Global| Mar 28 2019

Global| Mar 28 2019U.S. GDP Growth Is Revised Lower

by:Tom Moeller

|in:Economy in Brief

Summary

Economic growth was weaker than originally estimated at the end of last year. Real gross domestic product growth slowed to 2.2% in Q4'18, revised from 2.6%, following a 3.4% increase in Q3. The Action Economics Forecast Survey [...]

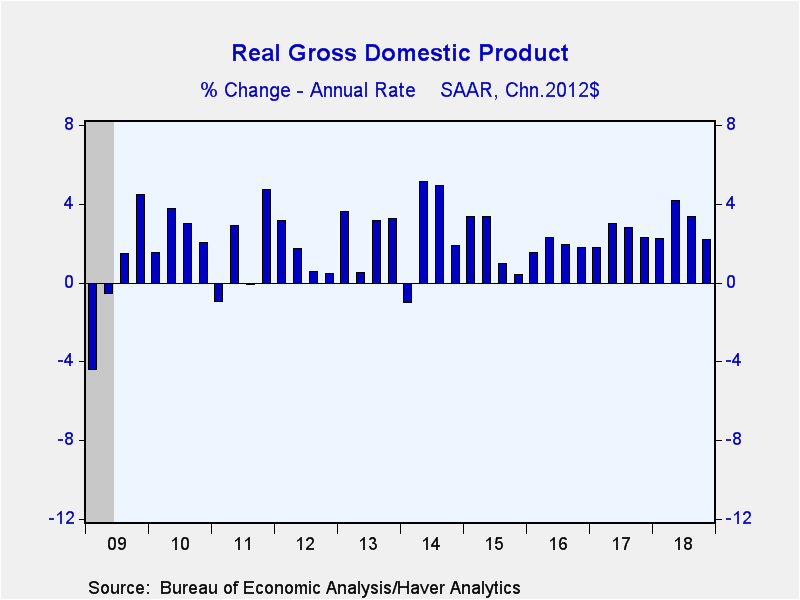

Economic growth was weaker than originally estimated at the end of last year. Real gross domestic product growth slowed to 2.2% in Q4'18, revised from 2.6%, following a 3.4% increase in Q3. The Action Economics Forecast Survey estimated a 2.4% rise. It was the weakest growth rate since Q1'18. For the year as a whole, GDP increased 2.9% in 2018, actually the strongest full-year gain since 2005.

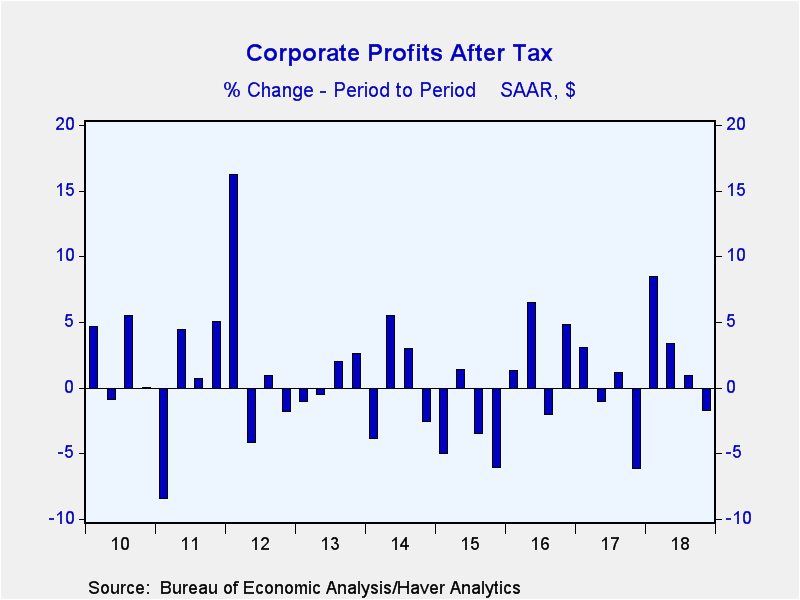

After-tax corporate profits declined 1.7% (+11.1% y/y) without IVA & CCA adjustments. After-tax profits with these adjustments were fairly steady (14.3% y/y).

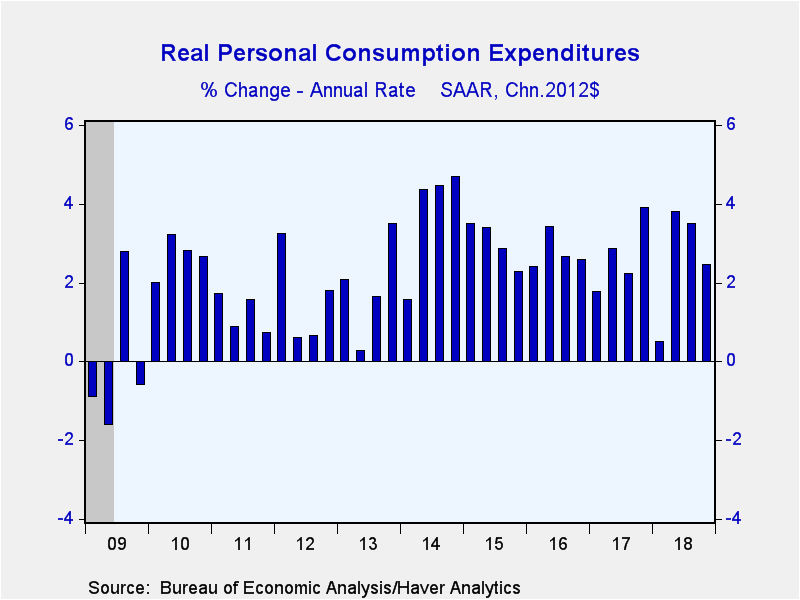

Lessened growth in consumer spending led the slowdown last quarter as it was revised to 2.5% (2.6% y/y) from 2.8%. Durable goods spending was shaved to 3.6% (3.4% y/y) from 5.9%, and was stable with Q3 growth. Motor vehicle expenditures increased 8.6% (-0.3% y/y) after a 1.8% decline. Home furnishing buying declined 4.9% (+2.2% y/y) following a 6.3% jump, and spending on recreational goods & vehicles weakened to 2.5% (6.9% y/y) from 9.0% in Q3. Expenditure growth on nondurable consumer goods halved to 2.1% (2.7% y/y) as apparel buying dropped to 1.0% (3.2% y/y) after rising 11.0% in Q3. Restaurant expenditures nudged 0.7% higher (2.3% y/y) following a 3.4% gain. Gasoline & fuel oil buying rose 3.0% (0.2% y/y) and reversed the prior quarter's decline. Spending growth on services eased to 2.4% (2.4% y/y) from 3.2% as expenditure growth on health care dropped to 0.3% (2.1% y/y) from 4.7%. Recreational spending increased 1.5% both q/q and y/y, reversing the Q3 decline. Housing & utilities spending rose 1.7% (1.4% y/y) after a 1.0% rise at the end of last year.

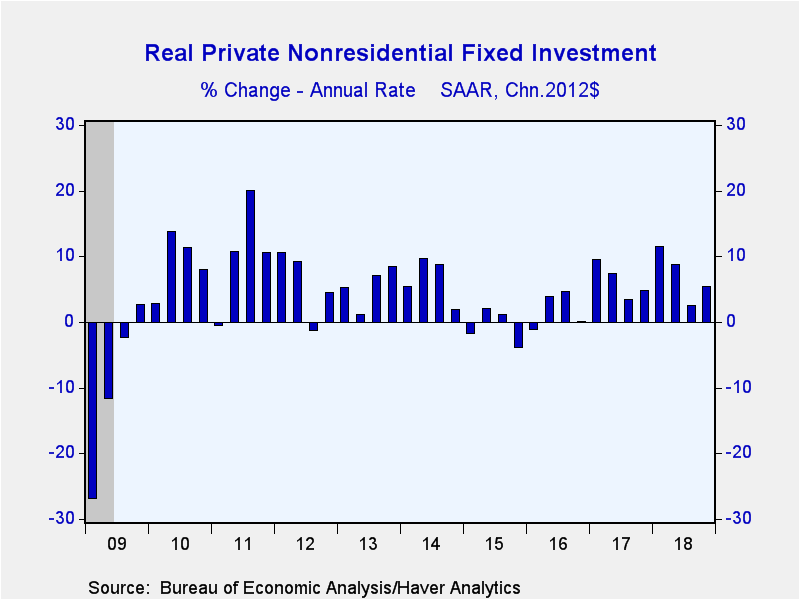

Growth in business fixed investment was lessened to 5.4% (7.0% y/y) from 6.2%, but growth more than doubled versus Q3. Structures spending declined 3.9% (+4.9% y/y), about the same as in Q3. Growth in equipment purchases roughly doubled, however, to 6.6% (5.8% y/y). Transportation equipment investment increased 16.9% (4.0% y/y) after a 3.5% decline, and industrial equipment buying grew 5.6% (4.6% y/y) following a 9.4% rise. Offsetting these gains was a 2.9% decline (+6.4% y/y) in computer investment. Intellectual property product investment surged 10.7% (10.2% y/y) and doubled Q3 growth. Software spending growth surged to 40.8%, and research & development gained 12.2% (9.6% y/y) after a 3.2% increase.

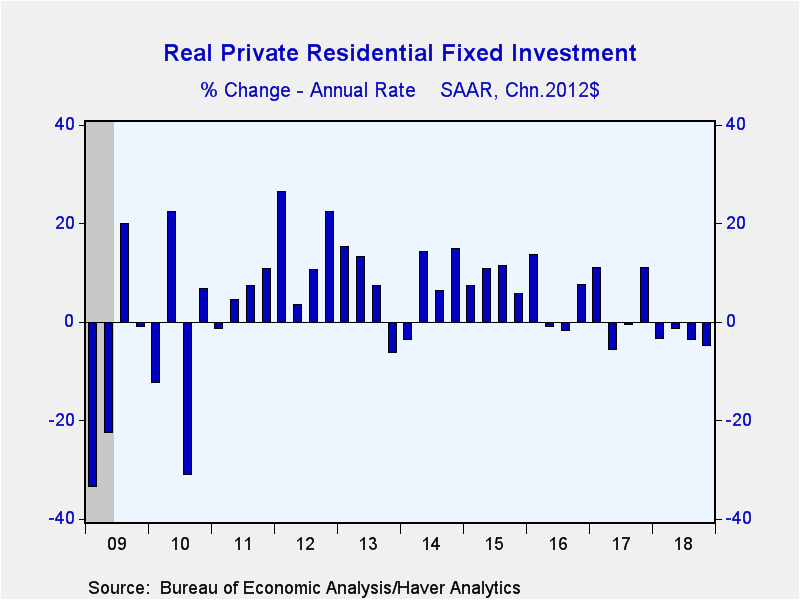

Continuing to decline was residential investment. It fell 4.7% (-3.3% y/y), down for the sixth quarter in the last seven.

Government spending eased 0.4% (+1.5% y/y) following four quarters of firm growth. Federal government spending increased 1.1% (2.7% y/y), its weakest rise in five quarters. Defense spending strengthened 6.3%. The 5.0% y/y growth followed y/y declines from 2011 until 2016. State & local government outlays declined 1.3% (+0.8% y/y) after a 2.0% rise.

The contribution to the economy's growth from inventory investment weakened to 0.1 percentage points from 2.3 percentage points in Q3. For the year as a whole, inventories had little effect on growth, just as in 2017. Deterioration in the foreign trade deficit subtracted slightly from GDP growth, as it has since 2014. Exports rose 1.8% (2.3% y/y) last quarter following a 4.9% decline. Imports rose 2.0% (3.4% y/y) due to an 8.5% surge (4.2% y/y) in services imports.

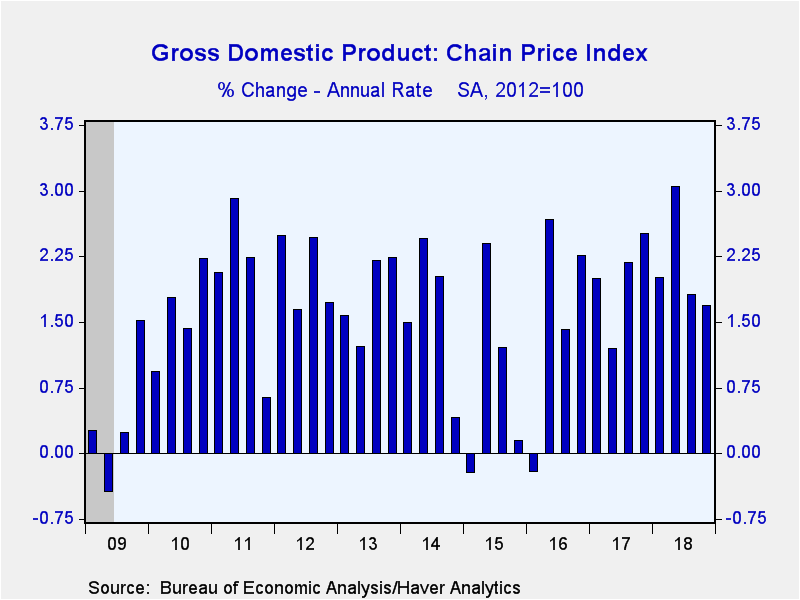

The GDP chain price index increased an expected 1.8% (2.2% y/y), as it did during Q3. The personal consumption price index rose a steady 1.5% (1.9% y/y) driven by a 2.7% strengthening (2.6% y/y) in the service price index. Both the durable & nondurable price indexes declined. The business fixed investment price index improved 1.1% (1.3% y/y), the weakest increase in three quarters, as a 0.7% decline (+0.3% y/y) in equipment was offset by a 6.0% (4.3% y/y) strengthening in the structures price index. The residential price index rose 3.0% (5.7% y/y), the weakest rise since Q1'17.

The GDP figures can be found in Haver's USECON and USNA database. USNA contains virtually all of the Bureau of Economic Analysis' detail in the national accounts. Both databases include tables of the newly published not seasonally adjusted data. The Action Economics consensus estimates can be found in AS1REPNA.

| Chained 2012 $ (%, AR) | Q4'18 (Third Estimate) | Q4'18 (Advance Estimate) | Q3'18 | Q2'18 | Q4'18 Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Gross Domestic Product | 2.2 | 2.6 | 3.4 | 4.2 | 3.0 | 2.9 | 2.2 | 1.6 |

| Inventory Effect (%-point) | 0.1 | 0.1 | 2.3 | -1.2 | 0.4 | 0.1 | 0.0 | -0.5 |

| Final Sales | 2.1 | 2.5 | 1.0 | 5.4 | 2.6 | 2.7 | 2.2 | 2.1 |

| Foreign Trade Effect (%-point) | -0.1 | -0.2 | -2.0 | 1.2 | -0.1 | -0.2 | -0.3 | -0.3 |

| Domestic Final Sales | 2.1 | 2.6 | 2.9 | 4.0 | 2.7 | 2.9 | 2.5 | 2.3 |

| Personal Consumption Expenditure | 2.5 | 2.8 | 3.5 | 3.8 | 2.6 | 2.6 | 2.5 | 2.7 |

| Nonresidential Fixed Investment | 5.4 | 6.2 | 2.5 | 8.7 | 7.0 | 6.9 | 5.3 | 0.5 |

| Residential Investment | -4.7 | -3.5 | -3.5 | -1.4 | -3.3 | -0.3 | 3.3 | 6.5 |

| Government Spending | -0.4 | 0.4 | 2.6 | 2.5 | 1.5 | 1.5 | -0.1 | 1.4 |

| Chain-Type Price Index | ||||||||

| GDP | 1.8 | 1.8 | 1.8 | 3.0 | 2.2 | 2.2 | 1.9 | 1.1 |

| Personal Consumption Expenditure | 1.5 | 1.5 | 1.6 | 2.0 | 1.9 | 2.0 | 1.8 | 1.1 |

| Nonresidential Investment | 1.1 | 1.1 | 1.6 | 2.0 | 1.3 | 1.2 | 0.7 | -0.8 |

| Residential Investment | 3.0 | 3.0 | 3.6 | 7.3 | 5.7 | 5.6 | 4.5 | 3.6 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates