Global| Apr 02 2020

Global| Apr 02 2020U.S. Initial Claims for Unemployment Insurance Double to 6.6 Million

Summary

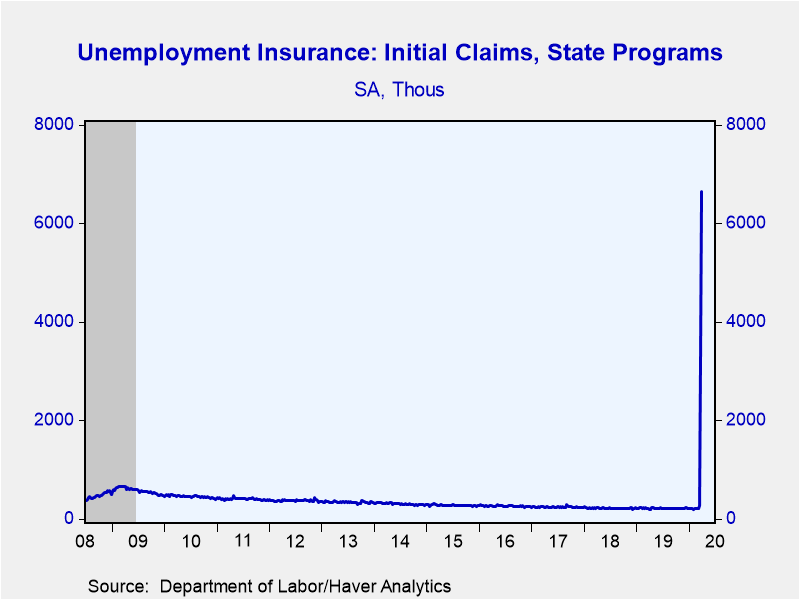

Initial jobless claims for unemployment insurance were 6.648 million (3,051% year-on-year) in the week ending March 28. The Action Economics Forecast Survey mean was 3.250 million claims while its median was 2.900 million; the [...]

Initial jobless claims for unemployment insurance were 6.648 million (3,051% year-on-year) in the week ending March 28. The Action Economics Forecast Survey mean was 3.250 million claims while its median was 2.900 million; the forecast range was 2.000 million to 7.150 million. The previous week's initial claims were revised slightly higher from 3.283 million to 3.307 million.

The four-week moving average of initial claims was 2.612 million in the March 28 week, up from 1.004 million the week before. As noted here last week, this measure is intended to smooth out week-to-week volatility, but such smoothing is not helpful due to the onset of the COVID-19 pandemic.

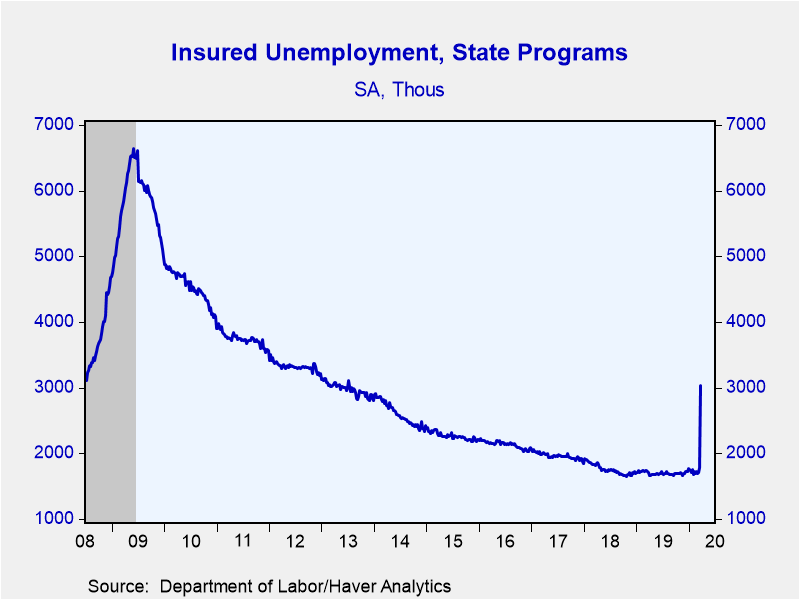

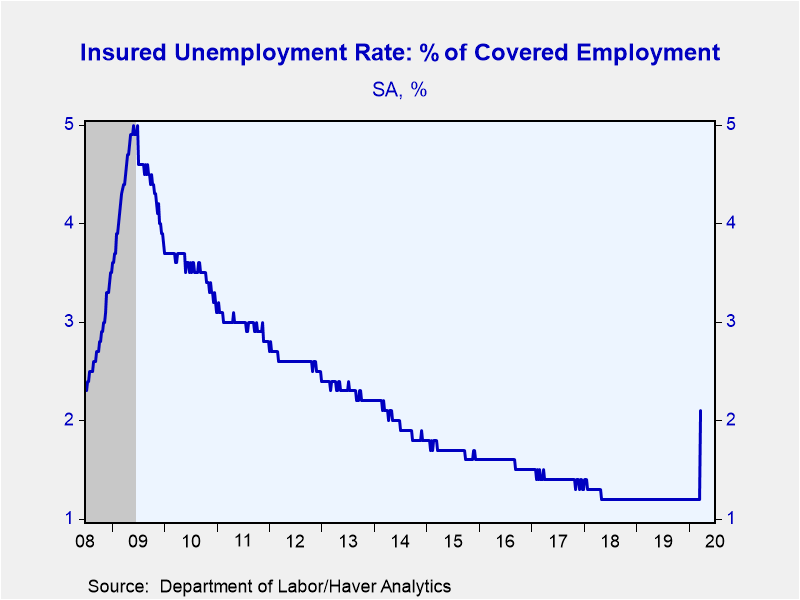

The total number of people receiving unemployment benefits was 3.029 million in the March 21 week (+76.2% y/y), up from 1.784 million the previous week; that number was revised down from 1.803 million. The resulting insured unemployment rate was 2.1%; that breaks the string of 1.2% readings that had extended back to May 5, 2018.

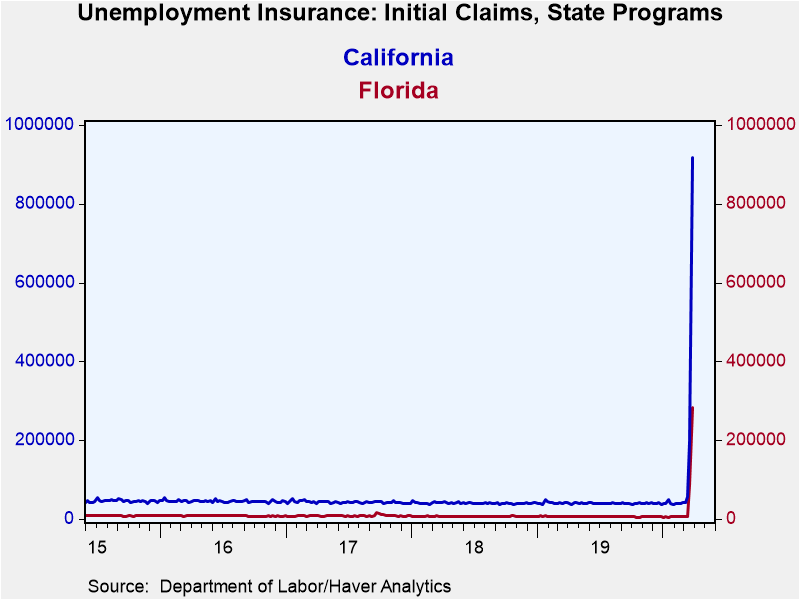

By state, advance data for the week ended March 28 show the largest number of initial claims in California at 918,210; this would not be a surprise given that California has the largest population. But weeks prior to early March show California with about 40,000 initial claims per week. These data are seasonally adjusted by Haver Analytics. New York State had 383,628, compared to a "normal" count of about 14,000-15,000. Texas had 290,592 in the latest week, up from an average range of 13,500. Even Montana saw a dramatic increase: 24,819 in the March 28 week compared to an average of 925 in the 52 weeks through February 29. These advance data will be revised next week, when more refined state data will be reported. Meantime in the March 21 week, all states reported increases and, according to the Labor Department, nearly every state making comments about its data cited COVID-19 as the causative force.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 03/28/20 | 03/21/20 | 03/14/20 | Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 6,648 | 3,307 | 282 | 3,050.7 | 218 | 221 | 244 |

| 4-wk avg | 2,612.00 | 1,004.25 | 232.50 | -- | -- | -- | -- |

| Continuing Claims | -- | 3,029 | 1,784 | 76.2 | 1,708 | 1,766 | 1,967 |

| 4-wk avg | -- | 2,053.50 | 1,726.25 | -- | -- | -- | -- |

| Insured Unemployment Rate (%) | -- | 2.1 | 1.2 |

1.2 |

1.2 | 1.2 | 1.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.