Global| Nov 15 2019

Global| Nov 15 2019U.S. Import and Export Prices Decline

Summary

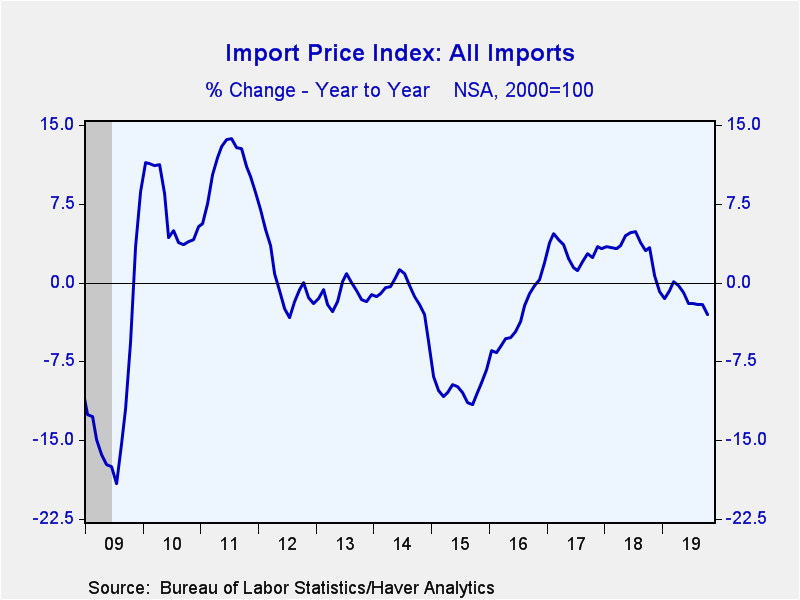

Import prices fell a greater-than-expected 0.5% during October (-3.0% year-on-year), following a downwardly revised 0.1% gain in September (was 0.2%). The Action Economics Forecast Survey expected a 0.4% decline in October. These [...]

Import prices fell a greater-than-expected 0.5% during October (-3.0% year-on-year), following a downwardly revised 0.1% gain in September (was 0.2%). The Action Economics Forecast Survey expected a 0.4% decline in October. These figures are not seasonally adjusted and do not include import duties.

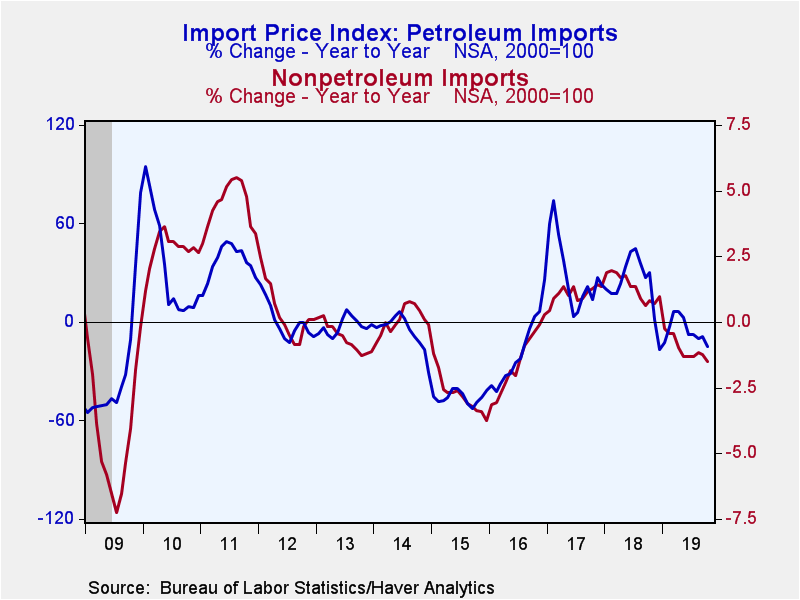

The decrease in import prices last month was primarily driven by a 3.7% drop in petroleum import costs (-14.7% y/y). Nonpetroleum import prices edged down 0.1% (-1.5% y/y). Among end-use categories, industrial supplies & materials costs excluding petroleum, capital goods, and nonauto consumer goods prices all decreased 0.1% (-3.1%, -1.6%, and -0.4% y/y respectively). Motor vehicle prices were unchanged (-0.8% y/y). Meanwhile, foods, feed and beverage prices declined 0.4% (-3.9% y/y).

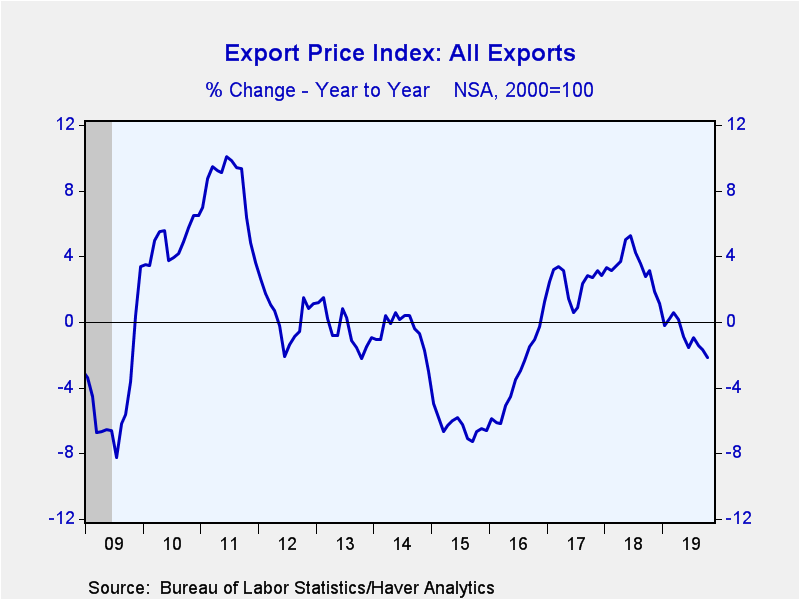

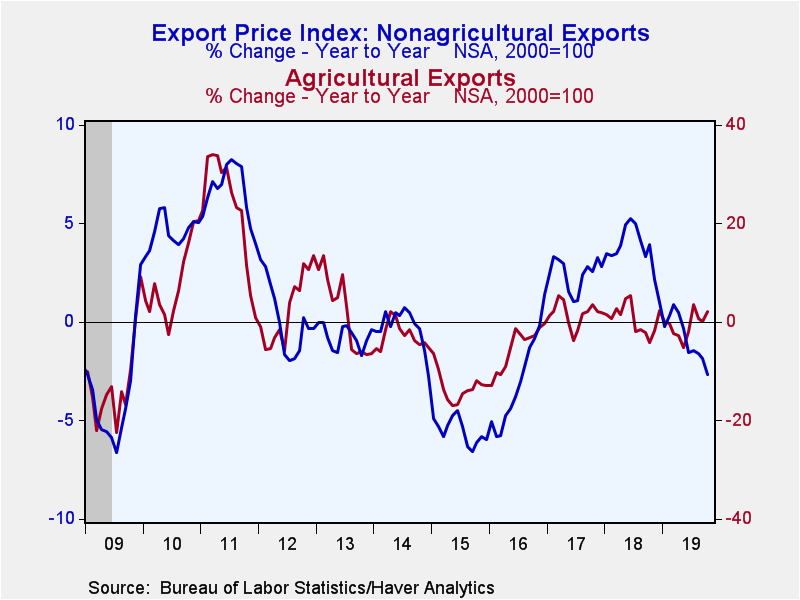

Export prices ticked down 0.1% in October (-2.2% y/y), following an unrevised 0.2% decline in September. Forecasters anticipated -0.1%. A 0.3% decline in nonagricultural exports (-2.7% y/y) more than offset the 1.9% jump in agricultural commodities prices (2.2% y/y). Industrial supplies & materials decreased 0.5% (-8.3% y/y), capital goods prices were down 0.3% (+0.5% y/y), and nonauto consumer goods prices were down 0.2% (+0.5% y/y). Motor vehicle & parts prices were unchanged (+0.1% y/y). Meanwhile, nonagricultural food (ie fish) & distilled beverage prices rose 0.6% (1.4% y/y).

The import and export price series can be found in Haver's USECON database. Detailed figures are available in the USINT database. The expectations figure from the Action Economics Forecast Survey is in the AS1REPNA database.

| Import/Export Prices (NSA, %) | Oct | Sep | Aug | Oct Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Imports - All Commodities | -0.5 | 0.1 | -0.6 | -3.0 | 3.1 | 2.9 | -3.3 |

| Petroleum & Petroleum Products | -3.7 | 1.5 | -4.7 | -14.7 | 22.0 | 26.6 | -19.7 |

| Nonpetroleum | -0.1 | 0.0 | -0.1 | -1.5 | 1.3 | 1.1 | -1.5 |

| Exports - All Commodities | -0.1 | -0.2 | -0.6 | -2.2 | 3.4 | 2.4 | -3.2 |

| Agricultural | 1.9 | -1.7 | -2.4 | 2.2 | 0.6 | 1.5 | -5.4 |

| Nonagricultural | -0.3 | -0.1 | -0.3 | -2.7 | 3.7 | 2.5 | -3.0 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates