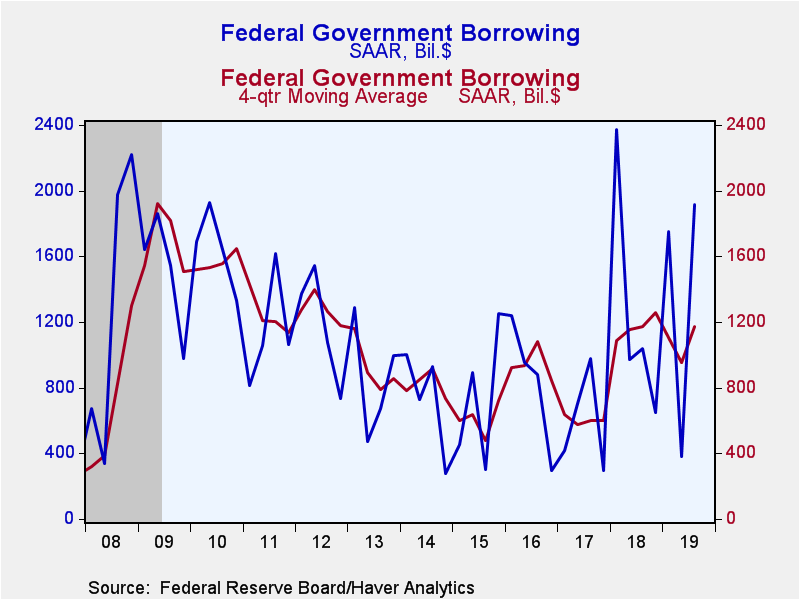

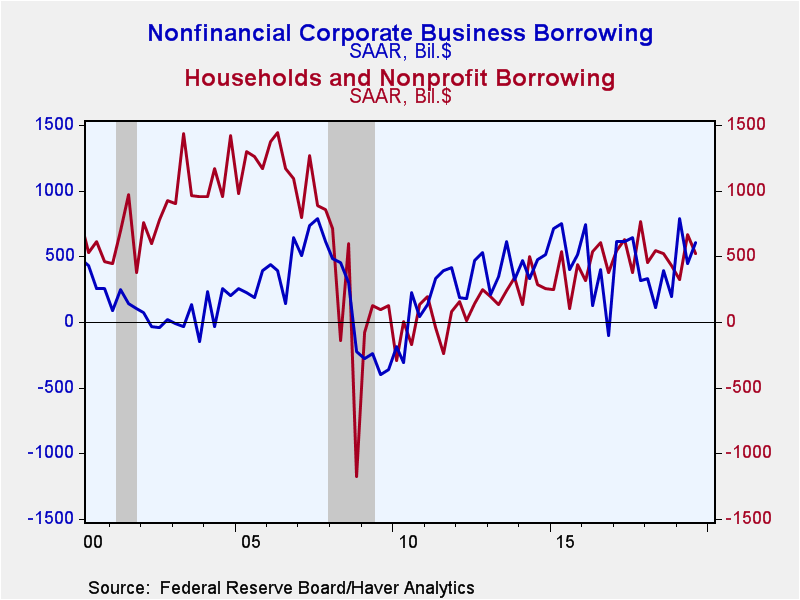

The prime mover of the sizable increase in total borrowing was the federal government. On a seasonally adjusted annual rate basis, it borrowed $1,919 billion in Q3, five times the $382 billion it borrowed in Q2. Households, by contrast, reduced their borrowing somewhat to $521 billion from $668 billion. Households, actually, were the only major sector of the economy to cut back borrowing, although the other sectors had only modest increases.

Nonfinancial corporations borrowed $603 billion in Q3, up from $445 billion in Q2. Corporate bond issuance was $381 billion, up from $303 billion, while loans from banks and other lending institutions were just barely higher at $198 billion in the latest quarter versus $189 billion the quarter before. Along with commercial paper and municipal bonds, these debts together financed 28.4% of companies' capital spending; this is above 2018 amounts but also well within the recent general range from 2011 through 2017.

Financial institutions borrowed $431 billion in Q3, just slightly more than the $424 billion in Q2. This represents 2.0% of GDP and is still close in line with the magnitude of those institutions' funding needs over the last five or six years. This recent trend is substantially less than in the run-up to the Great Recession, when the ratio was often greater than 10% and peaked at 17.9% in Q3 2007.

Breaking out some detail on household borrowing, the decrease in Q3 was in home mortgages, which were $279 billion versus $356 billion. "Other" loans, which can be quite erratic, went up just $4.9 billion after $80.2 billion. Consumer credit actually increased more in Q3, $207 billion, than in Q2, $168 billion. Auto loans grew $48.7 billion after $28.2 billion in Q2 and "other" consumer credit rose $34.3 billion after just $2.6 billion in Q2. Student loan borrowing went up just a little, amounting to $85.6 billion after $82.9 billion. The average has been $87 billion over the past eight years. By contrast, people did somewhat less borrowing with their credit cards in Q3, $38.6 billion, following $54.8 billion in Q2. The total of household borrowing equaled 3.1% of disposable personal income in Q3, down from 4.1% in Q2. These ratios compare -- as we have pointed out before -- to 12.5% from 2004 through 2006, just ahead of the Great Recession.

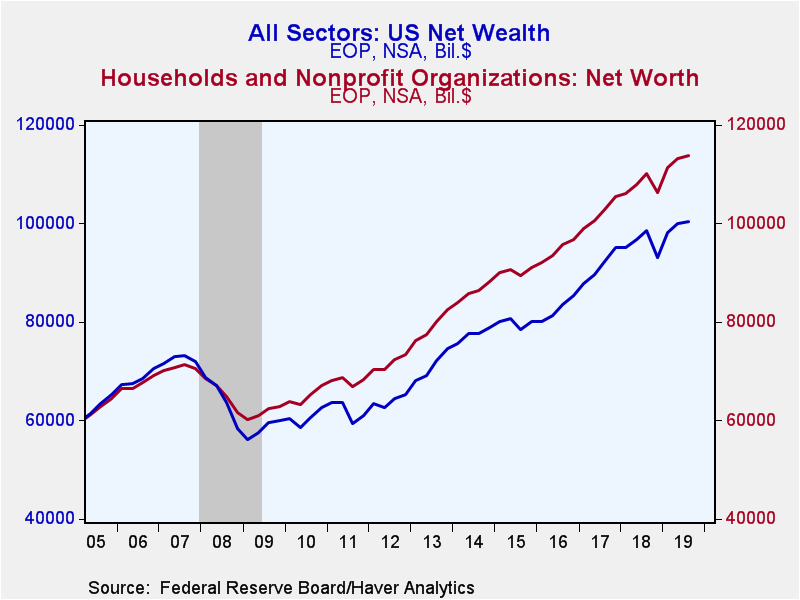

The Fed's press release of these Financial Accounts and the associated press reports highlight household balance sheets and net worth. Household net worth grew modestly in Q3; it was $113.8 trillion on September 30 (amount outstanding, not seasonally adjusted), compared to $113.3 trillion on June 30. The Q3 amount was 688% of disposable personal income, down slightly from 692% in Q2. In Q3, households' holdings of corporate equities and mutual fund shares edged lower by $180 billion (not seasonally adjusted quarterly change) after gaining $843 billion in Q2, while holdings of debt securities and money fund shares increased $176 billion, versus $238 billion. Real estate holdings and other nonfinancial assets increased $258 billion in Q3 after $328 billion in Q2. Household liabilities rose $176 billion in Q3, almost exactly the same amount as Q2's $174 billion increase. Home mortgage liabilities were $10.517 trillion on September 30, which represents 36.0% of household real estate holdings, almost exactly the same as the 35.8% at the end of the quarter before. Along with 35.7% at the end of Q1, the Q2 and Q3 ratios are the smallest fraction since Q3 1991 and contrast with 53%-54% from 2009 through early 2012, during and in the aftermath of the Great Recession financial crisis.

Net wealth of the total U.S. economy increased $289 billion in Q3, much less than $1.901 trillion of Q2 and $4.982 trillion of Q1, when the stock market rebounded after its late-2018 drop. The net wealth total on September 30 was $100.4 trillion, compared to $100.1 trillion on June 30 (levels, not seasonally adjusted). The associated market value of domestic corporations edged lower by $36 billion rose during Q3, following gains of $1.385 trillion in Q2 and $4.492 trillion in Q1. Net financial claims on the "rest of the world" were -$10.202 trillion on September 30, a bit larger than the -$9.901 trillion deficit on June 30. The remainder of the net wealth measure consists of nonfinancial assets held by households, noncorporate business and governments; these totaled $69.736 trillion on September 30, up $625 billion from June 30.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database as well as in FFUNDS.

| Financial Accounts (SAAR, Bil.$) | Q3'19 | Q2'19 | Q1'19 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Total Borrowing* | 4,266 | 2,489 | 3,355 | 2,803 | 2,705 | 2,522 | 2,126 |

| Federal Government | 1,919 | 382 | 1,751 | 1,258 | 599 | 843 | 725 |

| Households | 521 | 668 | 324 | 489 | 579 | 459 | 330 |

| Nonfinancial Corporate Business | 603 | 445 | 787 | 257 | 545 | 292 | 593 |

| Financial Sectors | 432 | 424 | 333 | 346 | 325 | 468 | 185 |

| Foreign Sector | 479 | 406 | -75 | 177 | 398 | 38 | 32 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.