Global| Mar 12 2020

Global| Mar 12 2020U.S. Initial Claims for Unemployment Insurance Decline

Summary

• Initial jobless claims decreased to 211,000 in the week ending March 7th. • Four-week moving average edged up to 214,000. Initial jobless claims for unemployment insurance declined 4,000 to 211,000 (-5.8% year-on-year) during the [...]

• Initial jobless claims decreased to 211,000 in the week ending March 7th.

• Four-week moving average edged up to 214,000.

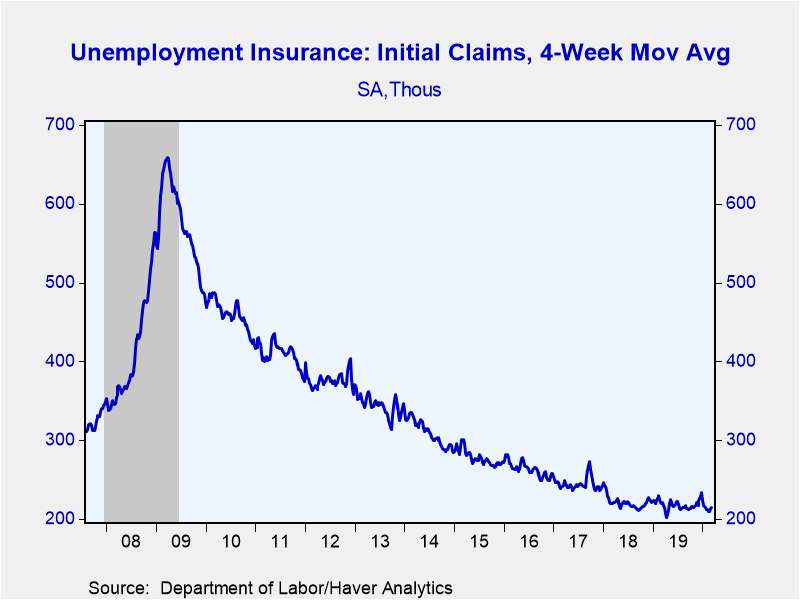

Initial jobless claims for unemployment insurance declined 4,000 to 211,000 (-5.8% year-on-year) during the week ending March 7th. The previous week was revised slightly lower to 215,000 (was 216,000). The Action Economics Forecast Survey expected 220,000 claims. This data suggest that layoffs did not increase as concern about the coronavirus’ impact on the U.S. economy took hold. The four-week moving average of initial claims, which smooths out week-to-week volatility though which is less important at the moment since its spans pre- and post-coronavirus concerns, edged up to 214,000.

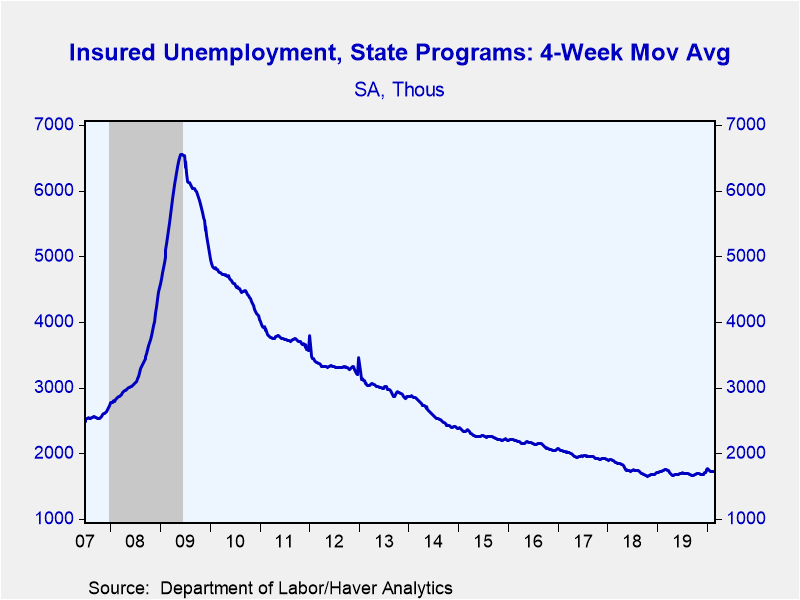

Continuing claims for unemployment insurance decreased 11,000 to 1.722 million (-2.0% y/y) in the week ending February 29th, from a slightly-upwardly revised 1.733 million. The four-week moving average of claimants increased to 1.728 million from 1.722 million.

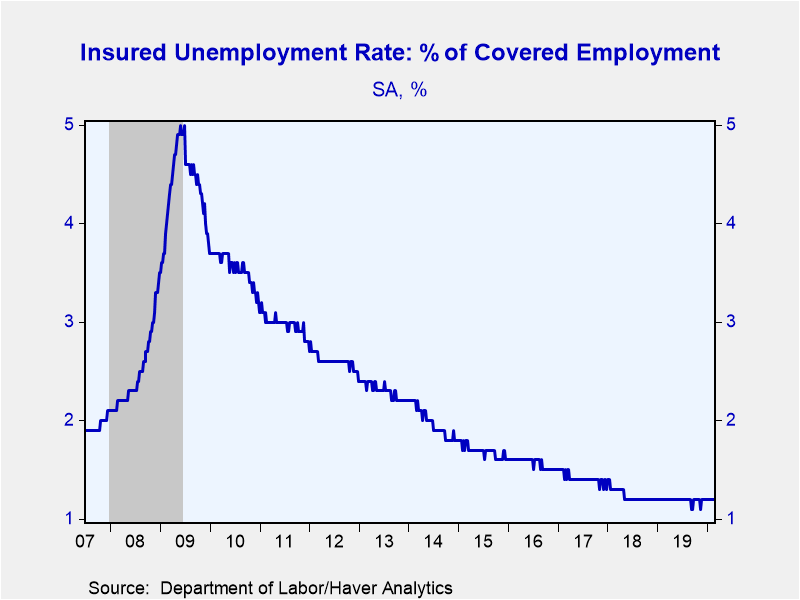

The insured rate of unemployment was unchanged at 1.2%, slightly higher than November 2019’s record low of 1.1%. Data on the insured unemployment rate go back to 1971.

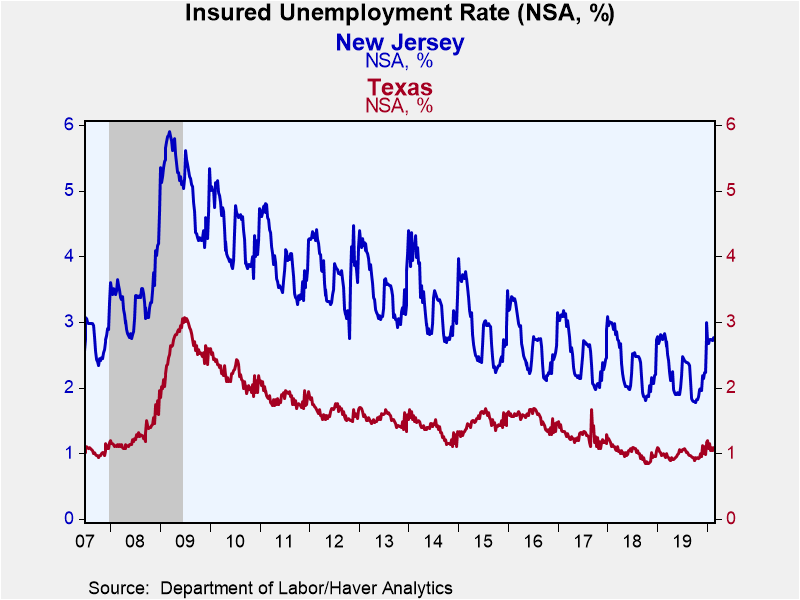

Insured rates of unemployment vary widely by state. During the week ending February 22nd, the lowest rates were in Florida (0.39%) North Carolina (0.48%), Virginia (0.60%), New Hampshire (0.62%), and Georgia (0.62%). The highest rates were in West Virginia (2.51%), Connecticut (2.55%), Rhode Island (2.62%), New Jersey (2.76%), and Alaska (2.91%). Among the other largest states by population not mentioned above the rate was 2.14% in California, 1.09% in Texas, 1.95% in New York, and 2.33% in Pennsylvania. These state data are not seasonally adjusted, thus Alaska has particularly large seasonal swings in insured rates of unemployment.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 03/07/20 | 02/29/20 | 02/22/20 | Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 211 | 215 | 219 | -5.8 | 218 | 220 | 244 |

| 4-wk avg | 214.00 | 212.75 | 209.75 | -- | -- | -- | -- |

| Continuing Claims | -- | 1,722 | 1,733 | -2.0 | 1,700 | 1,756 | 1,961 |

| 4-wk avg | -- | 1727.50 | 1722.25 | -- | -- | -- | -- |

| Insured Unemployment Rate (%) | -- | 1.2 | 1.2 |

1.2 |

1.2 | 1.2 | 1.4 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates