Global| Aug 21 2008

Global| Aug 21 2008U.S. Initial Jobless Claims Ease for a Second Week; Supplemental Program Reaches 1.3 Million

Summary

Initial claims for unemployment insurance fell last week to 432,000 from 445,000 during the prior week. Consensus expectations had envisioned a slightly smaller decrease. Claims for both last week and the week before were revised [...]

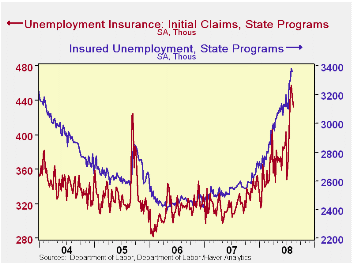

Initial claims for unemployment insurance fell last week to 432,000 from 445,000 during the prior week. Consensus expectations had envisioned a slightly smaller decrease. Claims for both last week and the week before were revised downward marginally. The four-week moving average increased to 444,750 (39.3% y/y).

Continuing claims for unemployment insurance edged down 17,000

during the latest week, after increasing 77,000 the week before, which

also reflects a slight downward revision. The total number of

recipients was 3,362,000; this represented 2.5% of covered employment.

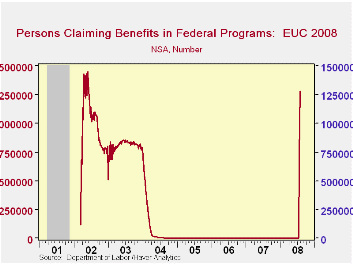

This report included data for a second week of the recently enacted "Emergency Unemployment Compensation" program, a federally funded effort targeting people who have exhausted all other unemployment insurance programs. There were 1,284,252 recipients in the week ended August 2, following 713,968 the prior week. Thus, while the regular state programs showed some reductions among newer beneficiaries, this supplemental program has obviously found a reservoir of necessitous individuals who have been unemployed for quite some time. This is about the same magnitude so far as the number of beneficiaries of a similar temporary program initiated in 2002.

| Unemployment Insurance (000s) | 08/16/08 | 08/09/08 | 08/02/08 | Y/Y | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 432 | 445 | 457 | 32.5% | 322 | 313 | 331 |

| Continuing Claims | -- | 3,362 | 3,379 | 30.9% | 2,552 | 2,459 | 2,662 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.