Global| Mar 10 2016

Global| Mar 10 2016U.S. Financial Accounts Show More Borrowing But Also Modest Gain in Net Wealth

Summary

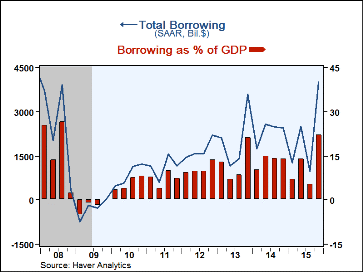

Total borrowing in the U.S. rebounded in Q4 to $4,014 billion at a seasonally adjusted annual rate, according to the Financial Accounts of the U.S., which were released today by the Federal Reserve Board. The large total was mainly [...]

Total borrowing in the U.S. rebounded in Q4 to $4,014 billion at a seasonally adjusted annual rate, according to the Financial Accounts of the U.S., which were released today by the Federal Reserve Board. The large total was mainly due to a whipsaw federal government borrowing which resulted from the debt ceiling crisis in the early autumn. Otherwise, customary borrowing by households and businesses remained moderate. The Q4 borrowing total was 22.1% of GDP, compared to just 5.4% in Q3. For all of 2015, credit market borrowing totaled $2,188 billion, 12.2% of GDP, very similar to the 10-13% range of the previous three years.

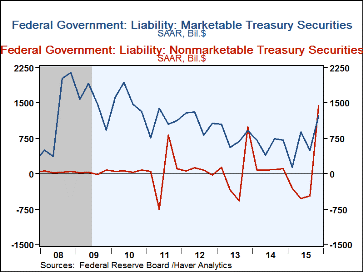

The federal government's total credit market borrowing of $2,682 billion SAAR in Q4 consisted of $1,230 billion of marketable bills, notes and bonds, and $1,450 billion of nonmarketable securities. There was also a tiny amount of borrowing of multi-family mortgages. The marketable debt issuance in Q3 had been $496 billion, whereas nonmarketable debt was paid down then at a $471 billion annual rate. The relatively small total in Q3 resulted from the debt ceiling crisis, and trust funds were liquidated then to meet current needs. Later, in Q4, after the debt ceiling was finally raised, the trust funds were replenished, according to the Federal Reserve's explanation and nonmarketable borrowing reflected that need. In the accompanying graph, note the similar patterns in 2011 and 2013.

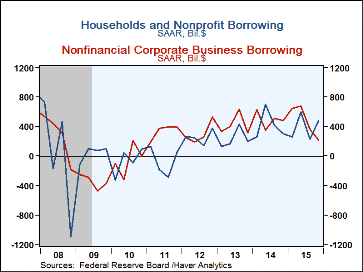

Borrowing by households did increase in Q4 to $481 billion SAAR, up from Q3's $229 billion. However, this increase, too, was related to a "special factor", as it was concentrated in "other" loans and in business-oriented depository institution loans, which are generally used by hedge funds, not ordinary households. Traditional types of borrowing by households actually decreased somewhat in Q4; home mortgage borrowing was $147 billion, SAAR, down from Q3's $162 billion, and consumer credit borrowing was $207 billion, down a bit from Q3's $246 billion.

Nonfinancial corporate business borrowing decreased to $214 billion SAAR in Q4 from $365 billion in Q3. Corporate bond issuance was just $220 billion SAAR, compared to Q3's $319 billion. Depository institution loans and "other" loans were paid down at a $15 billion annual rate after Q3's $33 billion paydowns. Commercial paper issuance also slowed, to just $23 billion, from $70 billion in Q3.

The financial sector continued its minimal net borrowing pace, just $206 billion SAAR in Q4, following $284 billion in Q3.

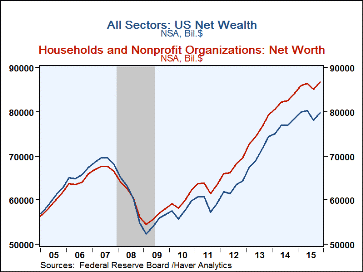

Press reports of these Financial Accounts highlight household balance sheets and net worth. Household net worth rose in Q4 to $86.8 trillion (not seasonally adjusted) from $85.2 trillion at the end of Q3. Households' holdings of corporate equities rose somewhat, as did mutual fund shares. Pension fund entitlements, which had decreased in Q3, recovered in Q4. Homeowners' equity also increased.

Net wealth of the total economy also increased in Q4. This measure, recently devised by the Federal Reserve, was $86.8 trillion (not seasonally adjusted level) at year-end, up $1.6 trillion from end-Q3. Much of that, $1.2 trillion, was seen in the increased market value of domestic corporations. Household holdings of nonfinancial assets increased $517 billion, but net U.S. claims on foreign assets went down $263 billion.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates