Global| Apr 15 2021

Global| Apr 15 2021U.S. Industrial Production Rebounded in March

by:Sandy Batten

|in:Economy in Brief

Summary

• IP rose 1.4% m/m with manufacturing output up 2.7% and mining up 5.7%. • Utilities plunged 11.4% after the cold-weather boosted 9.2% surge in February. • In the first quarter, IP rose 2.5% saar. Industrial production rebounded in [...]

• IP rose 1.4% m/m with manufacturing output up 2.7% and mining up 5.7%.

• Utilities plunged 11.4% after the cold-weather boosted 9.2% surge in February.

• In the first quarter, IP rose 2.5% saar.

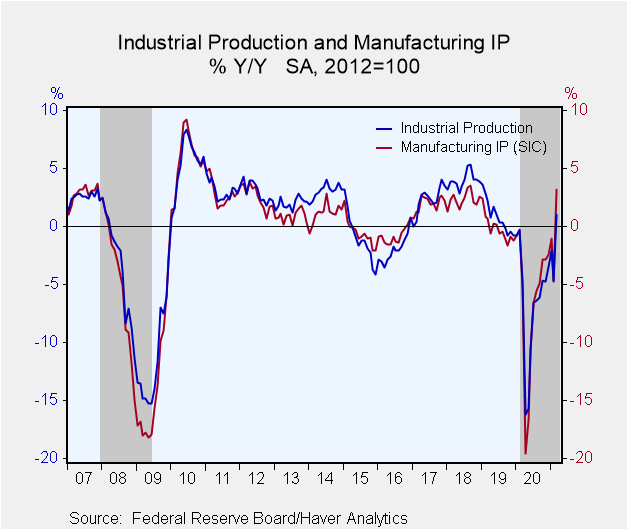

Industrial production rebounded in March, rising 1.4% m/m (+1.0% y/y) after a downwardly revised 2.6% m/m drop in February (initially -2.2% m/m). The February decline had been due largely to unusually cold and severe weather across much of the country, particularly the south central region. The 1.0% y/y increase was the first annual rise since August 2019. The Action Economics Forecast Survey looked for a 3.0% m/m gain for March. For the first quarter of 2021, IP rose 2.5% saar, down from 9.5% in 2020 Q4.

The more normal March weather was clearly observed in the industry breakdown. Manufacturing output rose 2.7% m/m (3.1% y/y) in March after having fallen 3.7% m/m in February. This was the largest monthly rise since last July. Mining rebounded even more strongly, jumping up 5.7% m/m (-8.8% y/y) to offset a 5.6% m/m plunge in February. The March monthly gain for mining was the largest since October 2008. By contrast, utilities output plummeted 11.4% m/m (-0.2% y/y) in March as the demand for heating fell sharply with weather conditions and temperatures returning to more in line with seasonal norms. This was the largest monthly decline in the series history dating back to 1939; the 9.2% m/m jump in February was the largest monthly increase in series history.

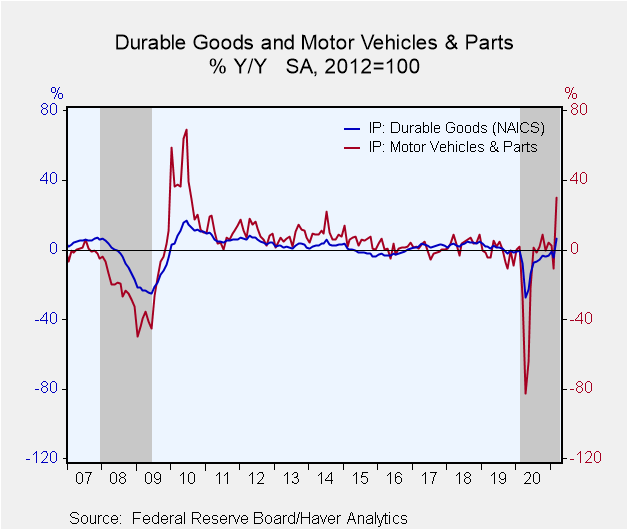

Durable manufacturing output rose 3.0% m/m (6.4% y/y) in March following a 3.3% m/m decline in February. All major categories of durables registered increases, most of which were between 2% and 3%. The output of motor vehicles and parts rose 2.8% m/m in March after falling 10.0% in February. Shortages of semiconductors held down vehicle production in both months, while cold weather also curbed production in February.

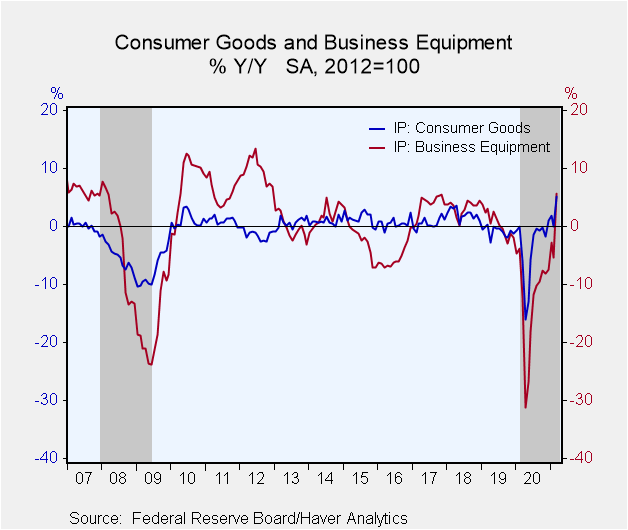

Nondurable goods output increased 2.6% m/m (0.4% y/y) in March following a 4.1% m/m decline in February. Among nondurables, all major industry categories recorded gains except plastics and rubber products. The petroleum and coal products industry and the chemicals industry registered gains of 5.7% m/m and 4.1% m/m, respectively, after posting declines in February because of severe weather. The recovery in chemicals was incomplete in March, however, as some factories remained offline because of weather-related damage sustained during February.

The drop in overall utilities reflected significantly lower demand for heating as weather conditions and temperatures in March were much milder than in February. Average heating degree days in February were nearly 70% higher than in March. Electric power generation in March fell 9.3% m/m following a 7.2% m/m jump in February. Natural gas distribution plummeted 21.1% m/m in March, offsetting a 20.0% m/m surge in February.

The rebound in mining output mostly reflected a 5.4% m/m rebound in oil and gas extraction.

Output of selected high technology equipment increased 1.8% m/m in March after having edged up 0.1% m/m in February. Excluding these products, overall production rose 1.4% m/m in March following a 2.2% monthly decline in February.

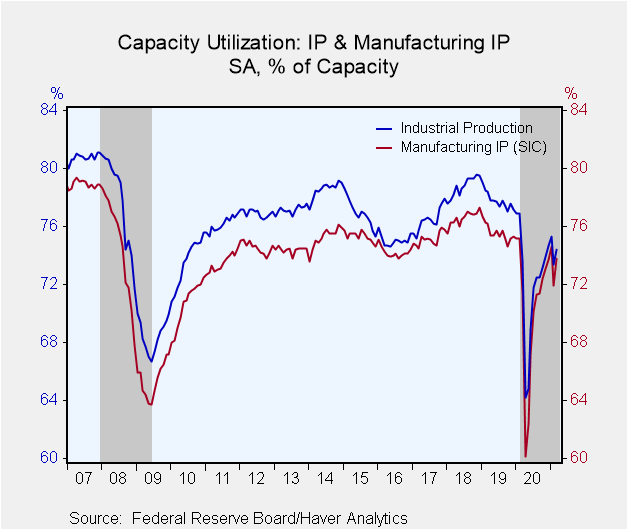

Capacity utilization for the industrial sector increased 74.4% in March from 73.4% in February. Factory sector utilization was 73.8%, up from 71.9%.

Industrial production and capacity are located in Haver's USECON database. Additional detail on production and capacity can be found in the IP database. The expectations figures come from the AS1REPNA database.

| Industrial Production (SA, % Change) | Mar | Feb | Jan | Mar Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Total Output | 1.4 | -2.6 | 0.9 | 1.0 | -6.7 | 0.9 | 3.9 |

| Manufacturing | 2.7 | -3.7 | 1.3 | 3.1 | -6.5 | -0.2 | 2.3 |

| Durable Goods | 3.0 | -3.3 | 1.8 | 6.4 | -8.7 | 0.7 | 3.4 |

| Motor Vehicles | 2.8 | -10.0 | 1.0 | 29.7 | -15.1 | -2.4 | 4.1 |

| Selected High Tech | 1.8 | 0.1 | 0.8 | 7.7 | 4.3 | 5.1 | 6.4 |

| Nondurable Goods | 2.6 | -4.1 | 0.8 | 0.4 | -3.9 | -0.7 | 1.9 |

| Utilities | -11.4 | 9.2 | -3.1 | -0.2 | -2.7 | -0.8 | 4.4 |

| Mining | 5.7 | -5.6 | 2.1 | -8.8 | -10.3 | 7.1 | 12.4 |

| Capacity Utilization (%) | 74.4 | 73.4 | 75.3 | 73.6 | 72.0 | 77.8 | 78.7 |

| Manufacturing | 73.8 | 71.9 | 74.6 | 71.4 | 70.3 | 75.6 | 76.6 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates