Global| Jan 14 2011

Global| Jan 14 2011U.S. Industrial Production Surges; Utility Output Up with Weather, But Manufacturing Also Gains

Summary

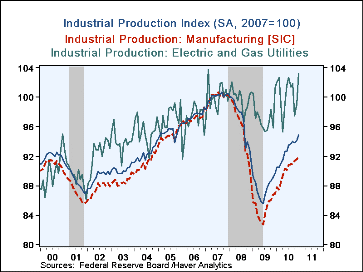

U.S. industrial production rose 0.8% in December, following 0.3% in November, which was revised from 0.4%. September and October were both revised upward modestly. The December result compares to a consensus forecast of 0.5%. Year-on- [...]

U.S. industrial production rose 0.8% in December, following 0.3% in November,

which was revised from 0.4%. September and October were both revised

upward modestly. The December result compares to a consensus forecast of

0.5%. Year-on-year growth is up to 5.9%, and the year 2010 averaged 5.7%

above 2009, which in turn had plunged 9.3%. The rebound traces out the

strong "V" shape so clear in the first graph.

U.S. industrial production rose 0.8% in December, following 0.3% in November,

which was revised from 0.4%. September and October were both revised

upward modestly. The December result compares to a consensus forecast of

0.5%. Year-on-year growth is up to 5.9%, and the year 2010 averaged 5.7%

above 2009, which in turn had plunged 9.3%. The rebound traces out the

strong "V" shape so clear in the first graph.

Also evident in the first graph is the erratic contribution of utility output. The oversized jump in total output in December indeed came from a weather-related 4.2% month-on-month surge in utilities. Apart from this sector, manufacturing production and mining production were each up 0.4%, and manufacturing in particular extended its trend which has been averaging 0.3%-0.4% per month.

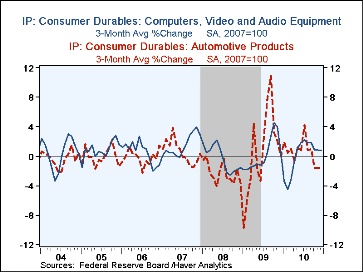

Consumer goods output rose 1.1% in December. This too was pushed by consumers' use of energy goods and services. Otherwise, consumer durable goods actually fell 0.5% and nonenergy nondurable goods edged up 0.1%. Among durable goods, the auto sector continues to struggle, with December output down 0.4% following November's huge 5.7% drop. Household durables also declined, by 1.1%, largely reversing a promising two-month advance. Computers and other technology goods, however, gained 0.9%, a pick-up from 0.6% and 0.7% in October and November, respectively. In the business equipment sector, output was up 0.6%; the impact of such a good gain is muted, though, by a moderation in November from the strong 0.9% reported initially to 0.4% in this report. Construction supplies sagged anew, with an 0.8% drop in December that followed increases that averaged 1.0% in each of the two prior months. Growth prospects in that sector remain tenuous.

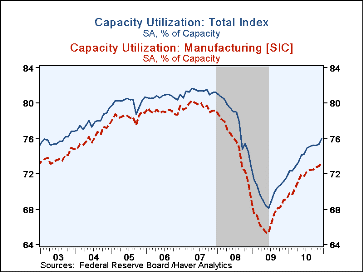

Capacity utilization overall improved to 76.0%, the highest level since August 2008 and an increase of 0.6 percentage points over November. This, of course, is partly due to the jump in utilities. In manufacturing alone, utilization ran at 73.2%, up from 72.9% in November.

Industrial production and capacity data are included in Haver's USECON database, with additional detail in the IP database; that database contains index data at more decimal precision and also includes extensive lists of relative importance figures for several breakdowns of production by industry and market group.

| Industrial Production (SA, % Change) | Dec | Nov | Oct | Year Ago | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|

| Total Output | 0.8 | 0.3 | -0.1 | 5.9 | 5.7 | -9.3 | -3.3 |

| Manufacturing | 0.4 | 0.2 | 0.4 | 5.9 | 6.1 | -11.1 | -4.5 |

| Consumer Goods | 1.1 | -0.5 | -0.1 | 3.1 | 4.6 | -5.8 | -4.2 |

| Business Equipment | 0.6 | 0.4 | 1.4 | 11.8 | 7.9 | -12.2 | -1.5 |

| Construction Supplies | -0.7 | 1.6 | 0.4 | 8.7 | 4.0 | -16.7 | -9.5 |

| Materials | 0.9 | 0.5 | -0.3 | 7.1 | 7.0 | -9.7 | -2.7 |

| Utilities | 4.2 | 1.5 | -4.3 | 2.0 | 3.2 | -2.6 | -0.1 |

| Capacity Utilization (%) | 76.0 | 75.4 | 75.2 | 71.6 | 74.3 | 70.0 | 77.9 |

| Manufacturing | 73.2 | 72.9 | 72.8 | 69.1 | 71.7 | 67.2 | 75.0 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.