Global| Dec 11 2018

Global| Dec 11 2018U.S. Financial Accounts Show Moderate Borrowing, Average Ratio to GDP

Summary

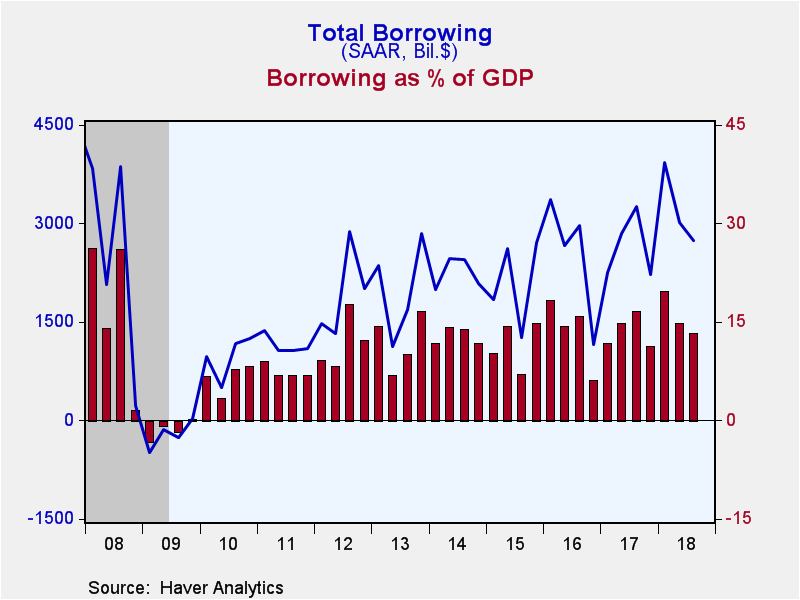

Total borrowing in U.S. financial markets slowed modestly in Q3 2018, according to the Federal Reserve's Financial Accounts data, which were published last Thursday, December 6. It totaled $2,737 billion at a seasonally adjusted [...]

Total borrowing in U.S. financial markets slowed modestly in Q3 2018, according to the Federal Reserve's Financial Accounts data, which were published last Thursday, December 6. It totaled $2,737 billion at a seasonally adjusted annual rate, compared to $3,019 billion in Q2. That earlier period was, however, revised upward from $2,596 billion reported in September, so borrowing in the middle of the year was somewhat larger than first tabulated. The third quarter total represents 13.2% of GDP, down from 14.8% in Q2 and 19.6% in Q1. The third quarter's 13.2% nearly matches the trailing five-year (20-quarter) average of 13.6%.

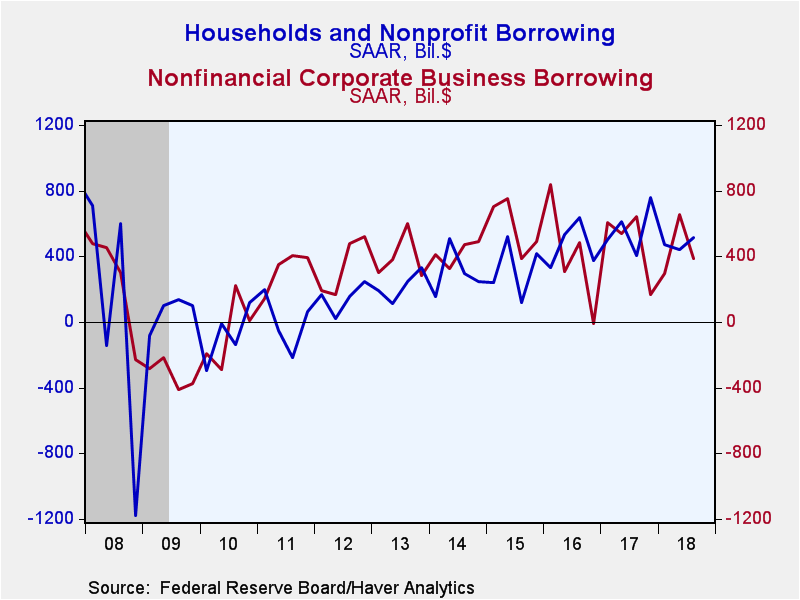

The borrowing slowdown in Q3 was mainly accounted for by nonfinancial corporations. They had used $653 billion in Q2 but only required $389 billion in Q3. Their "other loans and advances," which had increased $644 billion in Q2, rose by a lesser $253 billion in Q3. Companies had paid down corporate bond liabilities in Q2, but returned to this longer-term borrowing in Q3, by $172 billion. That is still considerably less than its five-year average of $279 billion. All borrowing amounts cited here are seasonally adjusted annual rates.

Households borrowed $516 billion in Q3, up from $444 billion in Q2 and $470 billion in Q1, neither earlier period revised materially. The Q3 amount is 3.3% of disposable personal income, close to the five-year average of 3.0%, and as we've pointed out before, it remains far lower than the 10%-12% range that prevailed ahead of the Great Recession. Home mortgages grew $313 billion in Q3, up from $269 billion in Q2, and well within the range since early 2017. Use of consumer credit, including credit cards, student loans and auto loans, among others, was $210 billion in Q3, up from $144 billion in Q2, the increase accounted for mainly by auto loans and "other" consumer credit.

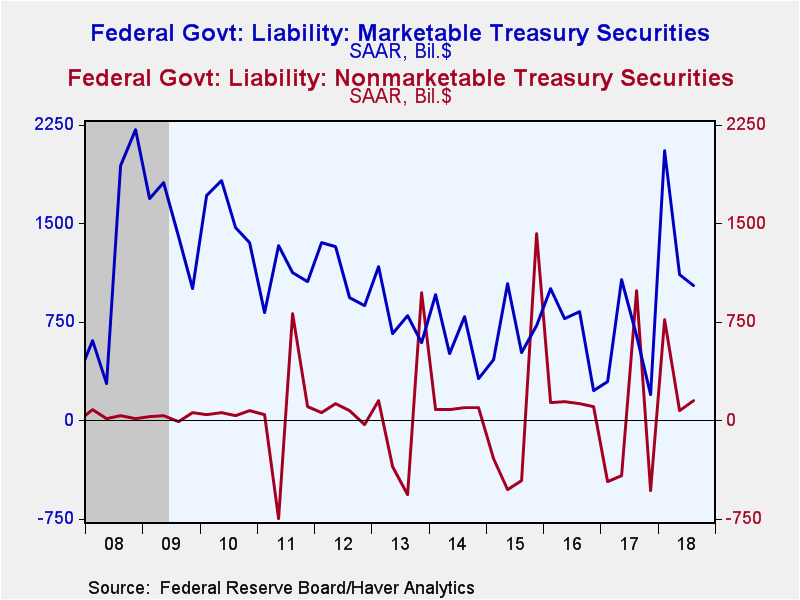

The federal government borrowed $1,180 billion in Q3, almost the same amount as the $1,186 billion in Q2. The government's borrowing these last two quarters was almost entirely in ordinary marketable bills, notes and bonds. Nonmarketable security issuance, which has occasionally been quite sizable, was just $78 billion in Q2 and $155 billion in Q3.

Financial institutions' borrowings decreased slightly in Q3 to a $216 billion annual rate from $255 billion in Q2. These two periods compare with an average over the last two years of $275 billion and again, represent much less credit usage by the financial sector itself than was the case before the Great Recession.

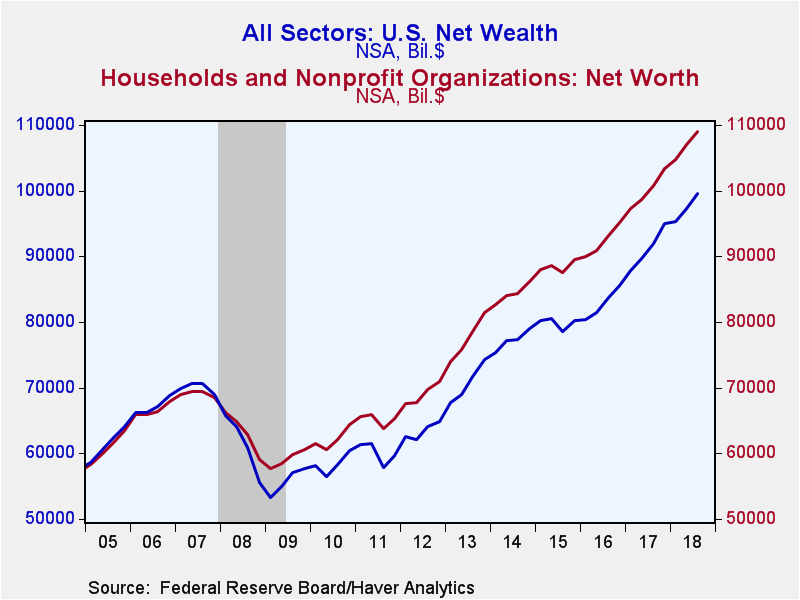

Press reports of these Financial Accounts highlight household balance sheets and net worth. Household net worth continued to rise in Q3, reaching $109.0 trillion (amount outstanding, not seasonally adjusted) from $107.0 trillion at the end of Q2. The Q3 amount represents 699.9% of disposable personal income, up from 678.7% a year ago. In the third quarter, households' holdings of corporate equities and mutual fund shares increased $1.045 trillion (not seasonally adjusted quarterly change), holdings of debt securities and loans by $394 billion, equity in noncorporate businesses $101 billion, and pension entitlements $350 billion. Real estate holdings and other nonfinancial assets gained $320 billion. Household liabilities increased $168 billion. Home mortgage liabilities were $10.267 trillion, which represents 40.1% of real estate holdings; this is the lowest ratio since mid-2002 and contrasts with 63.5% in Q1 2009 in the midst of the Great Recession financial crisis.

Net wealth of the total U.S. economy rose $2.321 trillion in Q3 after a $1.900 trillion increase in Q2. It amounted to $99.6 trillion on September 30, up from $97.3 billion on June 30 (levels, not seasonally adjusted). The total market value of domestic corporations gained $2.199 trillion in Q3 following a $1.535 trillion increase in Q2. Net financial claims on the "rest of the world" were -$6.292 trillion at end-Q3, a larger deficit than Q2's -$5.877 trillion. The remainder of the net wealth measure consists of nonfinancial assets held by households, noncorporate business and governments; these totaled $64.217 trillion on September 30, up $538 billion from June 30.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database as well as in FFUNDS.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates