Global| Jun 10 2020

Global| Jun 10 2020U.S. FY to Date Government Budget Deficit Rises to a Record $1.9 Trillion

Summary

• May budget deficit of $399 billion; fiscal-year-to-date (FY) deficit of $1.88 trillion. • Last month FY surpassed dollar deficit record, this month share of GDP at 75-year high. • FY outlays up 29.4% versus a year ago; revenues down [...]

• May budget deficit of $399 billion; fiscal-year-to-date (FY) deficit of $1.88 trillion.

• Last month FY surpassed dollar deficit record, this month share of GDP at 75-year high.

• FY outlays up 29.4% versus a year ago; revenues down 11.2%.

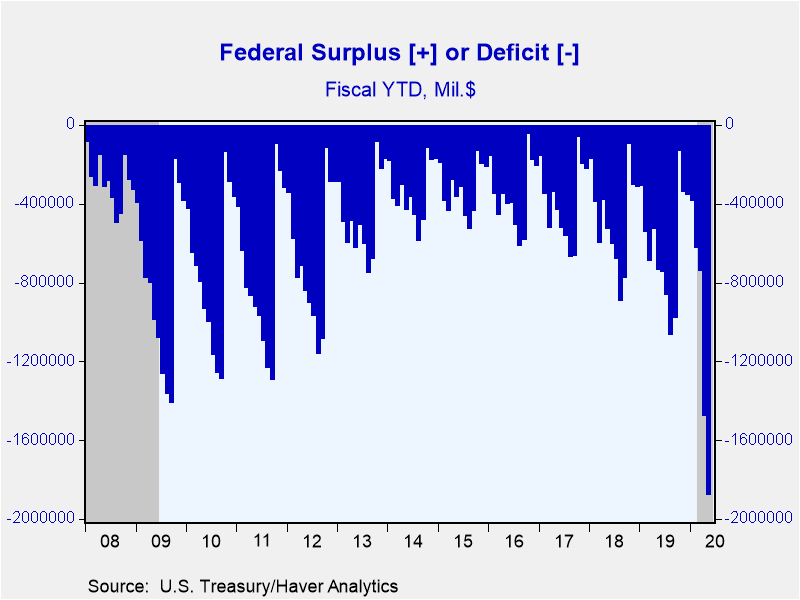

The U.S. Treasury Department reported that the federal government ran a $398.8 billion budget deficit during May, compared to a $207.8 bil. twelve months earlier. The Action Economics Survey anticipated a $670 bil. deficit. Since the start of the fiscal year, which begins in October, the cumulative deficit increased to $1.88 trillion versus $739 bil. a year ago.

In April, the seven-month cumulative deficit surpassed the full fiscal year record of $1.41 trillion set in 2009. May’s fiscal-year-to-date deficit surpassed the 75-year high 9.8% of GDP hit in 2009 (this is based on the Congressional Budget Office estimate of second quarter GDP). While GDP is expected to rebound in the third quarter, the deficit needs to rise by just another $100 billion through the end of the FY in October to surpass the 2008 share.

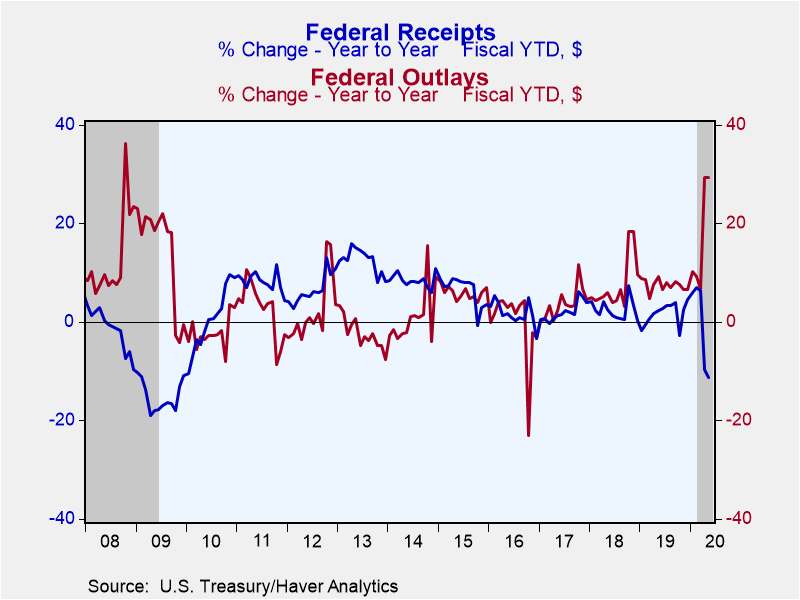

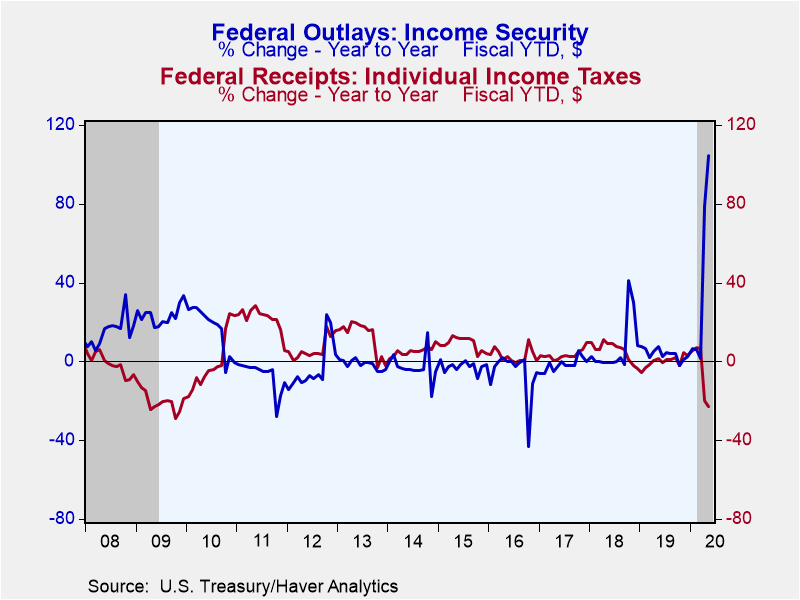

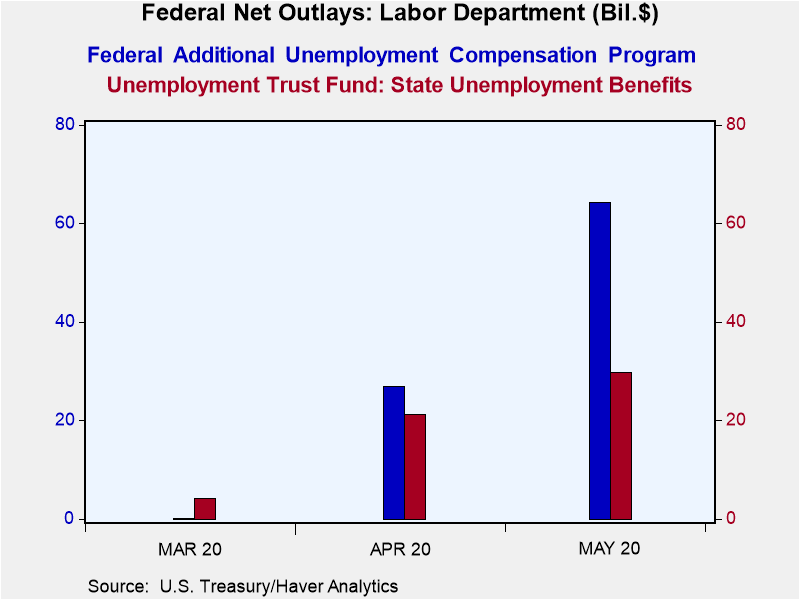

On a FY basis, federal government outlays jumped 29.4% year-on-year, which is only surpassed by the 36.3% increase in October 2008 in the midst of the Great Recession (data goes back to 1968). The increase in outlays was driven by an unprecedented 104% y/y spike in income support followed by a 25% gain in health care. Meanwhile, revenues fell 11.2% y/y, the weakest since late 2009. Income and corporate taxes fell 23.1% and 23.6% respectively as economic activity cratered. The extension of the April 15 tax-filing deadline to July 15 also likely played a role in the weakness in receipts.

Haver's data on Federal Government outlays and receipts as well as CBO forecasts are contained in USECON; detailed data can be found in the GOVFIN database. The Action Economics Forecast Survey numbers are in the AS1REPNA database.

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates