Global| Nov 15 2019

Global| Nov 15 2019U.S. Industrial Production Plummets in October

by:Sandy Batten

|in:Economy in Brief

Summary

Industrial production fell a more-than-expected 0.8% m/m (-1.1% y/y) in October on top of a slightly upwardly revised 0.3% m/m decline in September. This was the third monthly decline in the past four months and the weakest monthly [...]

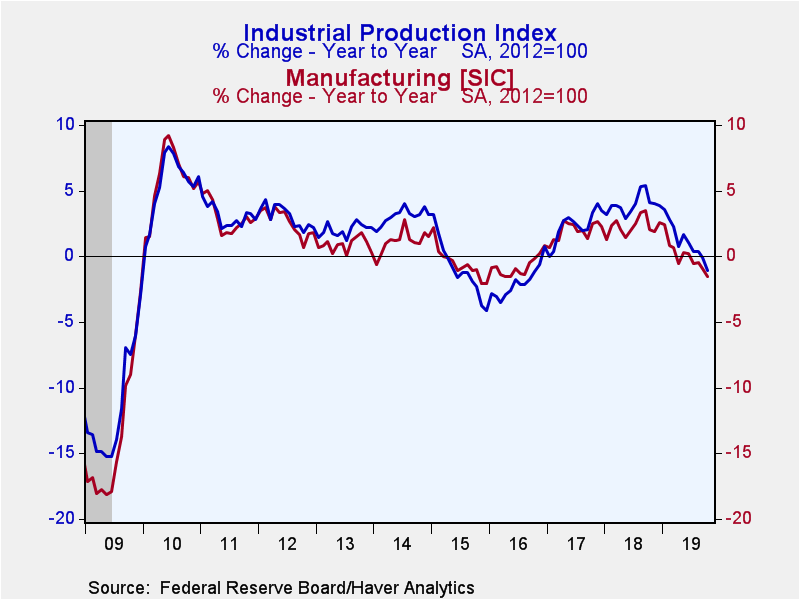

Industrial production fell a more-than-expected 0.8% m/m (-1.1% y/y) in October on top of a slightly upwardly revised 0.3% m/m decline in September. This was the third monthly decline in the past four months and the weakest monthly change recorded in this economic expansion as escalated trade tensions and slower economic growth abroad continue to take their toll on the U.S. industrial sector. A 0.5% m/m decline had been expected by the Action Economics Forecast Survey. Factory sector output declined 0.6% (-1.5% y/y), also the third monthly decline in the past four months.

Output of motor vehicles and parts collapsed 7.1% m/m (-11.9% y/y) in October, reflecting in large part the strike at General Motors. This strike is now over and motor vehicle output is set to rebound in November. Still, total production in October was weak outside of the auto sector with total industry output excluding motor vehicles and parts falling 0.5% m/m (-0.6% y/y) in October though manufacturing output excluding motor vehicles slipped only 0.1% m/m in October, the same decline as in September. Production apart from manufacturing was also weak in October with mining output down 0.7% m/m (+2.7% y/y) on top of a 0.8% m/m decline in September. Utilities output decreased 2.6% m/m (-4.1% y/y) after a 1.9% m/m rise in October.

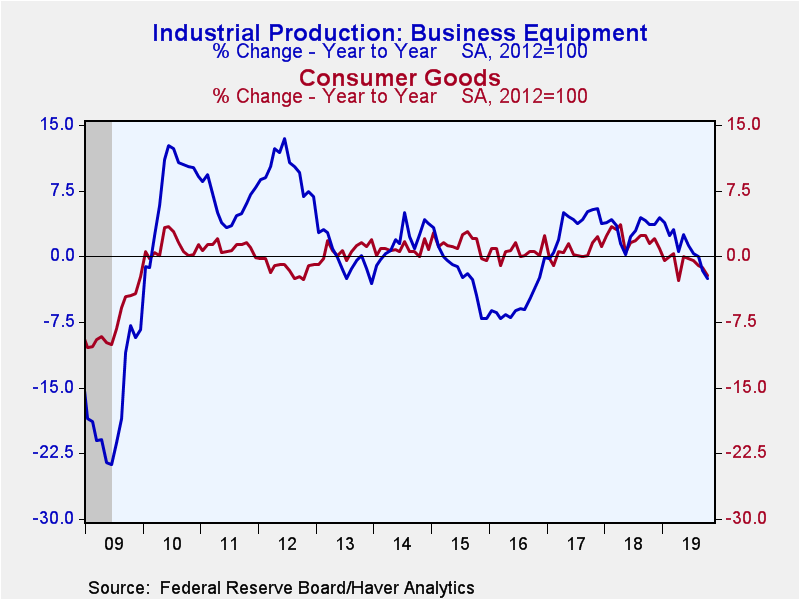

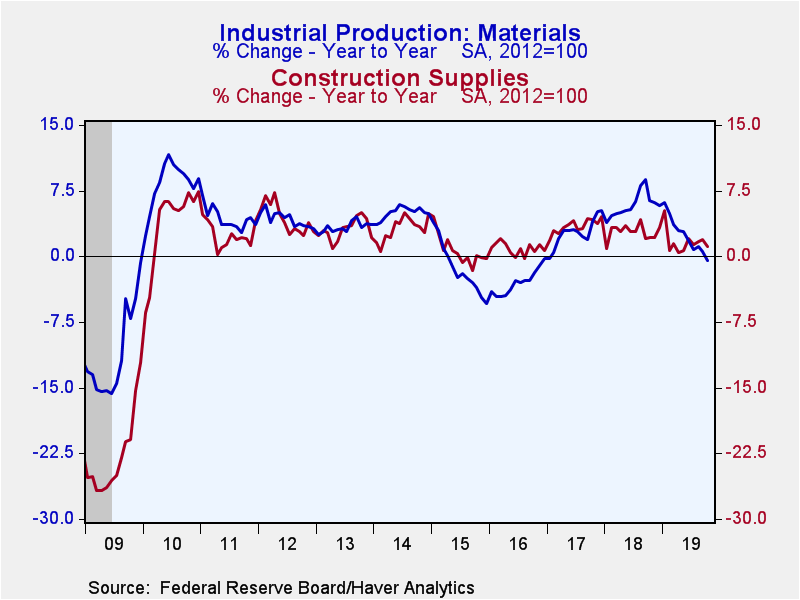

Output of final products decreased 0.8% m/m (-1.9% y/y) on top of a 0.3% m/m drop in September. Consumer goods production fell 0.8% m/m (-2.2% y/y). Business equipment output declined 0.6% m/m (-2.5% y/y). Construction supplies production fell 0.4% m/m (+1.1% y/y). Materials production fell 1.0% (-0.6% y/y) with production of both energy and nonenergy materials dropping 1.0% m/m.

In the special aggregate groupings, production of computers, communications equipment and semiconductors rose 0.1% m/m (+5.6% y/y). Computers and peripheral output edged up 0.1% m/m while communications equipment fell 0.4% m/m. Factory output excluding high-tech and motor vehicles fell 0.1% (-0.8% y/y).

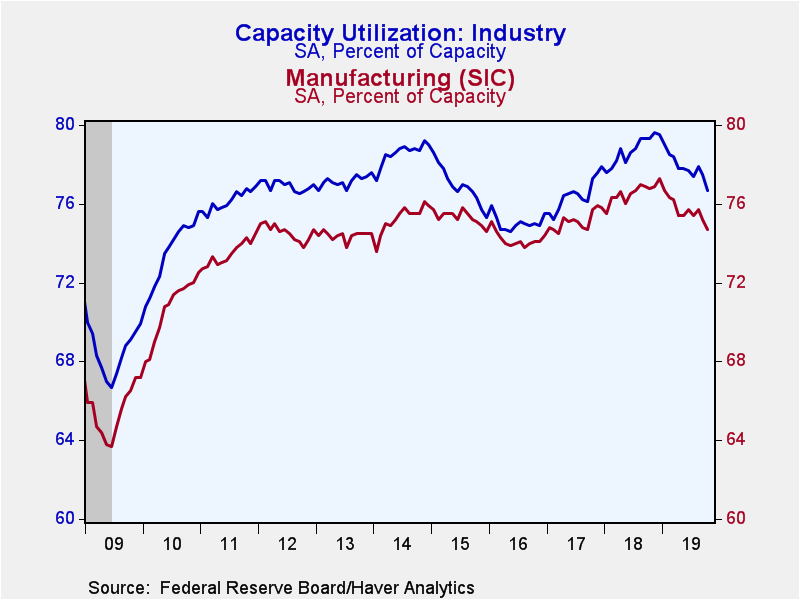

The total industry capacity utilization rate fell to 76.7% in October, its lowest reading since September 2017, from 77.5% in September. It has generally declined from its recent high of 79.6% reached last November. The factory sector utilization rate also declined in October, to 74.7% from 75.2%. The October reading was also the lowest since September 2017.

Industrial production and capacity data are included in Haver's USECON database. Additional detail on production and capacity can be found in the IP database. The expectations figures come from the AS1REPNA database.

| Industrial Production (SA, % Change) | Oct | Sep | Aug | Oct Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Total Output | -0.8 | -0.3 | 0.7 | -1.1 | 3.9 | 2.3 | -2.0 |

| Manufacturing | -0.6 | -0.5 | 0.6 | -1.5 | 2.3 | 2.0 | -0.8 |

| Consumer Goods | -0.8 | -0.1 | -0.2 | -2.2 | 2.1 | 0.5 | 0.6 |

| Business Equipment | -0.6 | -1.1 | 1.0 | -2.5 | 3.2 | 3.6 | -5.3 |

| Construction Supplies | -0.4 | -0.2 | 1.0 | 1.1 | 2.8 | 3.5 | 0.9 |

| Materials | -1.0 | -0.4 | 1.4 | -0.6 | 5.9 | 2.7 | -3.0 |

| Utilities | -2.6 | 1.9 | -0.6 | -4.1 | 4.4 | -0.8 | -0.4 |

| Mining | -0.7 | -0.8 | 2.6 | 2.7 | 12.4 | 7.4 | -9.9 |

| Capacity Utilization (%) | 76.7 | 77.5 | 77.9 | 79.3 | 78.7 | 76.5 | 75.0 |

| Manufacturing | 74.7 | 75.2 | 75.7 | 76.8 | 76.6 | 75.1 | 74.2 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates