Global| Sep 18 2015

Global| Sep 18 2015U.S. Financial Accounts Show Moderate Borrowing; Little Change in Net Wealth

Summary

Total borrowing in the U.S. resumed a more normal pace in Q2, according to the Federal Reserve's Financial Accounts of the U.S., following a much smaller amount in Q1. Indeed, Q1 net paydowns by the federal government and the [...]

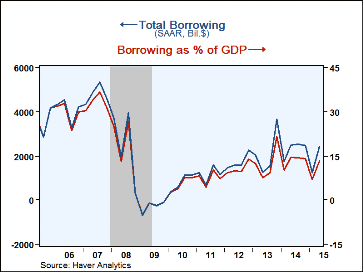

Total borrowing in the U.S. resumed a more normal pace in Q2, according to the Federal Reserve's Financial Accounts of the U.S., following a much smaller amount in Q1. Indeed, Q1 net paydowns by the federal government and the financial sector were reversed in Q2, and household sector borrowing increased. Total borrowing thus was $2.422 trillion at a seasonally adjusted annual rate, almost exactly double the $1.234 trillion in Q1. The Q2 total amount is 13.5% of GDP, following a very low 7.0% in Q1.

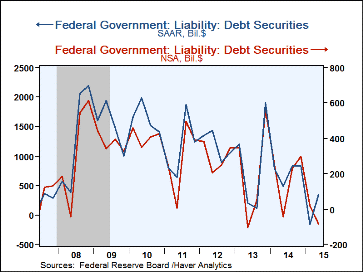

Last quarter, we were concerned here with the role of the federal government, as seasonally adjusted data showed a net paydown in Q1, a period when there is outright borrowing. The seasonally adjusted figure was indeed reversed in Q2, with the Financial Accounts showing borrowing of $350 billion, SAAR, while the actual, unadjusted Treasury debt operations in fact paid down $81 billion. In addition, the financial sector reversed Q1's seasonally adjusted paydowns of $160 billion with Q2 borrowing of $377 billion.

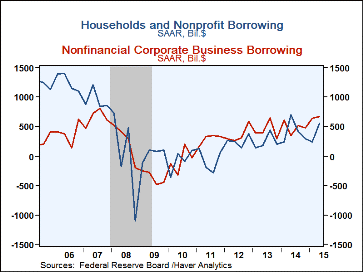

Households did increase their borrowing in Q2. Consumer credit grew $271 billion, SAAR, compared to $174 billion in Q1. Home mortgages went up at a $206 billion annual rate after being basically unchanged in Q1. The Q2 amount is the largest since Q1 2008, when people borrowed on homes at a $358 billion pace.

Nonfinancial corporate business borrowing changed little in Q2. Companies issued $622 billion, SAAR, in corporate bonds, up from $449 billion in Q1, but other borrowing diminished; depository institution loans went up $68 billion, less than the $118 billion increase in Q1, and companies paid down somewhat more in commercial paper than they had in Q1.

Press reports of these Financial Accounts tend to emphasize household balance sheets and net worth. Net worth did increase modestly in Q2, reaching $85.7 trillion. The amount was 645% of disposable income, virtually the same as in Q1, with both Q1 and Q2 the highest such ratios since Q3 2007, before the financial crisis and recession.

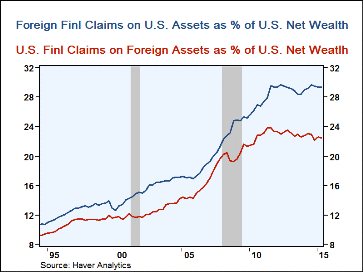

At the same time, these Financial Accounts cover the entire economy, and in our commentary, as seen here, we also emphasize portions describing other sectors and broader aggregates. In that regard, the Fed, in today's report, introduces a new measure of "net U.S. wealth". This is defined as the value of nonfinancial assets held by households, noncorporate businesses and governments plus the market value of corporation plus net U.S. financial claims on the rest of the world. In Q2, this net wealth measure stood at $79.7 trillion, up marginally from $79.2 trillion at the end of Q1. Interestingly, foreign claims on U.S. assets came to $23.4 trillion at the end of Q2, just shy of 30% of total net wealth. This ratio has been almost flat for four years. U.S. financial claims on foreign assets run to 22.5% of U.S. wealth; that ratio has eased ever so slightly over the past four years from 23.8% in the middle of 2011. Both of these ratios had seen fairly steady uptrends prior to that time. So U.S. interaction with foreign markets, borrowers and lenders is extensive and these new data series highlight that well.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates