Global| Aug 15 2019

Global| Aug 15 2019U.S. Industrial Production Lower on Manufacturing and Mining

Summary

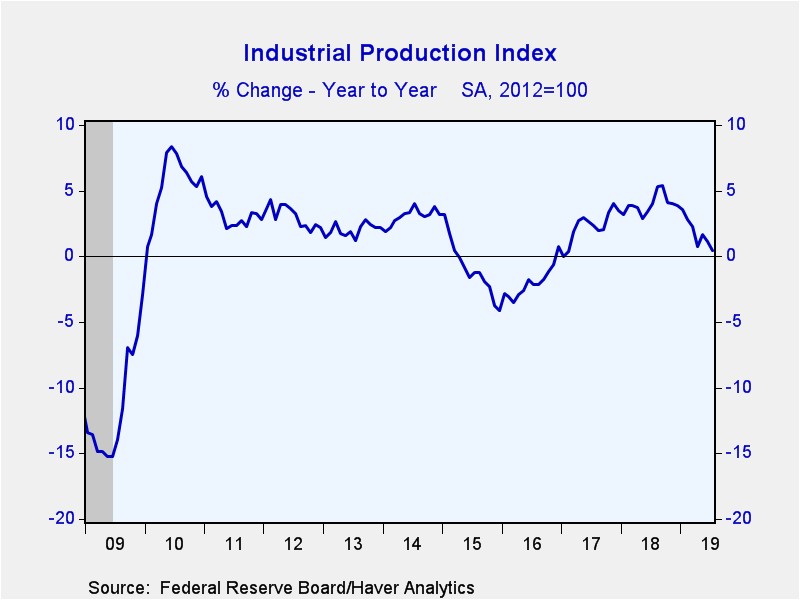

Industrial production declined 0.2% during July (+0.5% year-on-year) following an offsetting revisions to May and June – now both 0.2% gains revised from 0.4% and unchanged respectively. The Action Economics Survey forecast a 0.1% [...]

Industrial production declined 0.2% during July (+0.5% year-on-year) following an offsetting revisions to May and June – now both 0.2% gains revised from 0.4% and unchanged respectively. The Action Economics Survey forecast a 0.1% increase in July.

Manufacturing activity fell 0.4% (-0.5% y/y) during July, after growth of 0.6% in June and 0.2% in May (was 0.4% and 0.2% respectively). Utilities output jumped 3.1% (0.3% y/y), as warmer-than-normal weather in July increased demand. Meanwhile mining activity fell 1.8% (+5.5% y/y) with the Fed noting that Hurricane Barry caused a sharp but temporary decline in oil extraction in the Gulf of Mexico.

Manufacturing of durable goods declined 0.2% (+1.1% y/y), with motor vehicles down the same amount (+3.7% y/y). Machinery output fell 1.1% (-1.1% y/y), while computer and electronics was unchanged (+4.6% y/y). Aerospace output jumped 1.8% (2.7% y/y). Nondurable output decreased 0.5% (-2.1% y/y) as chemicals were down 0.4% (-2.9% y/y), food declined 0.6% (-0.5% y/y) and as petroleum & coal was 0.2% lower (+0.8% y/y)

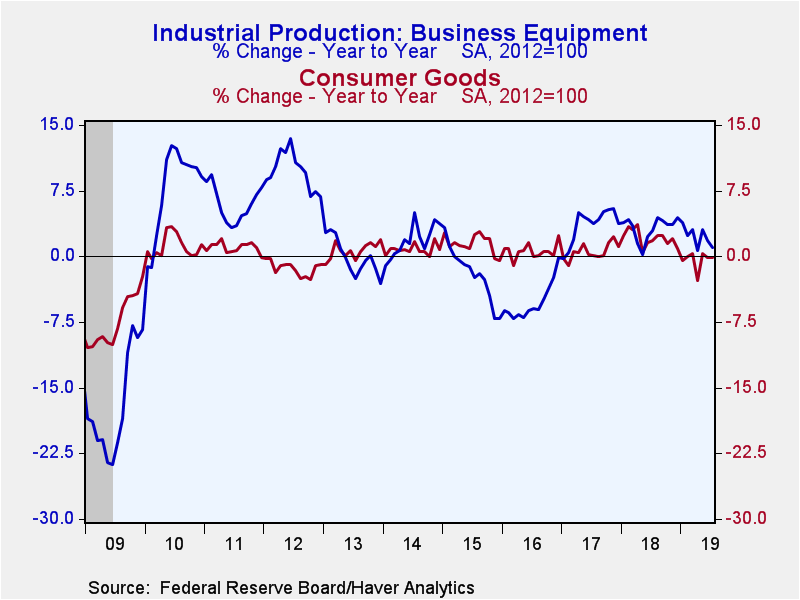

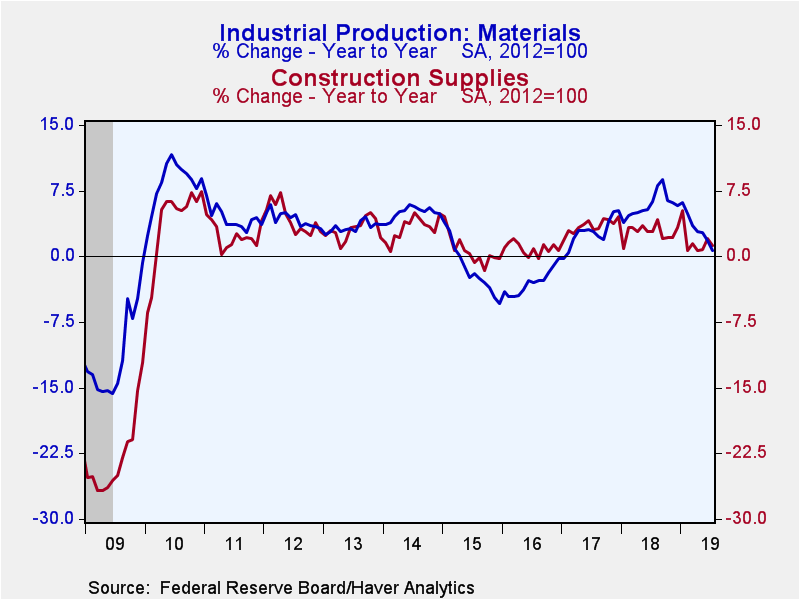

By market group, consumer goods output rose 0.2% in July (unchanged y/y), while business equipment declined 0.4% (+1.0% y/y) and construction supplies fell 1.0% (+1.2% y/y). Materials output decreased 0.3% (+0.6% y/y) driven by the same contraction in energy materials (+3.7% y/y).

In the special aggregate groupings, production of high technology products increased 0.2% (5.3% y/y). Semiconductor & electronic components declined 0.2% (-0.1% y/y) while computer & peripheral equipment was up 0.6% (3.2% y/y). Output in communications equipment grew 0.8% and previous months were revised substantially higher. The y/y growth decelerated to a still strong 20.9% in July from the 23.3% y/y gain in June (May’s reading of 24.3% was the fastest gain since April 2007). Factory sector production excluding the motor vehicle and high tech sectors declined 0.4% (-0.9% y/y) and is still 11% below its 2007 peak.

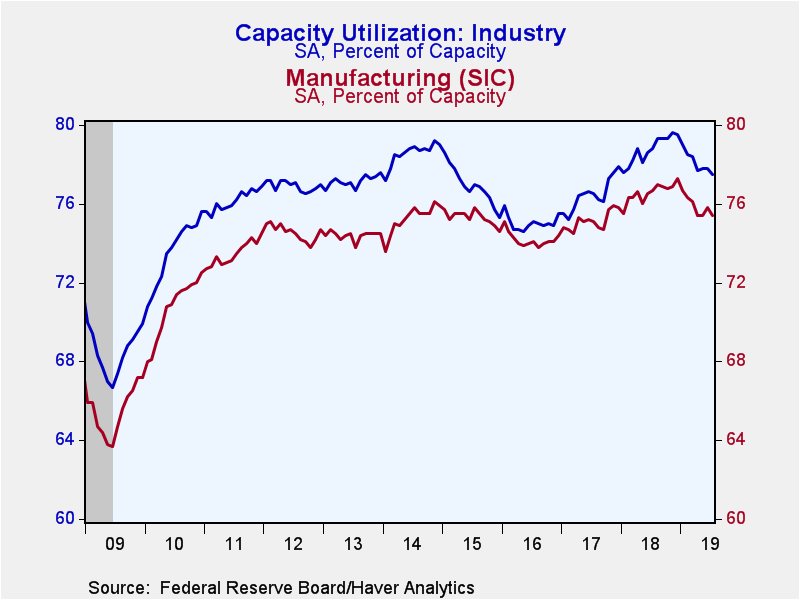

Capacity utilization declined to 77.5% in July from a downwardly-revised 77.8% (was 77.9%). The Action Economics Survey expected 77.8%. Factory sector use decreased to 75.4%, and is down 1.9 percentage points from December’s cyclical peak. Mining fell to 89.2%, well below the cycle high of 93.3% in December. Capacity in the manufacturing sector grew 1.2% y/y, though capacity is still slightly below its 2008 peak.

Industrial production and capacity data and US Population-Weighted Heating and Cooling Days are included in Haver's USECON database. Additional detail on production and capacity can be found in the IP database. The expectations figures come from the AS1REPNA database.

| Industrial Production (SA, % Change) | Jul | Jun | May | Jul Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Total Output | 0.0 | 0.4 | -0.5 | 1.3 | 3.9 | 2.3 | -2.0 |

| Manufacturing | 0.4 | 0.2 | -0.7 | 0.4 | 2.3 | 2.0 | -0.8 |

| Consumer Goods | 0.0 | 0.5 | -1.7 | -0.7 | 2.1 | 0.5 | 0.6 |

| Business Equipment | 0.5 | 0.4 | -1.5 | 1.8 | 3.2 | 3.6 | -5.3 |

| Construction Supplies | 0.5 | 0.6 | -0.8 | 1.4 | 2.8 | 3.5 | 0.9 |

| Materials | -0.2 | 0.4 | 0.5 | 2.6 | 5.9 | 2.7 | -3.0 |

| Utilities | -3.6 | 2.4 | -3.3 | -2.6 | 4.4 | -0.8 | -0.4 |

| Mining | 0.2 | 0.2 | 2.6 | 8.7 | 12.4 | 7.4 | -9.9 |

| Capacity Utilization (%) | 77.9 | 78.1 | 77.9 | 78.6 | 78.7 | 76.5 | 75.0 |

| Manufacturing | 75.9 | 75.6 | 75.6 | 76.5 | 76.6 | 75.1 | 74.2 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates