Global| Sep 14 2018

Global| Sep 14 2018U.S. Industrial Production Posted Solid Increase in August

by:Sandy Batten

|in:Economy in Brief

Summary

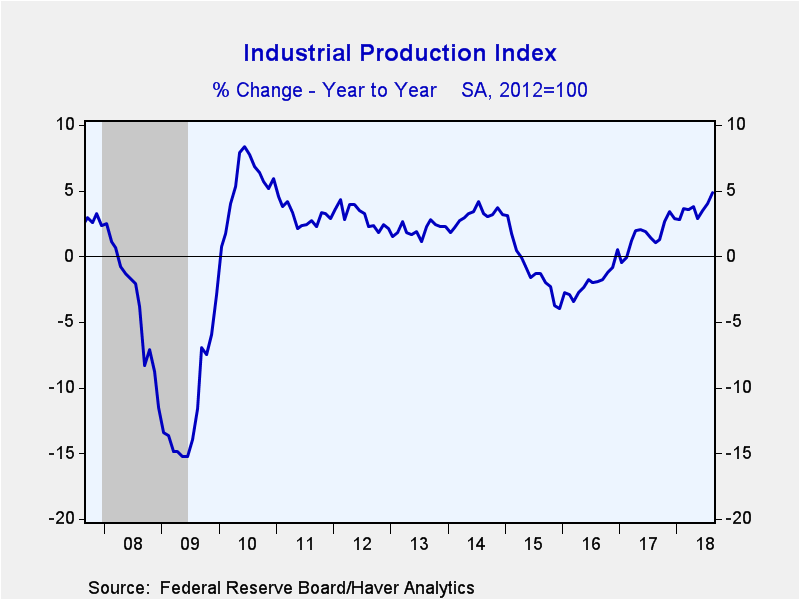

Industrial production increased a solid 0.4% m/m (4.8% y/y) in August and the modest 0.1% m/m rise initially reported for July was revised up to a 0.4% m/m gain. The consensus from the Action Economics Survey had looked for a 0.3% m/m [...]

Industrial production increased a solid 0.4% m/m (4.8% y/y) in August and the modest 0.1% m/m rise initially reported for July was revised up to a 0.4% m/m gain. The consensus from the Action Economics Survey had looked for a 0.3% m/m gain in August. Manufacturing activity softened slightly with a 0.2% m/m rise (3.2% y/y) in August versus an unrevised 0.3% m/m gain in July. Mining output was up 0.7% m/m in August (14.2% y/y), the same monthly rise as in July. And utilities output rebounded in August, rising 1.2% m/m (4.8% y/y) following a tepid 0.1% m/m rise in July.

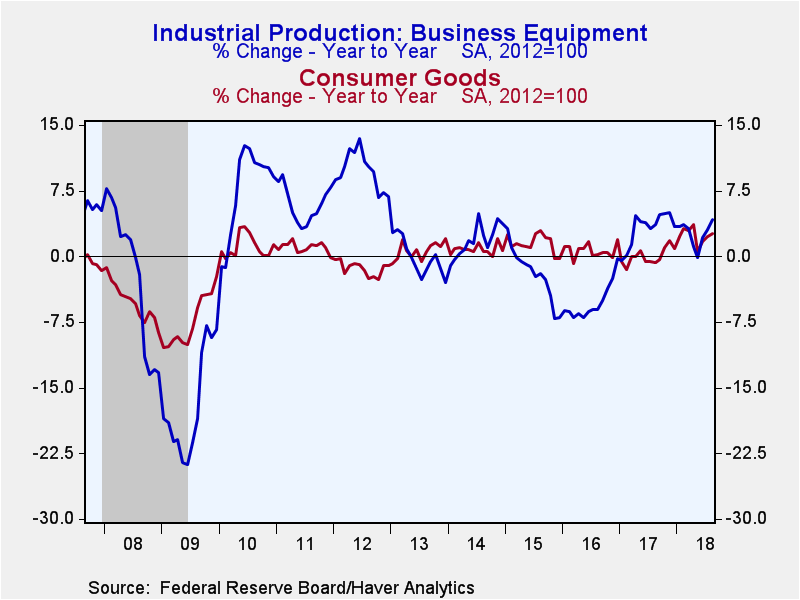

The rise in manufacturing output was led by a 4.0% m/m jump in the output of motor vehicles and parts after a 1.4% m/m decline in July. Motor vehicle assemblies totaled 11.5 million units at an annual rate, the strongest performance since April. More generally, manufacturing output was boosted by a 1.2% m/m (4.2% y/y) rise in the production of business equipment. Transit production (led by motor vehicles) was up 2.1% m/m and production of industrial equipment rose 1.6%. Output of oil and gas well drilling equipment slipped 0.5% m/m in August following a downwardly revised 4.2% m/m slump in July.

Consumer goods production rose 0.3% m/m (2.6% y/y) in August with output of consumer durables jumping 1.6% m/m (again led by motor vehicles) while output of nondurables was unchanged with nonenergy nondurable production off 0.2% m/m.

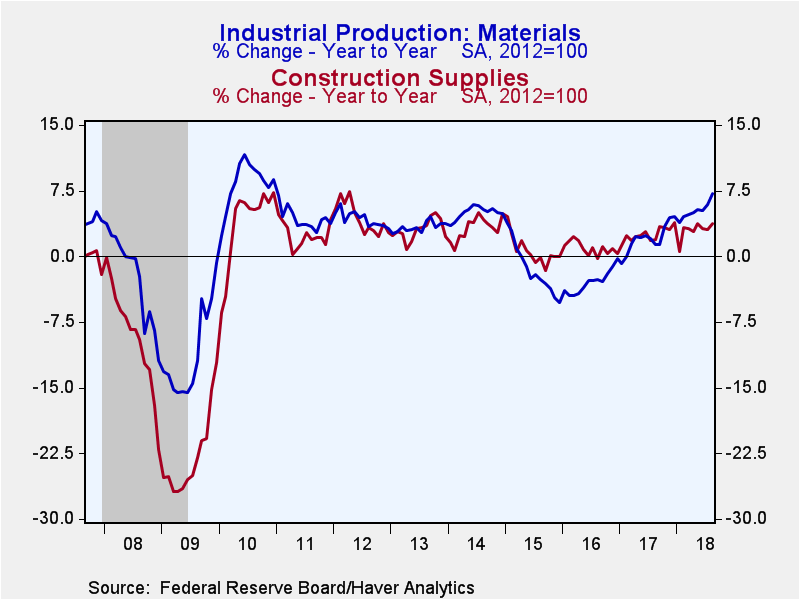

The production of construction supplies was unchanged in August (+3.8% y/y) after a 0.3% m/m decline in July (revised down from -0.1% m/m initially) and a 0.6% m/m drop in June. Materials output increased 0.5% m/m (7.2% y/y) with the initially reported 0.1% m/m rise for July revised up to a solid 0.6% m/m increase.

The rebound in utilities output, dictated largely by the weather, was due entirely to a 1.4% m/m jump in electric power generation. Natural gas distribution slipped 0.2% m/m but this followed a 6.9% m/m surge in July. Output of energy continued its robust performance. It rose 0.7% m/m in August, its third consecutive monthly increase with the y/y rate rising to 9.7%, its fastest annual rate of advance since 1979.

In the special aggregate groupings, production in selected high-technology industries rebounded in August, rising 0.4% m/m after a 0.2% m/m decline in July. Non-energy production excluding high-tech advanced 0.3% m/m in August, the same monthly rise as in July. Factory sector production excluding both high-tech and autos slipped 0.1% m/m in August following a solid 0.5% m/m rise in July.

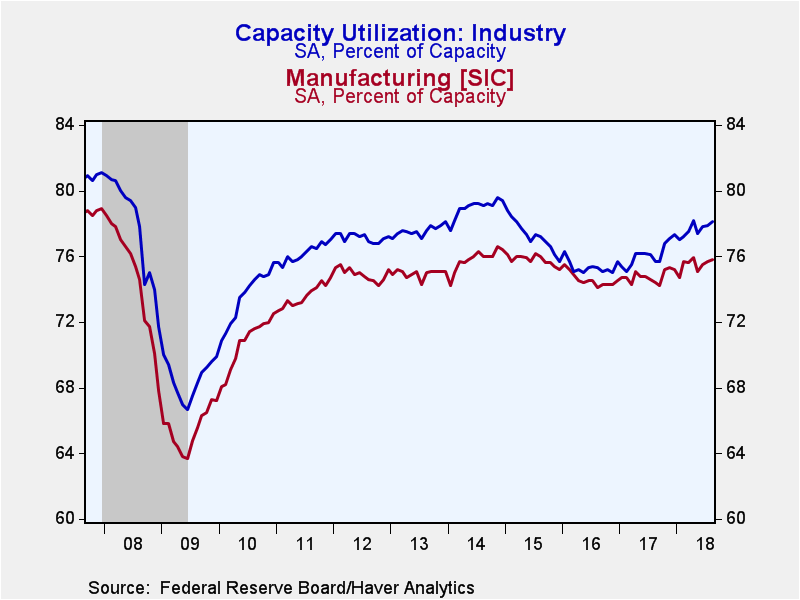

Capacity utilization jumped 0.2 percentage point to 78.1% in July. This is well off the recession low of 66.7% in 2009 but still meaningfully below the pre-recession peak of 81.1% in 2007. Factory sector capacity utilization edged up to 75.8% in August from 75.7% in July.

Industrial production and capacity data are included in Haver’s USECON database, with additional detail in the IP database. The expectations figure is in the AS1REPNA database.

| Industrial Production (SA, % Change) | Aug | Jul | Jun | Aug Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Total Output | 0.4 | 0.4 | 0.6 | 4.8 | 1.6 | -2.0 | -1.0 |

| Manufacturing | 0.2 | 0.3 | 0.7 | 3.2 | 1.2 | -0.8 | -0.6 |

| Consumer Goods | 0.3 | 0.4 | 0.7 | 2.6 | 0.0 | 0.7 | 1.5 |

| Business Equipment | 1.2 | 0.4 | 2.2 | 4.2 | 3.2 | -5.3 | -2.0 |

| Construction Supplies | 0.0 | -0.3 | -0.6 | 3.8 | 2.5 | 0.9 | 0.6 |

| Materials | 0.5 | 0.6 | 0.4 | 7.2 | 2.0 | -3.0 | -1.5 |

| Utilities | 1.2 | 0.1 | -1.5 | 4.8 | -1.3 | -0.4 | -0.8 |

| Mining | 0.7 | 0.7 | 1.8 | 14.2 | 6.4 | -9.7 | -3.4 |

| Capacity Utilization (%) | 78.1 | 77.9 | 77.8 | 75.7 | 76.1 | 75.4 | 77.3 |

| Manufacturing | 75.8 | 75.7 | 75.5 | 74.4 | 74.8 | 74.6 | 75.8 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates