Global| Dec 09 2016

Global| Dec 09 2016U.S. Financial Accounts Show More Government Borrowing, but Little Change in Other Sectors

Summary

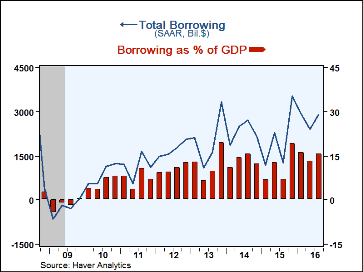

Relatively sluggish economic conditions in the U.S. continue to be reflected in moderation in the use of credit. Total borrowing in the U.S. was $2,895 billion at a seasonally adjusted annual rate in Q3, up from $2,414 billion in Q2, [...]

Relatively sluggish economic conditions in the U.S. continue to be reflected in moderation in the use of credit. Total borrowing in the U.S. was $2,895 billion at a seasonally adjusted annual rate in Q3, up from $2,414 billion in Q2, according to the Financial Accounts of the U.S., released by the Federal Reserve Board on December 8. The Q3 amount represented 15.5% of GDP, up from 13.1% in Q2; this is somewhat larger than the general 10-13% range that has prevailed since 2012, but compares to the almost 29% average in the 5 years before the Great Recession and just under 20% over long stretches before then.

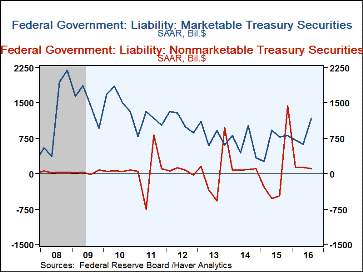

Federal government borrowing was noticeably larger in Q3, at $1,285 billion SAAR versus $722 billion in Q2. Issuance of marketable Treasury securities was $1,170 billion in Q3 following $629 billion the quarter before. Nonmarketable borrowing tapered to $115 billion after $141 billion, maintaining a more normal pace in the absence of controversy over the debt ceiling.

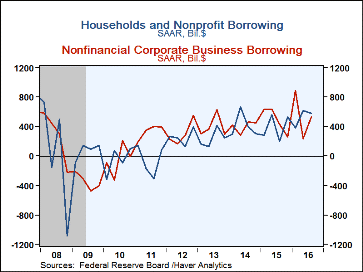

Households borrowed $580 billion SAAR in Q3, similar to Q2's $621 billion. Net new home mortgages came to $282 billion, up from $242 billion in Q2. The Q3 amount marked another new high since Q1-2008, but still substantially smaller than during the housing boom just ahead of the recession. It also marked the second successive quarter since the recession that mortgage borrowing was larger than consumer credit borrowing. A situation in which consumer credit use is larger than mortgage borrowing is extraordinary historically and is another sign of the retreat in home buying and borrowing that has persisted even after the nominal end of the recession.

Consumer credit itself expanded $273 billion in Q3, up from $231 billion in Q2. Credit card debt rose $51 billion after $69 billion, and student loans rose $87 billion, almost exactly the same as the $86 billion in Q2. Auto loans grew $93 billion in Q3, up from $78 billion in Q2, with both of these quarters showing some rebound after smaller amounts the two prior periods. Borrowing by non-profits, hedge funds and others assigned to the "household" sector was just $35 billion in Q3, much less than the $157 billion SAAR in Q2. Household borrowing was 4.2% of disposable personal income in Q3, a bit easier than the 4.4% in Q2. In sharp contrast, from 2003 through 2006, this ratio was just over 12%.

Borrowing by nonfinancial corporate businesses increased to $529 billion SAAR in Q3 from just $237 billion in Q2. Corporate bond issuance was $341 billion, up from $291 billion, and net new depository institution loans were $120 billion, compared to a mere $8 billion in Q2. Loans from other lenders rose $102 billion after net paydowns of $158 billion, while commercial paper was paid down in the latest period by $135 billion following a marginal usage of $12 billion in Q2.

Borrowing by the financial sector itself was fairly steady in Q3; it amounted to $480 billion, similar to Q2's $547 billion and Q1's $596 billion. As we've noted before, those periods make the strongest six months since the recession, but as with other sectors, they are still small compared to the pre-recession borrowing boom, when financial sector borrowing averaged more than $1 trillion a year and $2 trillion in 2007.

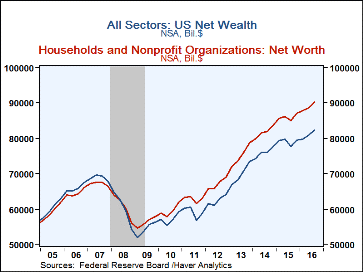

Press reports of these Financial Accounts highlight household balance sheets and net worth, and again describe the latest quarter-end amount, $90.1 trillion, as a "record." Indeed, household net worth did rise in Q3, by $1.6 trillion (quarterly rate, not seasonally adjusted), although as in other recent periods, the increase is not dramatic. It reflects modest gains in a variety of asset types, including homeowners' equity, direct holdings of corporate equities, mutual fund holdings, pension entitlements and small business equity. Perhaps the most distinctive feature is that there were indeed modest gains in several types of assets, so some one-off special factor was not the sole cause.

Net wealth of the total economy moved ahead $1.5 trillion in Q3 to $82.4 trillion from $80.9 trillion at end-Q2 (also levels, not seasonally adjusted). The total market value of domestic corporations rose to $30.1 trillion from $29.4 trillion. Net financial claims on the "rest of the world" were virtually unchanged at -$5.92 trillion from -$5.95 trillion. The remainder of the net wealth measure consists of nonfinancial assets held by households, noncorporate business and governments; these totaled $58.3 trillion at end-Q3, up $790 billion from end-Q1.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates