Global| Mar 18 2021

Global| Mar 18 2021U.S. Initial Jobless Insurance Claims Rise Moderately

Summary

• PUA initial claims decline in March 13 week. • Continuing claims in regular state programs extend gradual downtrend. • Insured jobless rate edged back up to 3.0%. Initial claims for unemployment insurance rose 45,000 to 770,000 in [...]

• PUA initial claims decline in March 13 week.

• Continuing claims in regular state programs extend gradual downtrend.

• Insured jobless rate edged back up to 3.0%.

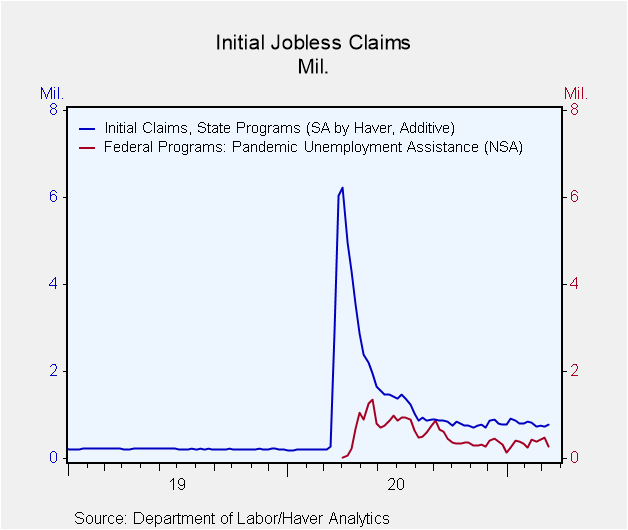

Initial claims for unemployment insurance rose 45,000 to 770,000 in the week ended March 13 from 725,000 the week before; that earlier week was revised from 712,000. The Action Economics Forecast Survey had expected 705,000 initial claims for the latest week. The four-week moving average of initial claims decreased to 745,250 from 762,250; this was the lowest four-week average since November 28.

Initial claims for the federal Pandemic Unemployment Assistance (PUA) program fell to 282,394 in the March 13 week from 478,914 the week before; that had been the largest amount since September 19. These initial claims do move relatively widely from week to week. The PUA program covers individuals such as the self-employed who are not included in regular state unemployment insurance. Given the brief history of this program, which started April 4, 2020, these and other COVID-related series are not seasonally adjusted.

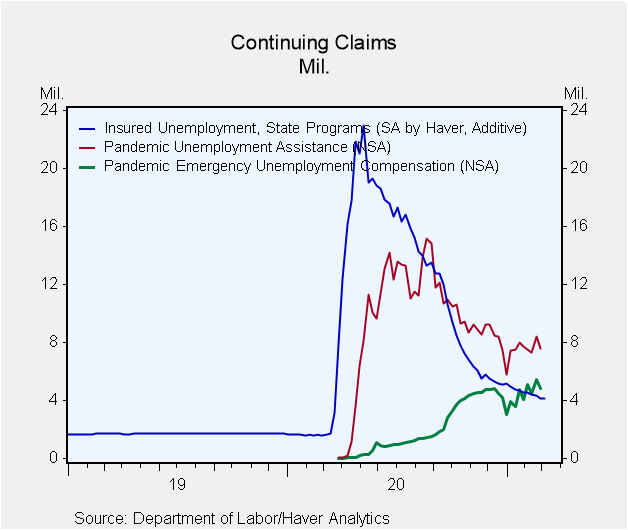

Continuing claims for regular state unemployment insurance fell to 4.124 million in the week ended March 6 from 4.142 million in the prior week, marginally revised from 4.144 million. Continuing PUA claims for the week of February 27 dropped to 7.615 million from a little-revised 8.388 million in the prior week. The number of Pandemic Emergency Unemployment Compensation (PEUC) claims also decreased in that week to 4.815 from their record 5.456 million, which was revised just slightly from the original 5.455 million. That program covers people who were unemployed before COVID but exhausted their state benefits. An extension of the PEUC benefits was included in the American Rescue Plan bill passed by the Congress last week and they will now be available until August 29.

The total number of all state, federal and PUA and PEUC continuing claims fell to 18.216 million in the week ended February 27 from 20.118 million in the February 20 week. This grand total is not seasonally adjusted.

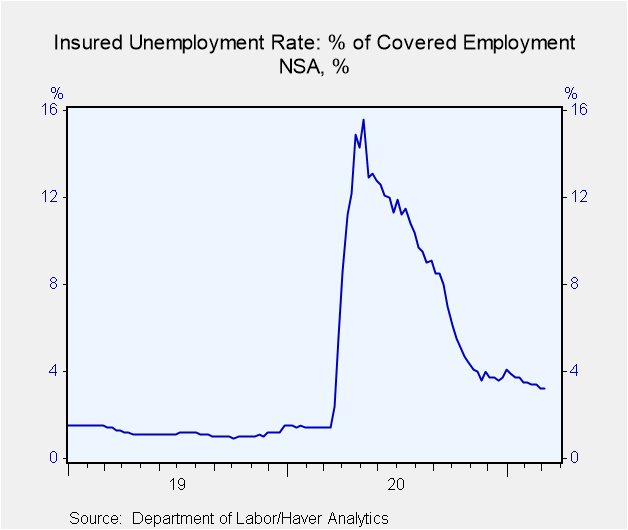

The seasonally adjusted state insured rate of unemployment edged back up to 3.0% in the week ended March 6 from 2.9% the previous week. That had been the lowest rate since the third week of March 2020, just as the pandemic was setting in; the high was 17.1% in the second week of May.

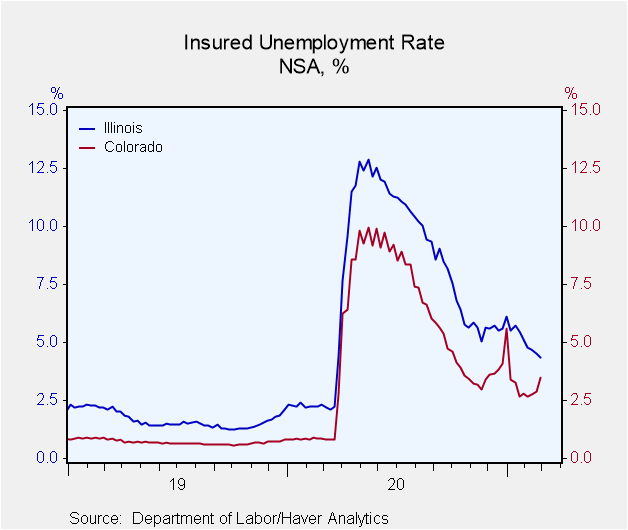

The state insured rates of unemployment continued to show wide variation. In the week ended February 27, the lowest rates were in Alabama (0.90%), Utah (1.03%), North Carolina (1.37), South Dakota (1.38%), and Nebraska (1.49%). The highest rates were in New York (4.73%), Connecticut (5.01%), Nevada (5.437%), Alaska (5.58%) and Pennsylvania (6.05%). These state rates are not seasonally adjusted.

As we continue to point out, the Labor Department changed its seasonal adjustment methodology back in August from multiplicative to additive. They did not restate the earlier data, so there is a break in the series in late August. Though the current comparison to early September is valid, comparisons with figures before August 22 are not. Haver Analytics has calculated methodologically consistent seasonally adjusted claims series dating back to 1979. This series matches the Department of Labor seasonally adjusted series since their change in methodology. For more details, please see the September 3 commentary on jobless claims.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey, carried in the AS1REPNA database.

| Unemployment Insurance (SA, 000s) | 03/13/21 | 03/06/21 | 02/27/21 | Y/Y % | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Initial Claims | 770 | 725 | 754 | 173 | 1,450 | 218 | 221 |

| Initial Claims (NSA) | 746 | 722 | 757 | 197 | 1,367 | 218 | 221 |

| Initial Claims Pandemic Unemployment Assistance (NSA) | 282 | 479 | 428 | -- | -- | -- | -- |

| Continuing Claims | -- | 4,124 | 4,142 | 142 | 10,664 | 1,701 | 1,756 |

| Continuing Claims (NSA) | -- | 4,486 | 4,582 | 127 | 10,358 | 1,704 | 1,763 |

| Continuing Claims Pandemic Unemployment Assistance (NSA) | -- | -- | 7,615 | -- | -- | -- | -- |

| Insured Unemployment Rate (%) | -- | 3.0 | 2.9 |

2.9 |

7.3 | 1.2 | 1.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.