Global| May 15 2008

Global| May 15 2008U.S. Industrial Output Fell Hard Last Month

by:Tom Moeller

|in:Economy in Brief

Summary

Industrial production fell a sharp 0.7% last month after a little revised increase of 0.2% during March. The decline was close to the largest since September 2005 and it was more than double Consensus expectations for a 0.3% drop. [...]

Industrial production fell a sharp 0.7% last month after a little revised increase of 0.2% during March. The decline was close to the largest since September 2005 and it was more than double Consensus expectations for a 0.3% drop.

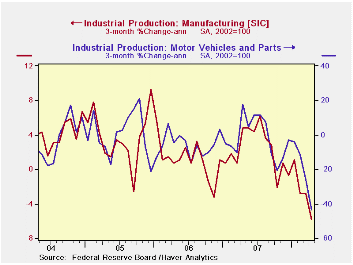

Factory output fell a slightly sharper 0.8% after no change during March. Output has now fallen 1.8% since its peak in July of 2007 and the three month rate change was a negative 5.8% (AR).

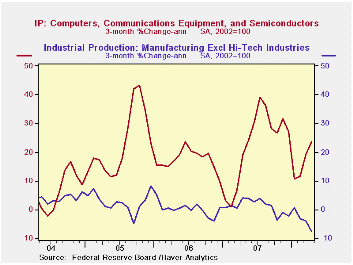

Production in the high tech sector continued strong and rose 1.0% (24.5% y/y) while the three month rate of change amounted to 23.5%. Production of computers & office equipment rose a lesser 0.5% and three month growth totaled 9.8% (AR). Output of communications equipment rose an even stronger 2.1%. The three month rate of growth was 27.5%.

The trend in output outside the high tech sector has been decidedly different and one of weakness. Less high tech, factory output fell 0.9% last month and three month output growth fell to -7.6% (AR). Output of motor vehicles & parts has been notably weak and fell 8.2% last month, at a -43.5% annual rate during the last three months. Furniture output also fell 0.7% last month and at a hard 10.2% rate during the last three. Electrical equipment fell 0.8% during April and at a 2.6% rate during the last three months. Machinery output also was quite weak and fell 1.7% and at a three month rate of -9.1%

In the nondurables area the picture is little better. Output ticked down 0.1% last month and at a 3.3% rate during the last three. Though apparel output rose 0.1% last month it followed sharp declines during the prior three. Three month annual growth was -7.0%. Paper output has been falling at an 8.9% rate during the last three months and chemical output is off at a 3.4% rate.

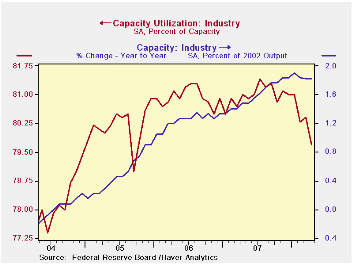

Capacity utilization fell sharply to 79.7% during April but utilization in the factory sector slipped even further to 77.5%, its lowest also since late 2004. Utilization rates in the durables industries outside of high tech were notably weak, exemplified by the machinery industry where utilization fell to 74.6% versus 81% nearly two years ago. Overall capacity grew 1.8% during the last year and 2.0% in the factory sector. Less high tech, factory capacity grew a lower 0.9% over the last year.Risk Management in Financial Institutions is today's speech by Fed Chairman Ben S. Bernanke and it is available here.

| INDUSTRIAL PRODUCTION (SA) | April | March | Y/Y | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|

| Total | -0.7 | 0.2 | 0.2 | 1.7 | 2.2 | 3.3 |

| Manufacturing | -0.8 | 0.0 | -0.3 | 1.7 | 2.4 | 4.0 |

| Utilities | 0.4 | 0.7 | 0.8 | 3.3 | -0.6 | 2.1 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates