Global| Dec 21 2018

Global| Dec 21 2018U.S. GDP Growth Revised Down 0.1%; Profits Growth Modestly Higher

Summary

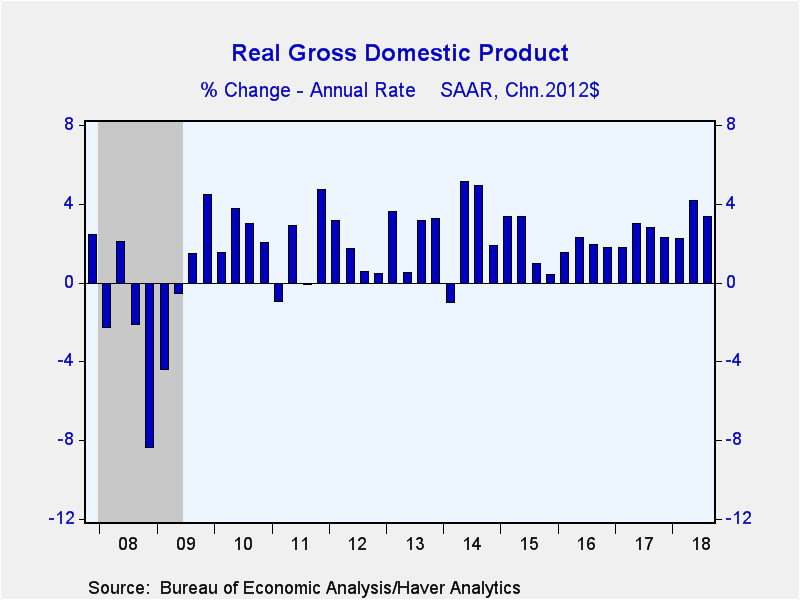

Real gross domestic product increased 3.4% (AR, 3.0% y/y) during Q3'18, a downward revision of 0.1% from November’s second estimate. This followed a 4.2% rise during the second quarter. Participants in the Actions Economics Forecast [...]

Real gross domestic product increased 3.4% (AR, 3.0% y/y) during Q3'18, a downward revision of 0.1% from November’s second estimate. This followed a 4.2% rise during the second quarter. Participants in the Actions Economics Forecast Survey had expected no change from the 3.5% rate.

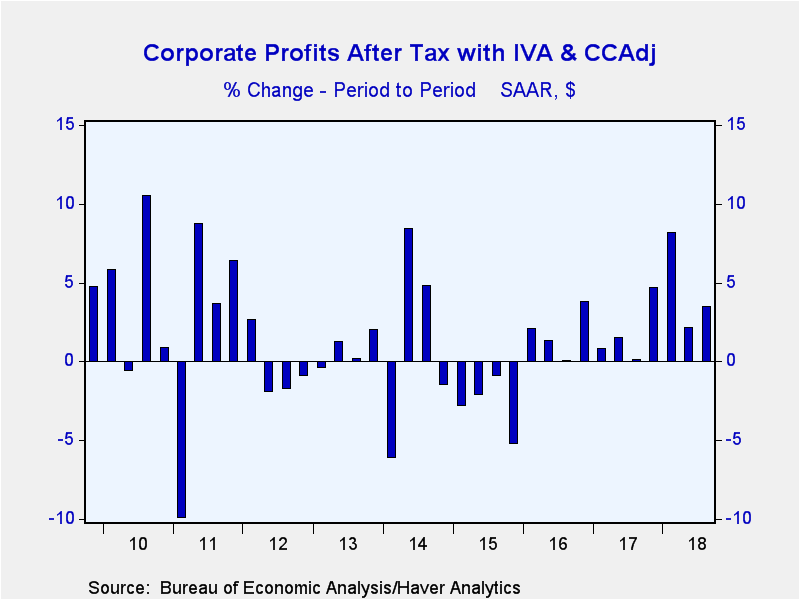

Third-quarter corporate profits data were also revised and now show 3.5% growth from Q2 (19.6% y/y) including adjustments for inventory valuation and depreciation, up from 3.3% reported last month. The rise followed 2.1% growth in the second quarter. Profits without inventory & depreciation allowances rose 0.9% (6.1% y/y), also up 0.2% from last month’s report, following a 3.3% Q2 increase.

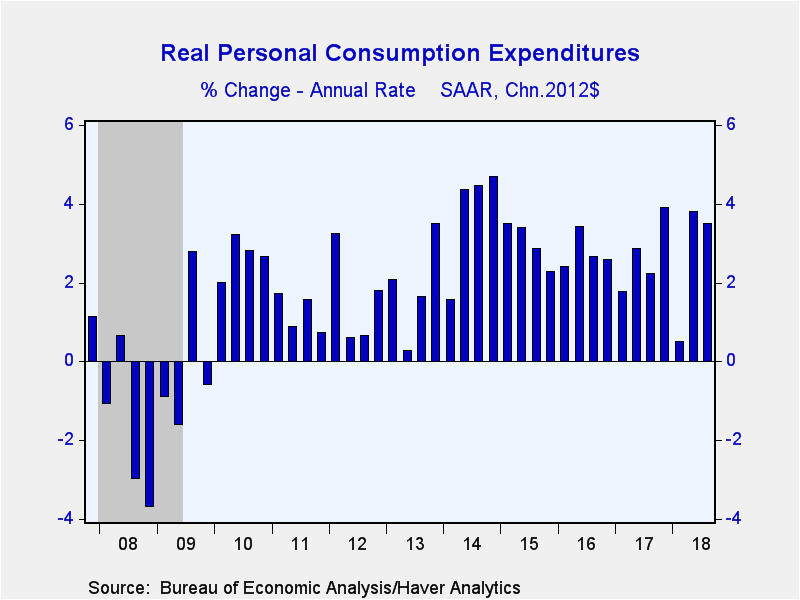

Domestic final sales increased 2.9% (3.2% y/y), which is revised down 0.2% from November’s estimate. Personal consumption expenditures were revised down to 3.5% growth (2.9% y/y) from 3.6%. Spending on durable goods was reduced to 3.7% (5.6% y/y) from 3.9%. Motor vehicle purchases fell at a 1.8% rate (1.5% y/y), revised from -1.5%. Recreational vehicle purchases growth was reduced from 9.1% to 8.9% (9.3% y/y) and spending growth on home furnishings of 6.3% (6.4% y/y) was revised from 6.8%.

Nondurable goods purchases grew at a 4.6% rate (3.2% y/y), revised from 5.3%. Clothing purchases strengthened 11.0% (5.2% y/y), still the quickest growth since Q4'05, and food & beverages expenditures rose 3.4% (3.6% y/y), revised from 3.8%. Gasoline & fuel oil buying dropped at a 3.4% pace (-1.0% y/y), revised from a 1.2% decrease reported last month.

Spending on services increased at a 3.2% pace (2.5% y/y). It remained the quickest growth since late 2014. Outlays at restaurants & hotels gained 7.1% (4.2% y/y) which followed an 8.1% Q2 rise. Health care outlays increased 4.7% (2.7% y/y) and financial services insurance rose 1.4% (0.4% y/y), revised from 1.0%. Housing & utilities outlays rose 1.0% (0.5% y/y) while recreation spending fell 1.3% (+0.7% y/y), revised from -0.2%.

Government sector spending also was reduced to 2.6% (2.3 y/y) from 3.3% reported before. Federal government outlays growth was unrevised at 3.5% both q/q and y/y. National defense spending remained at 4.9% growth in the quarter and the 4.2% y/y increase was the strongest since Q1 2010. Outlays by state & local governments were also unrevised, showing a 2.0% growth rate in the quarter (1.5% y/y).

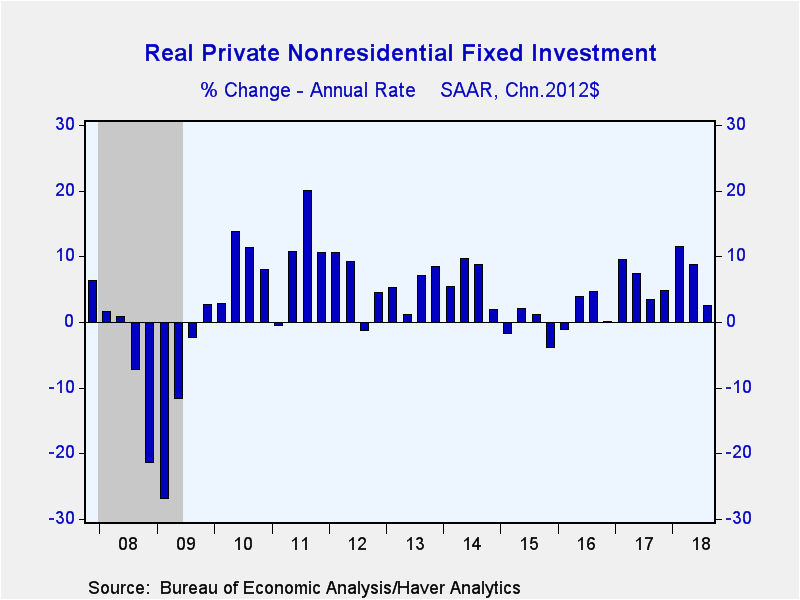

Growth in business fixed investment remained at a 2.5% pace (6.8% y/y). Structures investment, however, was revised to a decline of 3.4% (6.3%) from the -1.7% reported last month. Industrial equipment spending growth was trimmed to 9.5% (4.5% y/y) from 9.8% in last month’s report, while information processing equipment investment grew 7.2% (9.6% y/y). Transportation equipment expenditures declined 3.6% (+5.3% y/y), a slight improvement from last month’s -3.9%. Investment in intellectual products did better than seen before, growing at a 5.6% (7.6% y/y) pace, up from last month’s 4.3% estimate.

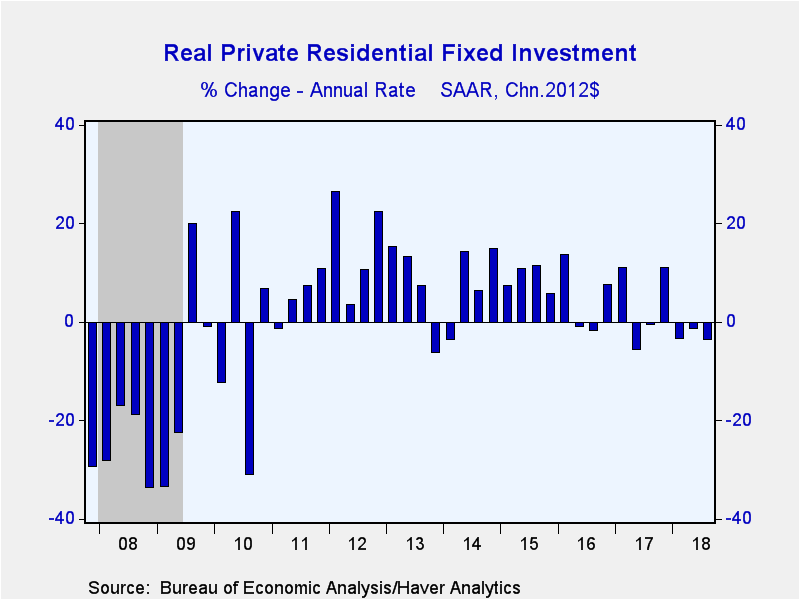

Residential investment was revised down to a 3.6% (+0.5% y/y) decline from -2.6%. It remained the third straight quarter of decline.

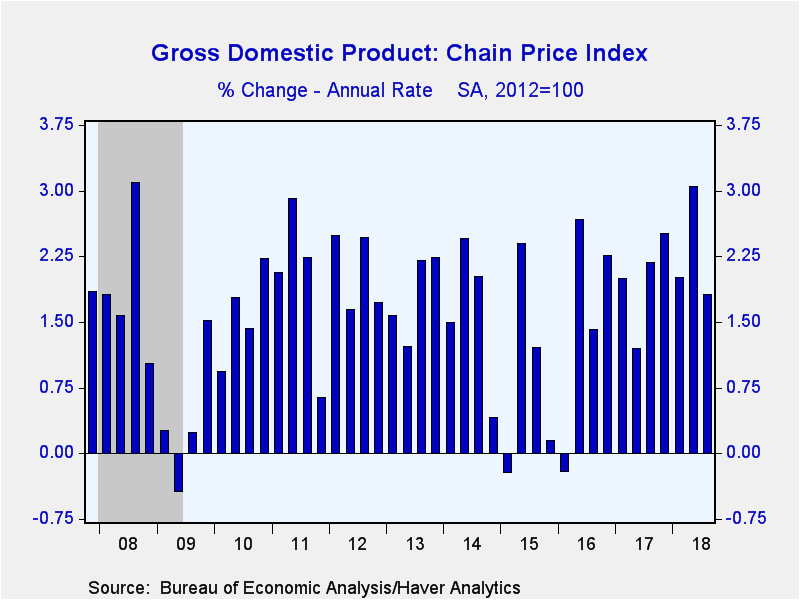

The chain type GDP prices index was revised upward marginally to a 1.8% increase (2.3% y/y), compared with the Action Economics survey’s 1.7% forecast, following the 3.0% increase in Q2. The PCE price index was increased to 1.6% (2.2% y/y) from 1.5% in last month’s report. Business fixed investment prices increased at a 1.6% pace (1.2% y/y), a bit stronger than the already firm 1.5% of last month’s estimates, making the last two quarters the strongest since 2014. The residential investment price index increased 3.6% (5.7% y/y), unchanged from last month’s tabulation and roughly half the growth during the prior two quarters.

The GDP figures can be found in Haver's USECON and USNA database. USNA contains virtually all of the Bureau of Economic Analysis' detail in the national accounts. Both databases include tables of the newly published not seasonally adjusted data. The Action Economics consensus estimates can be found in AS1REPNA.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates