Global| Apr 16 2021

Global| Apr 16 2021U.S. Housing Affordability Fell Back in February, but Still in Recent Range

Summary

• House prices down in January and up in February. • Income swings up in January and down in February. The National Association of Realtors reported that its Fixed Rate Mortgage Housing Affordability Index decreased 7.6% (-1.4% y/y) [...]

• House prices down in January and up in February.

• Income swings up in January and down in February.

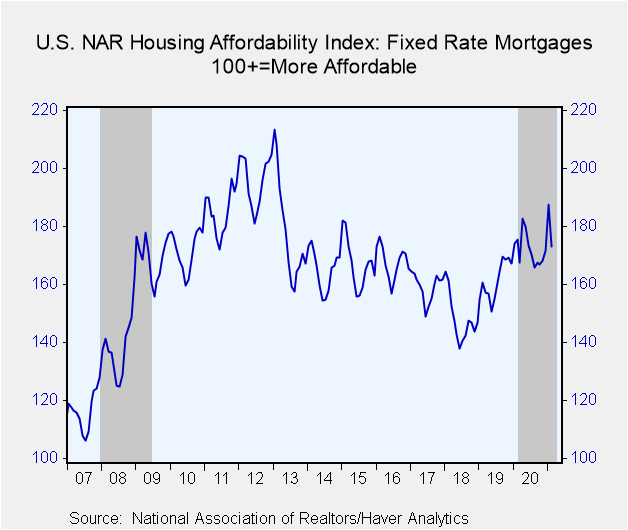

The National Association of Realtors reported that its Fixed Rate Mortgage Housing Affordability Index decreased 7.6% (-1.4% y/y) in February to 173.1. This decline followed a 9.1% jump in January, which had lifted the index to 187.4, its highest since 193.2 in March 2013. The Housing Affordability Index equals 100 when median family income qualifies for an 80% mortgage on a median-priced existing single-family home. A rising index indicates an increasing number of buyers can qualify for a mortgage to purchase the median-priced home

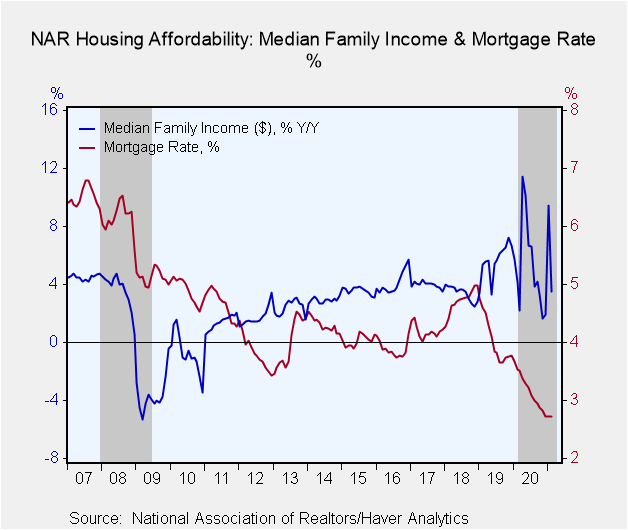

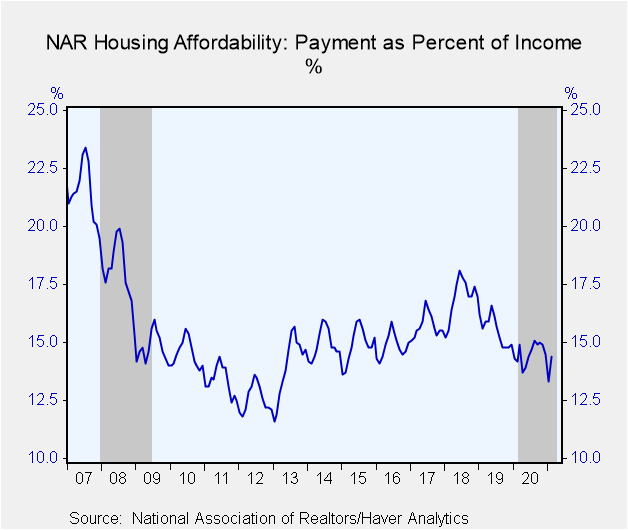

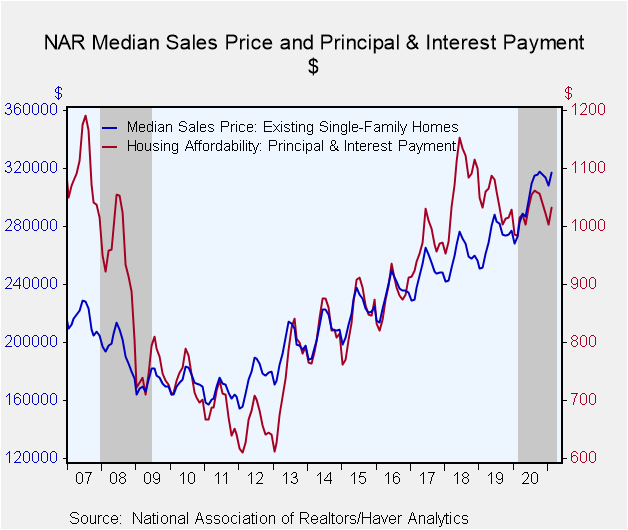

In February, median family income declined while median house prices increased. The income measure fell 4.9% (+3.5% y/y) after a hefty 7.0% rise in January, and house prices rose 3.0% (16.2% y/y) to $317,100 after falling 1.8% in January. Income had been bolstered in January by the federal government’s special income support payments. The mortgage interest rate was unchanged in February at its all-time low of 2.73%, which it sustained through December, January and February. The house price measure and the interest rate combine to make the monthly payment $1,033, also up 3.0% in February and 5% from a year ago. The payment represented 14.4% of median income, up from 13.3% in January and almost the same as the February 2020 amount of 14.2%.

Data on Housing Affordability can be found in Haver's REALTOR database. Median sales prices are located in USECON. Higher frequency interest rate data can be found in SURVEYW, WEEKLY, and DAILY.

| Housing Affordability | Feb | Jan | Dec | Y/Y% | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Fixed Rate Mortgage Housing Affordability Index (100+=More Affordable) | 173.1 | 187.4 | 171.8 | -1.4 | 172.0 | 161.1 | 147.9 |

| Payment as a Percent of Income | 14.4 | 13.3 | 14.5 | 14.2 | 14.5 | 15.5 | 17.0 |

| Principal and Interest Payment ($) | 1,033 | 1,003 | 1,022 | 5.0 | 1,028 | 1,044 | 1,079 |

| Monthly Mortgage Rate (%) | 2.73 | 2.73 | 2.73 | 3.53 | 3.17 | 4.04 | 4.72 |

| Median Family Income ($) | 85,817 | 90,239 | 84,290 | 3.5 | 84,843 | 80,704 | 76,401 |

| Median Sales Price (Existing Single-Family Home, $) | 317,100 | 308,000 | 313,700 | 16.2 | 298,708 | 272,333 | 259,458 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.