Global| Aug 19 2008

Global| Aug 19 2008U.S. Housing Starts Sag Back to Low

Summary

After Junes phantom jump in housing starts, which owed completely to a building code change in New York, they fell back in July by 11.0% to just 965,000 (S.A.A.R.). This was the lowest since 921,000 in March 1991. This month, both [...]

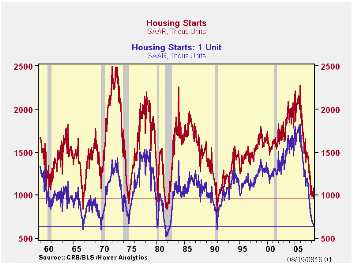

After June’s phantom jump in housing starts, which owed completely to a building code change in New York, they fell back in July by 11.0% to just 965,000 (S.A.A.R.). This was the lowest since 921,000 in March 1991. This month, both single-family and multi-family starts declined, by 2.9% and 23.6%, respectively. There were marginal upward revisions to June and May totals. As evident in the first graph, the total and the single-family amounts are not only the lowest since the last major housing contraction in 1991, but they are at levels that have only been since during periods of major housing distress.

At the same time, multi-family starts have been somewhat steadier. They retreated surely in July from their artificial surge in June, but their general pace has held up; in July, they numbered 324,000, just below their average over the last 10 years of 339,000. With the great weakness in single-family units, multi-family building now constitutes more than a third of new home construction.

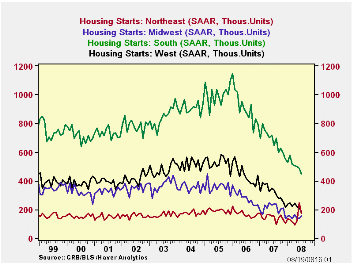

By region in July, the Northeast reversed its June increase, but it remains the steadiest part of the country on trend, and actually stands 13.0% above a year ago. The July loss was all in multi-family, while single-family units there were up smartly, by 11.3%. Total starts were also down in the South and the West, both, coincidentally, by 8.2%. Starts rose in the Midwest in July, by 10.0%.

Building permits followed the same pattern as starts nationally in July, falling 17.7% after a June increase of 16.4%. Single-family permits dropped 5.2% in the month to 584,000, the weakest since September 1982.

| Housing Starts (000s, SAAR) | July | June | May | Y/Y | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|

| Total | 965 | 1,084 | 982 | -29.6% | 1,341 | 1,812 | 2,073 |

| Single-Family | 641 | 660 | 682 | -39.2% | 1,034 | 1,474 | 1,719 |

| Multi-Family | 324 | 424 | 300 | +2.5% | 307 | 338 | 354 |

| Building Permits | 937 | 1,138 | 978 | -32.4% | 1,389 | 1,844 | 2,160 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.