Global| Mar 26 2020

Global| Mar 26 2020U.S. Initial Claims for Unemployment Insurance Soar to Record 3.3 Million

Summary

• Initial jobless claims jumped to a record 3.283 million in the week ending March 21. • This is the largest weekly increase since the data was first collected in 1967. • Claims rose in every state led by Pennsylvania, Ohio and New [...]

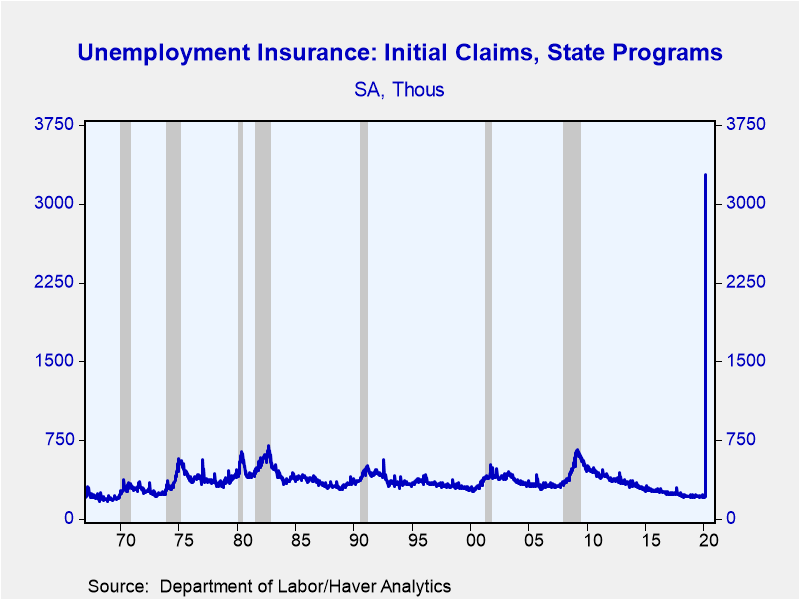

• Initial jobless claims jumped to a record 3.283 million in the week ending March 21.

• This is the largest weekly increase since the data was first collected in 1967.

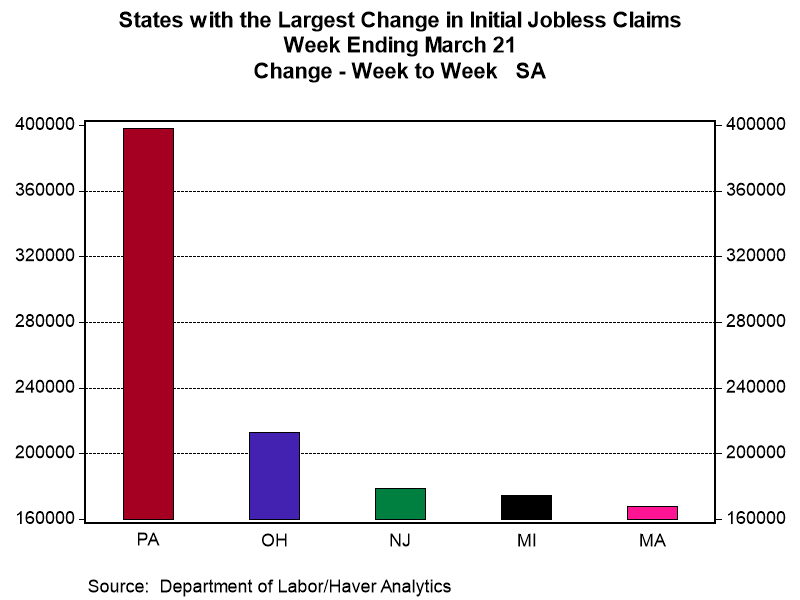

• Claims rose in every state led by Pennsylvania, Ohio and New Jersey.

• This data suggests a 1.8 percentage point rise in the unemployment rate.

Initial jobless claims for unemployment insurance jumped 3.001 million to a record 3.283 million (1,427% year-on-year) during the week ending March 21, This is also the largest weekly increase in claims both on a level and percent change basis since the data was first collected in 1967. The previous high for claims was 695,000 set in 1982. Based on this data alone, the unemployment rate should rise by 1.8 percentage points. The Action Economics Forecast Survey mean was 1.157 million claims while its median was 800,000.

The previous week's claims were revised slightly higher to 282,000 (was 281,000). This data is from the survey week for the March employment report, which is scheduled to be released on Friday, April 3. As a result, we will not see the rise in unemployment represented in the latest data until the April employment figures released on Friday, May 8. The Bureau of Labor Statistics anticipates that COVID-19 will not impact its release calendar.

The four-week moving average of initial claims, which smooths out week-to-week volatility and is less important at the moment since its spans pre- and post-coronavirus shutdowns, jumped to 998,250.

Claims increased in the week ending March 21, led by Pennsylvania (397,975), Ohio (212,773), and New Jersey (179,144) followed by Michigan, Massachusetts and California (these calculations are based on seasonally-adjusted data calculated by Haver Analytics). In total 11 states showed gains of over 100,000. New Hampshire, Rhode Island and Maine had the largest percent gains in claims. The Department of Labor notes that advance claims are not directly comparable to claims reported in prior weeks and some states indicated these numbers are only estimates. A more accurate picture of state claims in the week ending March 21 will be available next week.

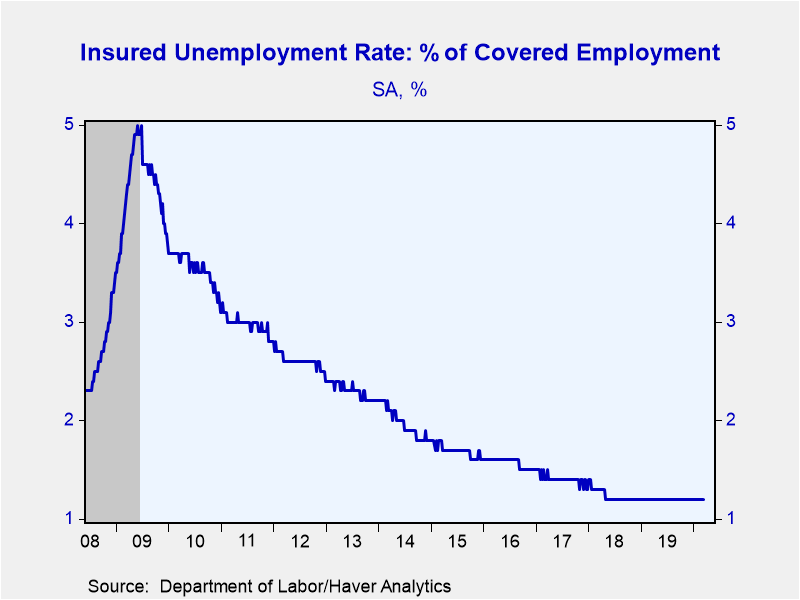

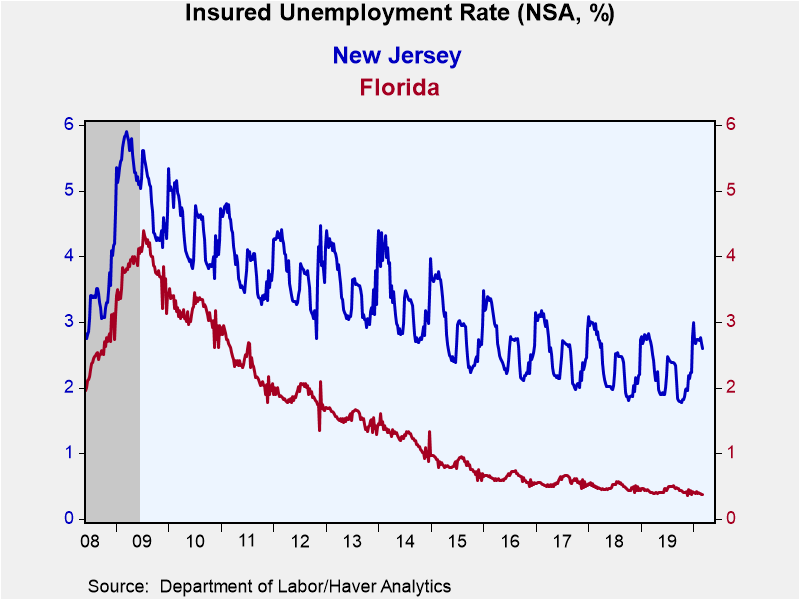

Continuing claims for unemployment insurance increased 101,000 to 1.803 million (4.1% y/y) in the week ending March 14, from a slightly-upwardly revised 1.702 million (was 1.701). The four-week moving average of claimants increased to 1.731 million from 1.704 million. The insured rate of unemployment was unchanged at 1.2%. The state insured rates of unemployment are lagged by two weeks, thus this data has yet to see any major impact from COVID-19.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 03/21/20 | 03/14/20 | 03/07/20 | Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 3,283 | 282 | 211 | 1,427.0 | 218 | 221 | 244 |

| 4-wk avg | 998.25 | 232.50 | 215.75 | -- | -- | -- | -- |

| Continuing Claims | -- | 1,803 | 1,702 | 4.1 | 1,701 | 1,756 | 1,961 |

| 4-wk avg | -- | 1731.00 | 1703.50 | -- | -- | -- | -- |

| Insured Unemployment Rate (%) | -- | 1.2 | 1.2 |

1.2 |

1.2 | 1.2 | 1.4 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates