Global| Jun 09 2016

Global| Jun 09 2016U.S. Financial Accounts Show Moderation in Credit Use; Slim Rise in Household Net Worth

Summary

Total borrowing in the U.S. decreased in Q1 to $2,493 billion at a seasonally adjusted annual rate, down from $3,950 billion in Q4 2015, according to the Financial Accounts of the U.S., released today by the Federal Reserve Board. The [...]

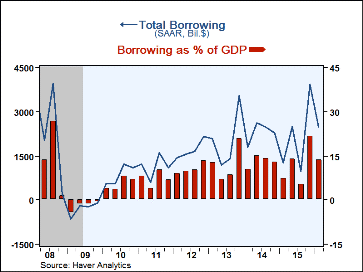

Total borrowing in the U.S. decreased in Q1 to $2,493 billion at a seasonally adjusted annual rate, down from $3,950 billion in Q4 2015, according to the Financial Accounts of the U.S., released today by the Federal Reserve Board. The Q1 amount represented 13.7% of GDP, compared to 21.7% in Q4 and similar to the general 10-13% range that has prevailed since 2012. Effects of a whipsaw in total borrowing caused by last fall's federal debt ceiling crisis faded away, so that total borrowing could proceed along a steadier path.

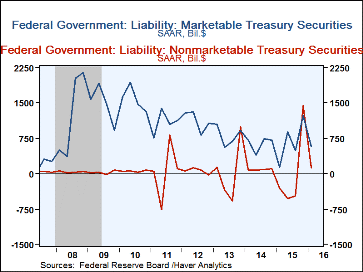

Indeed, the federal government's total credit market borrowing was $701 billion SAAR in Q1, near the annual totals of 2013-2015 (see the table below). In Q4, by contrast, the government had borrowed $2,682 billion SAAR. The Q1 amount consisted of $580 billion of marketable bills, notes and bonds, and just $121 billion of nonmarketable securities. Marketable debt issuance in Q4 had been $1,230 billion and nonmarketable debt had risen then at a $1,450 billion annual rate.

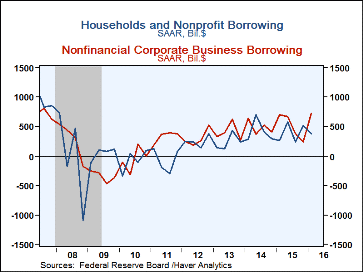

Borrowing by households was $379 billion SAAR in Q1, down from Q4's $521 billion. Net new home mortgages were $156 billion, almost the same as Q4's $155 billion. Consumer credit expanded $214 billion, also similar to its Q4 amount, $212 billion. Borrowing by hedge funds and others assigned to the "household" sector was actually quite modest, a mere $9 billion in Q1 compared to $154 billion in Q4. Household borrowing relative to disposable personal income was 2.8% in Q1, similar to the last four years' experience. This compares to paydowns in 2008, 2010 and 2011, but more than 12% from 2003 to 2006. So households seem quite cautious in their use of credit.

Nonfinancial corporate business borrowing expanded noticeably in Q1, to $723 billion SAAR from $234 billion in Q4. Corporate bond issuance was $529 billion SAAR, up from Q4's $215 billion. Depository institution loans increased $161 billion after Q4's slim $35 billion amount, while "other" loans were paid down at a $61 billion annual rate in Q1 after Q4's $82 billion paydown. Commercial paper issuance was similar in the two quarters, $34 billion in Q1 and $23 billion in Q4.

The financial sector continued its minimal net borrowing pace, just $349 billion SAAR in Q1, following $226 billion in Q4.

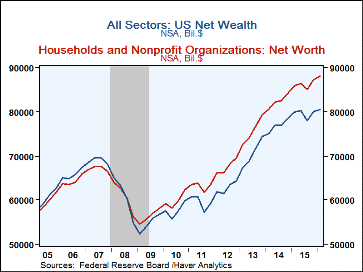

Press reports of these Financial Accounts highlight household balance sheets and net worth. Household net worth continued to grow in Q1, reaching to $88.1 trillion (not seasonally adjusted) from $87.2 trillion at the end of Q4. Among assets, homeowners' equity rose from $12.6 trillion to $13.0 trillion, but holdings of corporate stocks decreased in value from $14.0 trillion to $13.85 trillion.

Net wealth of the total economy barely changed in Q1. This measure, recently devised by the Federal Reserve, was $80.3 trillion (not seasonally adjusted level), compared to $80.1 trillion at the end of 2015. As with the household sector alone, the market value of corporate businesses lost a marginal amount, while households holdings of nonfinancial assets increased. Net U.S. claims on the rest-of-the-world were slightly more negative, at -$5.7 trillion at end-Q1 versus -$5.6 trillion at end-2015.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates